AI Goes Vertical in Financial Services

Deep Dive: Intelligence Layer Cutting Across Banking, Lending, Insurance & Payments

Consumer behaviour in India has changed in a big way, and so has the way people deal with financial services (FS). Things that once required a bank visit, long forms, or conversations with an agent are now handled quickly on a phone. Gen Z in particular is very comfortable investing online, using credit, trying new financial products, and managing all their money through apps. For them, digital is the default, not an option.

At the same time, impulsive buying has accelerated, fuelled by a growing culture of instant gratification. The gap between thinking about a purchase and actually buying it has become much shorter. Decisions that used to take days now happen within minutes, as everything is moving towards becoming seamless.

And the shift is visible in everyday life. People do not plan their travel or stays far in advance now; they simply check availability on an app, compare a few listings, and book on the spot. The entire journey from discovery to decision now fits inside a single screen.

As these behaviours become the norm, financial needs will evolve alongside them. Institutions must continually adapt to a world where users expect speed, simplicity, and convenience at every interaction. Across financial services, one-tap card payments, instant UPI transfers, and quick-access credit have stripped away nearly all friction. Digital nudges and targeted offers further accelerate decision-making, often pushing spending to happen before deliberate thought sets in.

India now produces nearly 20% of the world’s data and processes over 50% of global digital transactions. With such a massive volume of real-time data being generated, adding an AI layer over existing systems is no longer optional; it is inevitable. AI becomes the intelligence layer that helps institutions make sense of behaviour at scale, anticipate needs, and intervene at the right moment. The advantage will belong to those who can process signals faster than human judgement ever could.

Today’s blog is a bit long, recommended to read it on our website here.

Why India is Uniquely Positioned?

With a high level of digital advancement, often ahead of many developed markets in key areas, India can see much wider and newer use cases of AI emerge in financial services (FS). India’s Digital Public Infrastructure (DPI) platforms such as Aadhaar, UPI, and DigiLocker serve as a robust foundation to build low-cost AI solutions at scale, making the country a playground for innovation to prosper.

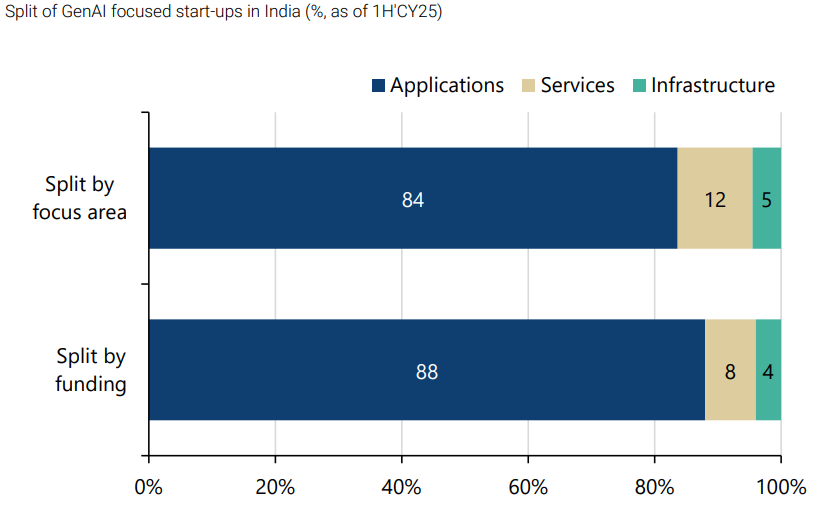

While India’s capabilities in building core AI infrastructure such as chips and data centers are still limited, it is at the application layer where the country has truly taken off and is seeing wide adoption. There are over 900 GenAI startups in India as of June 2025, compared to around 250 in June 2024 and just about 50 in June 2023. Government support has also helped, along with a clear willingness to accelerate adoption to improve system-level efficiencies. For instance, Indian Railways has started using AI-powered tools to optimise train occupancy, resulting in a 30% increase in rate of confirmed tickets.

Now within financial services, AI adoption is now cutting across 4 major segments at once: Banking, Lending, Insurance, and Payments. Across horizontal use cases, whether it is a bank on boarding a new customer, a lender assessing risk, an insurer detecting fraud, a wealth platform personalising advice, or a payments company improving dispute resolution, AI is enhancing speed, accuracy, and operational efficiency across the board.

These horizontal use cases span the entire value chain and are now very common:

AI is streamlining on boarding through automated KYC verification, document extraction, and identity checks.

