Building Slow in the Age of Fast Fashion

The Investor Operator Playbook: How Bombay Shirt Company is Creating the Quite Luxury Revolution in India

For decades, fashion has been a language of visibility. Logos grew larger, branding grew louder, and clothing became a shortcut for signalling status, taste, and aspiration. From monograms splashed across accessories to bold lettering on everyday wear, ‘logomania’ shaped how consumers expressed identity, especially in an era driven by mass consumption and social validation.

It has risen in distinct waves over the past few decades, closely tracking shifts in consumer culture and identity signalling. In the 1980s and early 1990s, visible logos became symbols of success and aspiration as global luxury houses like Louis Vuitton and Gucci turned monograms into shorthand for wealth and status. The trend intensified in the late 1990s and 2000s, when branding became louder and more repetitive, mirroring an era of mass consumption and celebrity-led marketing.

In the 2010s, this trend found a new engine in streetwear and hype culture, with brands like Supreme and Nike using bold logos to create instant recognisability, scarcity, & social currency across digital platforms.

Social media further amplified this effect, turning logos into visual signals optimised for feeds and fast attention.

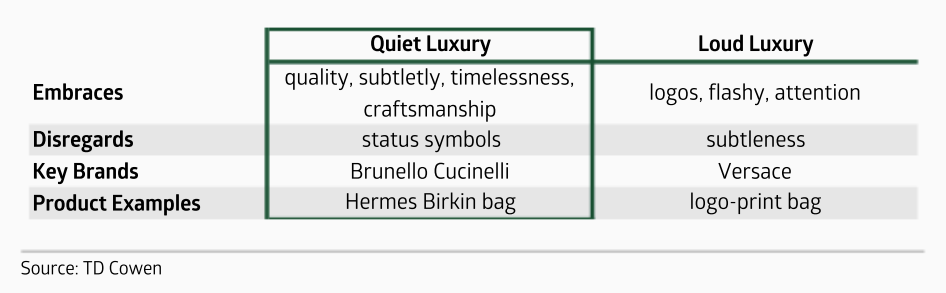

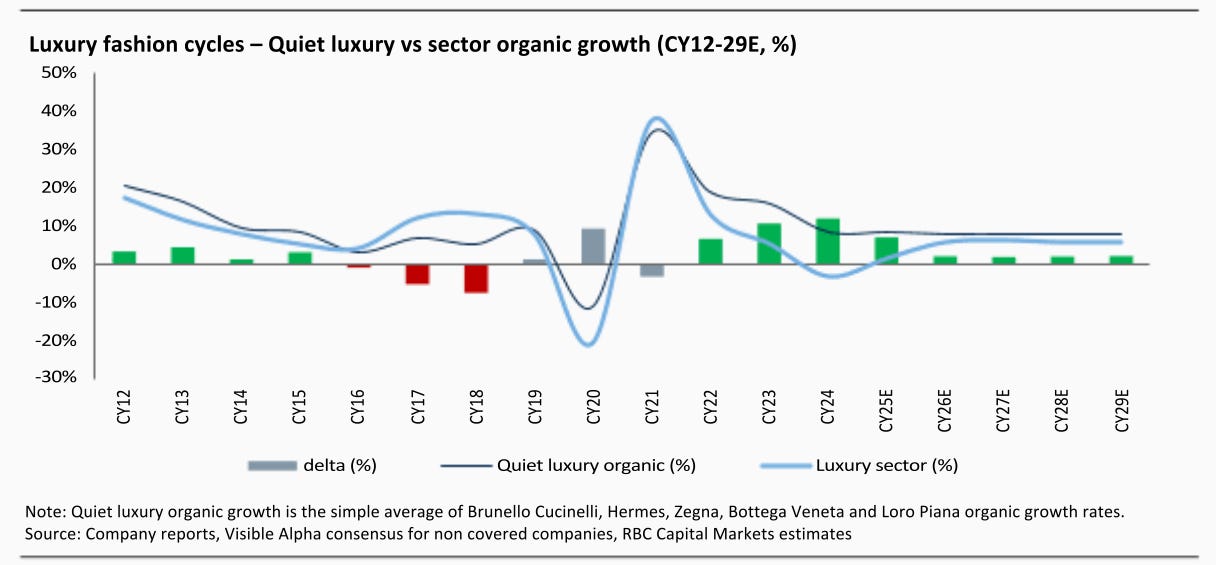

But as wardrobes filled up and trends cycled faster than ever, a quiet shift began to take place. Increasingly, consumers are stepping away from loud branding toward clothes that last longer, fit better, and feel more personal. This phenomena also explains why brands like LVMH’s Loro Piana (quiet luxury) & Hermes Birkin Bag sales are outperforming while loud-luxury peers like Gucci are suffering.

Even in countries like China, the idea of “Common Prosperity”, first articulated in the 1950s and was reintroduced by Xi Jinping in late 2021, focuses on encouraging modest and restrained lifestyles while discouraging overt displays of wealth. This shift attached a stigma to exaggerated, logo-heavy consumption that had earlier symbolised aspiration and success. Since then, consumer preferences among high-net-worth individuals have visibly evolved, with quiet luxury outperforming loud brands as discretion, subtlety, and understated quality increasingly became markers of status rather than conspicuous branding.

Quiet luxury as seen today is highly correlated with the return to classic and timelessness, as well as return to work and dressy, which includes tailoring. Luxury customers are now choosing fine materials and tailoring over large logos. And this global trend has helped ‘quiet luxury’ brands outperform the luxury sector sales ever since 2022, and are expected to continue outperforming through CY 2026-29 period as well.

In India, the shift toward quiet luxury in apparel is still at a nascent stage. The market continues to be dominated by fast fashion, led by high-velocity international players that specialise in trend-driven, affordable apparel produced at scale. Brands such as Zara, H&M, Uniqlo, and Zudio capture mass demand through rapid inventory churn and everyday basics. At the same time, logo-forward global brands like Levi’s, Nike, and Puma continue to scale on aspirational branding, while emerging homegrown fast fashion labels such as Snitch are growing rapidly through trend responsiveness.

While forces keep India firmly tilted