Strengthening underwriting and risk assessment through alternative data, behavioural patterns, and predictive models.

Fraud detection has become real-time, with AI spotting anomalies and suspicious transactions before they escalate.

Customer support is also being transformed through multilingual AI assistants that reduce wait times and resolve queries instantly.

With India’s digital rails feeding real-time data into the ecosystem, financial institutions can build dynamic credit lines, personalised product recommendations, proactive risk monitoring, and automated servicing workflows. The biggest gains will come from embedding AI into everyday processes rather than treating it as a separate tool. Over time, AI could become the baseline expectation across the entire financial services industry.

We will now discuss key vertical use cases across these 4 segments (Banking, Lending, Insurance, & Payments) one by one. Wealth Management is another segment, but shall discuss it in detail in some other blog.

Banking: From Chatbots to AI Relationship Managers

The first wave of virtual assistance was built on simple rule-based chatbots and Interactive Voice Response (IVR) systems. Early versions, including HDFC Bank’s initial “Eva”, launched around 2017, operated on decision trees and pre-scripted replies. These tools were useful for managing large volumes of repetitive queries such as balance checks or basic transaction history, but they struggled beyond that. They could not understand context, interpret intent, or manage multi-turn conversations.

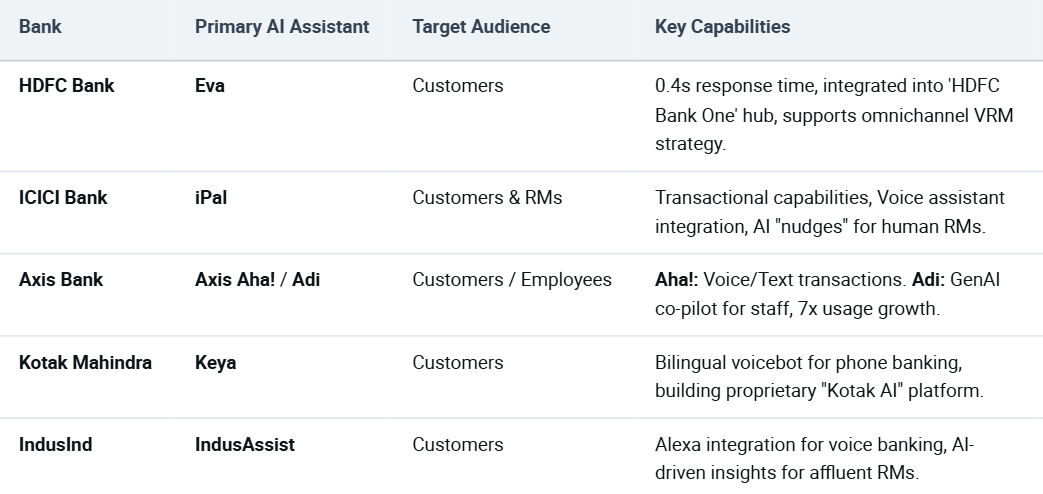

Over time, these chatbots have evolved with the help of GenAI, with leading private sector banks in India being early movers in adopting AI to scale their relationship management capabilities. They have transitioned from simple query-resolution chatbots to sophisticated Virtual Relationship Management (VRM) ecosystems that blend human expertise with AI-driven insights. Here are some details of key capabilities private banks now have in their chat bots with AI:

Public sector banks are also leveraging AI to manage massive customer volumes, enhance operational efficiency, and drive financial inclusion across diverse demographics. Bank of Baroda (BoB) has an AI-powered VRM named “Aditi”, designed as a computerized 3D digital avatar that interacts with customers via audio, video, and chat. It offers conversational banking rather than static, menu-based responses, along with 24/7 multilingual support.

“More than 55% of support requests were resolved digitally with over 30% of these journeys being straight-through resulting in reduced turnaround times, lower call volumes and improved customer satisfaction.” - HDFC Bank Annual Report FY2025

With Voice AI, the virtual ARM becomes an always-available, multilingual relationship manager that understands natural speech, resolves routine queries instantly, and guides customers through tasks with ease. It automates high-volume requests like balance checks, statements, EMI reminders, and card blocking, allowing human RMs to focus on higher-value interactions. It also acts proactively by tracking customer behaviour and sending timely voice nudges for payments, low balances, or salary credits. Even during human-assisted calls, Voice AI supports the RM by pulling data, suggesting responses, and summarising conversations. By enabling smoother on boarding, smarter cross-sell, and round-the-clock support, Voice AI reduces cost to serve and significantly improves customer experience.

“Few senior banking industry veterans claim that with AI, banks can reduce operational expenditure by 5-8% over the next 12 months (2026). This does not include Agentic AI, such as AI or voice bots answering or replying to customer queries, but rather focuses on digitising operations and creating automated workflows within banking apps. Another area where AI is helping is in hand-holding customers and creating customised journeys based on an individual’s digital footprint. Banks have been testing this and are seeing improvements in reducing drop-offs.”

Lending: Shift to Real-Time, Intelligence-Led Underwriting

As consumer behaviour has shifted and digital adoption has accelerated, decision timelines have compressed dramatically. Lenders today can reach and service customers with far less friction than before, expanding the addressable credit opportunity. The central challenge, however, lies in making real-time decisions on whom to lend to and how much to lend. As credit moves faster and becomes more digital, balancing speed with risk control has become increasingly difficult, particularly in markets like India, where a large share of borrowers are new to credit or remain thin-file.

While underwriting, lenders have to balance two competing objectives:

To approve genuine customers quickly, with minimal friction

To protect the lender by filtering out fraudulent or high-risk profiles

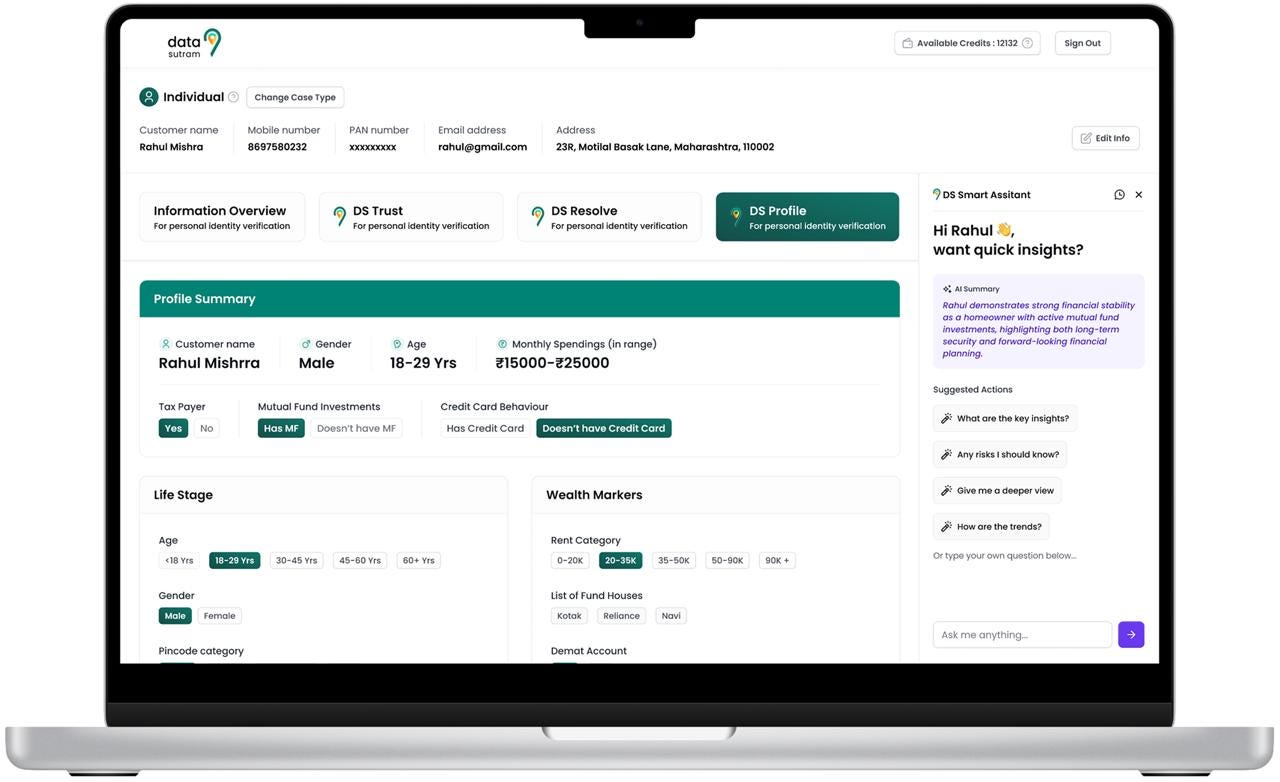

This is where a data intelligence layer like Data Sutram becomes critical. By increasing identity certainty and enriching the lender’s view of customer risk and financial capacity, it helps underwriting systems make sharper decisions earlier in the funnel.

They are building India’s largest identity bureau for profile-based underwriting, enabling lenders, fintechs, and financial platforms to make faster, safer, and more confident decisions. By collecting and structuring data from over 250 sources, they bring in alternative data such as satellite imagery, mobile pings, and past POS transactions in real time to strengthen underwriting.

At its core, this is advanced data aggregation and analytics, pulling insights from non-traditional sources. The question then becomes: what additional value can AI bring?

AI can act as a second layer of intelligence. Beyond structuring data, an AI agent can observe a potential customer’s behaviour both on and off the platform, including how they interact during the application journey and what signals emerge from those interactions. This creates an engagement layer that generates behavioural insights in real time, complementing static data sources and strengthening the underwriting proposition. Such agents can evaluate digital footprints and mobile usage patterns to assess ‘intent to pay’ and lifestyle stability, moving underwriting from pure data collection to dynamic behavioural assessment.

Key takeaways from CRO of an NBFC (Data Sutram client):

AI has enabled a fully straight-through underwriting process for small-ticket personal loans up to ₹2.5 lakh. There is no “refer to credit” layer; it is either an approval or a rejection, with virtually no incremental underwriting opex.

AI has also made on boarding sharper. Video KYC integrated with face recognition APIs has improved identity verification accuracy and reduced manual intervention.

Origination & borrower identification have become more data-driven. Using machine learning models, they identify borrower “look-alike” cohorts, overlay profiles, and attempt to predict repayment behaviour at the time of disbursal.

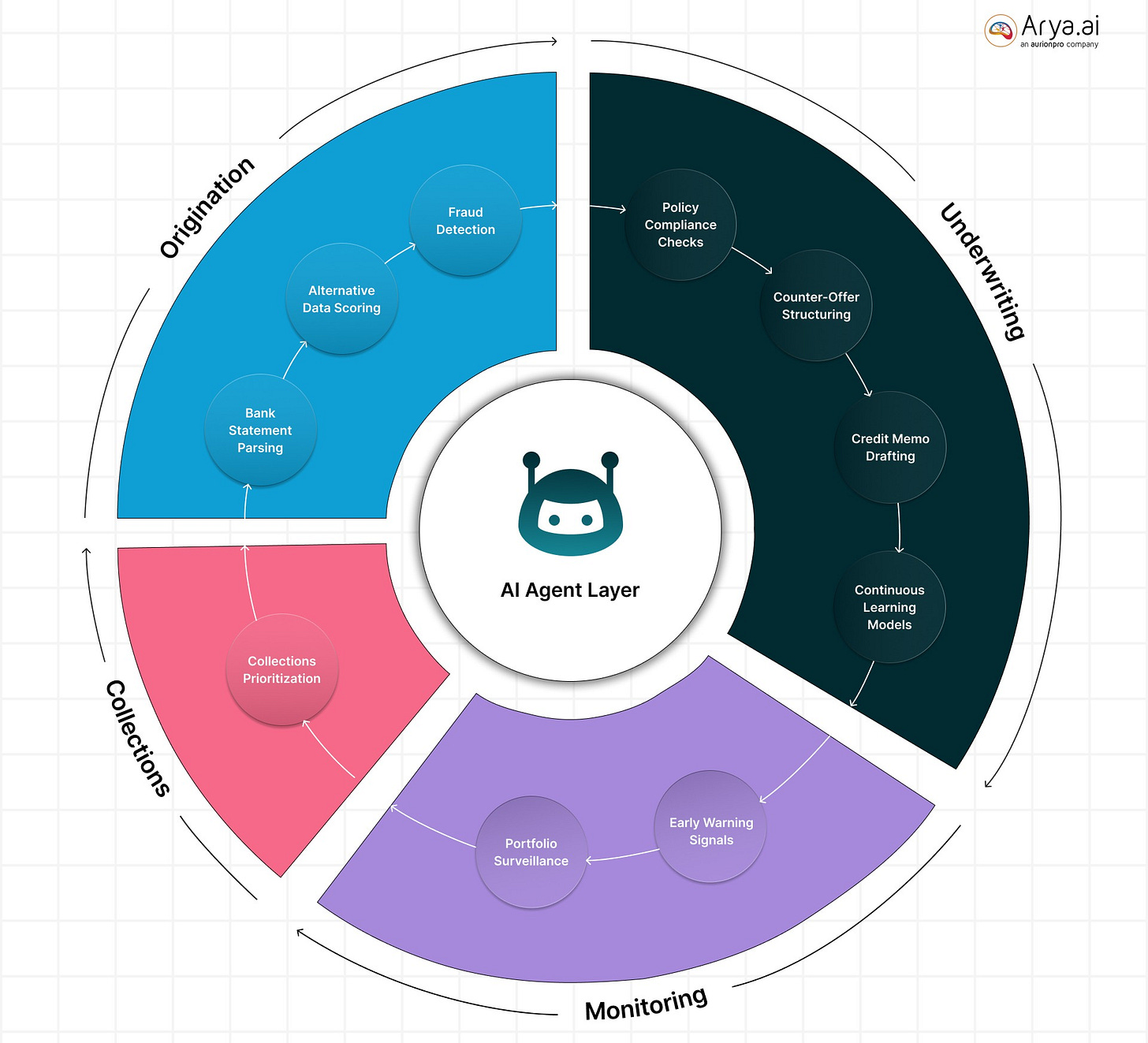

Collections remains a significant opportunity. Beyond automated calling and bot workflows, AI can potentially predict portfolio stress early and flag loans that may turn delinquent, enabling proactive intervention.

This helps enable not just more efficient underwriting, but also improves all key activities from origination to monitoring and collections.

Insurance: AI Across the Value Chain

Picture this:

While applying for motor insurance, customers can now create a short video of their vehicle, which is analysed using advanced deep learning models that assess around 60 attributes, including cracks, dents, and other damages. This is reality now!

Generative AI further enhances the process by identifying issues such as obstructed views, dirty windshields, or videos recorded in unsuitable locations like basements, while also estimating damage severity. By integrating these models, the entire underwriting process is completed in just 2-3 minutes - over 70% faster than manual inspections - delivering near real-time feedback and a vastly improved customer experience.

- PolicyBazaar (PB Fintech Annual Report 2024-25)

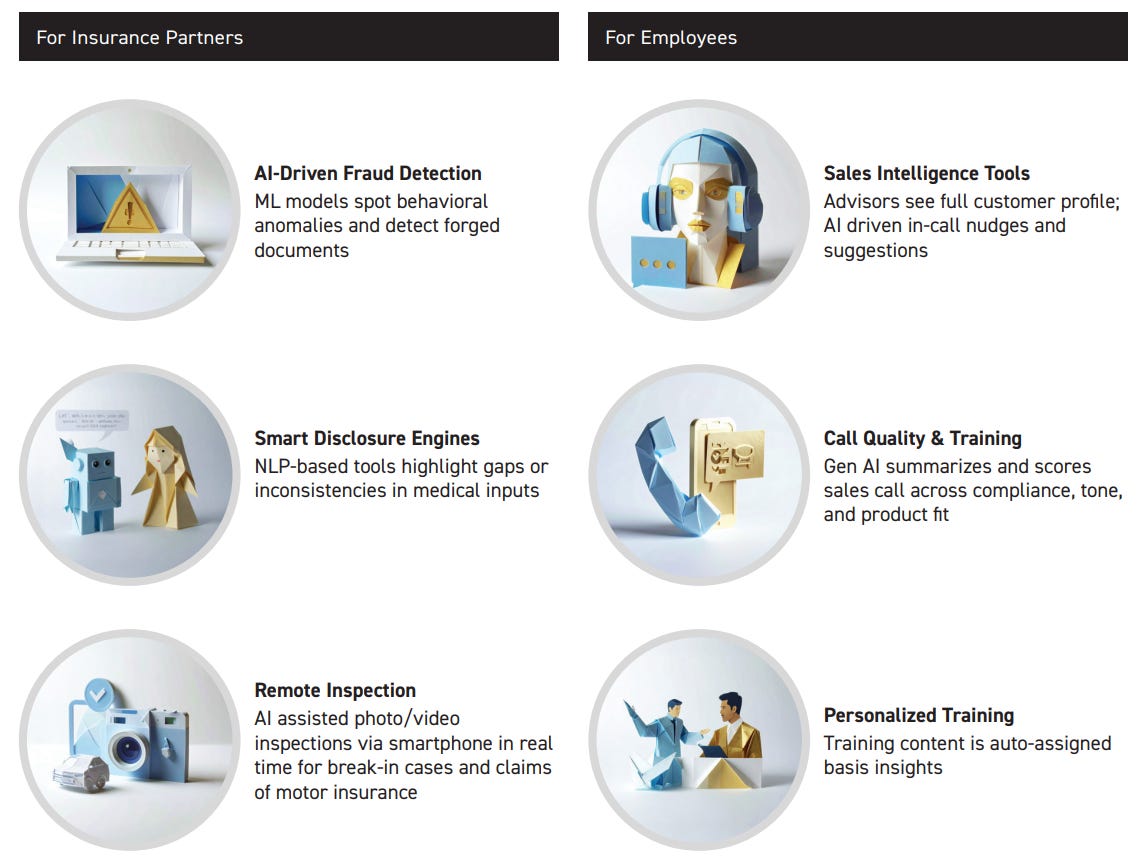

AI now runs across the entire insurance value chain, touching customers, partners, and employees in different but connected ways:

For customers, AI handles real-time assistance across purchase and post-sales journeys - from call-based interpretation tools and 24×7 chat interfaces to behavioural nudges, self-help dashboards, automated document uploads, and sentiment-aware escalation.

For insurance partners, AI strengthens core risk and operations through fraud detection, NLP-based disclosure checks, and remote photo/video inspections that speed up break-in cases and motor claims.

For their employees, AI surfaces deeper customer insights, provides in-call nudges, scores call quality, and automatically assigns personalised training modules. Together, these systems reduce friction, elevate accuracy, and compress turnaround times across the ecosystem, making every interaction faster, more consistent, and far more intelligent.

One area where AI can really help is in increasing the penetration levels of insurance in India by making it possible to introduce new products in the insurance industry. Agentic AI networks can engage millions of customers simultaneously through digital channels, replacing high-commission human models and making small ticket policies, say ₹1 to ₹500, profitable! It helps bring down the overall cost of assessing risk, underwriting, and processing claims. Many new forms of products can emerge, and one key example is the bundling of small-ticket insurance.

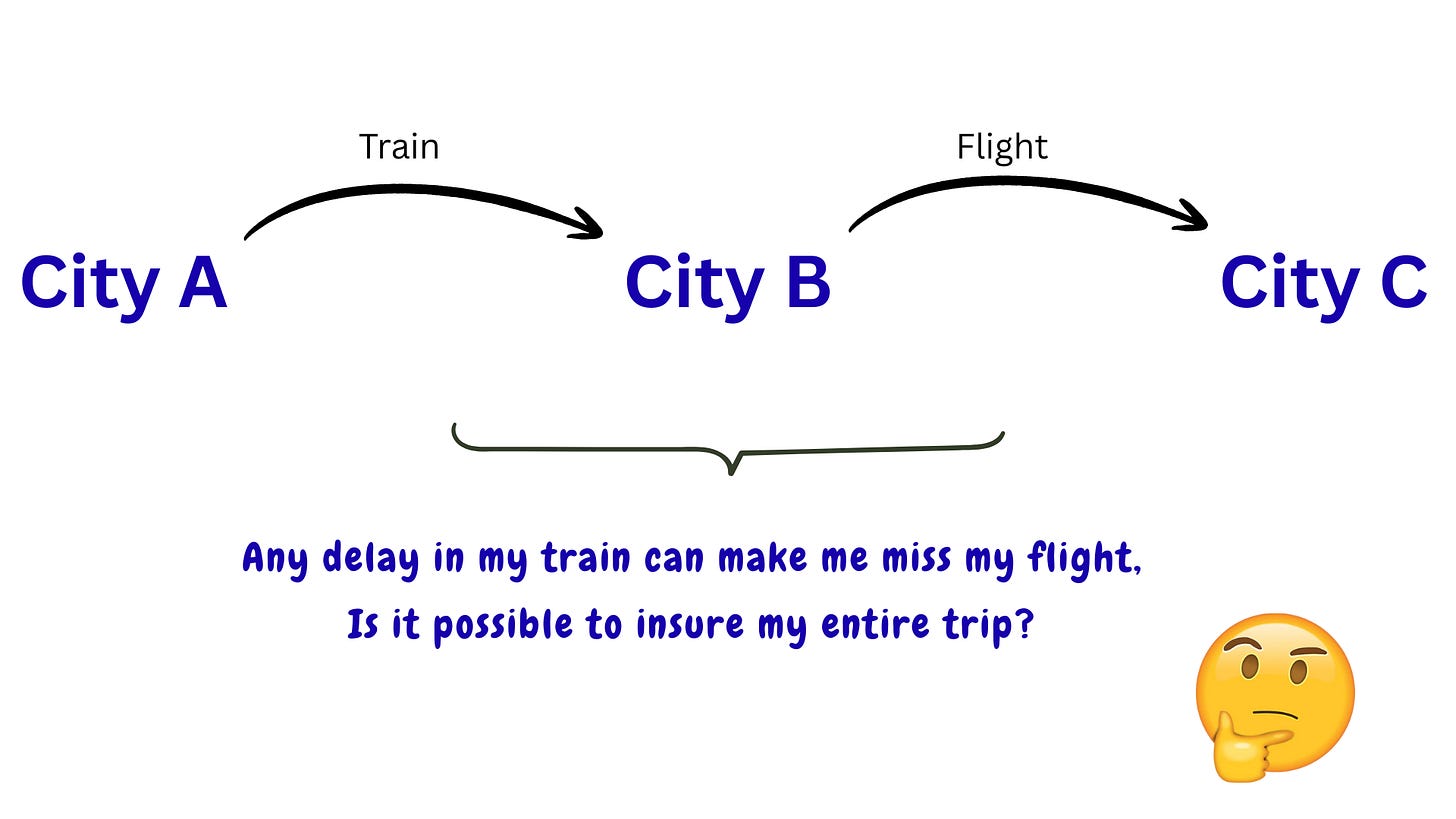

For example, for someone travelling from City A to City C, with the first half of the journey by train until City B and then by flight to City C, an insurance provider is today enabled, with the help of AI, to assess the probability of an adverse event in almost real time. They can underwrite the risk of the train getting delayed and the traveller missing the flight, thereby offering a bundled insurance option at the point of travel booking.

This is just one example. Millions of scenarios and insurance offerings, based on their possible outcomes with real-time risk assessment could shape the future of insurance as power of compute continues to accelerate.

Payments: AI makes Prevention Real Time

India has emerged as the undisputed global leader in digital payments. Today, the country processes more than half of the world’s real-time digital transactions, powered largely by the scale and ubiquity of UPI. In Dec’25 alone, 21.63 Bn real time transactions were processed.

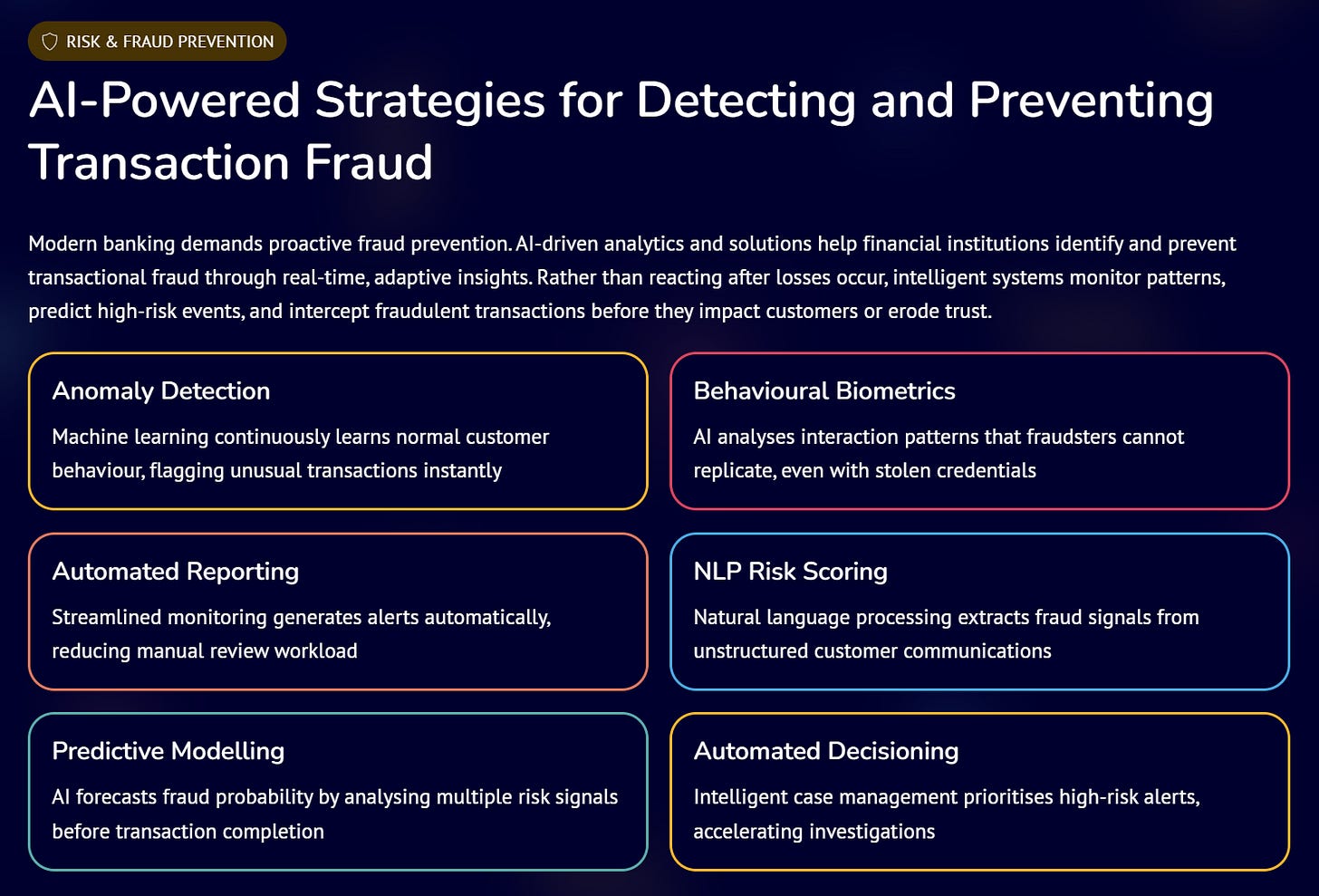

What began as a public digital infrastructure experiment has evolved into a mass adoption story, embedding digital payments into everyday life across income levels, geographies, and use cases. As volumes scale and transaction speed compresses, fraud prevention can no longer rely on post-facto controls. Modern banking systems need to identify risk as it emerges, not after losses have already occurred. This is where AI-driven fraud detection fundamentally changes the game.

Even areas such as how a user interacts with the interface of their usual payment app, with subtle behavioural cues like typing rhythm, swipe patterns, or navigation flow, can help validate identity even when credentials are compromised. At scale, AI automates fraud monitoring and case prioritisation, allowing teams to focus only on the highest-risk alerts. It can assess fraud risk before a transaction is completed by combining device, network, behavioural, and historical signals into a real-time risk score. This enables banks to block or delay genuinely risky transactions without adding friction for legitimate customers.

Payment security is a system-level challenge at the global level, which is why giants like MasterCard and Visa are actively investing in and acquiring companies to enhance their fraud protection capabilities for consumers worldwide. For example, Visa acquired Featurespace for a purchase consideration of $946 Mn in Dec’24 to help prevent and mitigate payments fraud and financial crime risks through the use of real-time AI.

They now have a real-time risk-scoring engine named Visa Advanced Authorization (VAA), that evaluates up to 500 unique attributes per transaction in roughly one millisecond, looking for unknown correlations in data to identify high-risk activity.

What more?

Apart from above key 4 areas that we discussed in this blog, AI assists in many more areas, one of them being wealth management sector through the creation of synthetic audiences and look-alike models by training on demographic & psychographic data, to simulate customer segments, identify high-potential prospects, and personalize outreach. Instead of relying only on historical client lists, wealth platforms can now model future demand. AI can forecast which investor cohorts are likely to shift from savings to market-linked products, who may upgrade to advisory mandates, or which clients show early signals of churn. Portfolio construction is also becoming more dynamic, with AI continuously re-balancing allocations based on risk tolerance, behaviour, and market movements.

Across banking, lending, insurance, payments, and wealth, AI is becoming the intelligence fabric that connects data, decisions, and customer interaction in real time. India’s digital rails, behavioural data scale, and application-layer innovation provide a unique backdrop for this shift. The institutions that embed AI deeply into workflows, rather than treating it as an experiment, will define the next decade of financial services.

That’s all for today!

Checkout our recent posts:

Excellent article, one company doing good is Emagia affiliate of TechNVision Venture Ltd. Watch their video https://youtu.be/78jD7DuxBxY?si=e3WEARBDb03pwHb7

Excellent breakdown. The shift from static data aggregation to dynamic behavioral assessment in lending is really the key unlock here. What's interesting is how this mirrors patterns in ad-tech from a decade ago, where real-time bidding went from demographic targeting to intent-based signals. The bundled insurance example is clever tho, shows how narrow AI gets when coordination costs drop low enough.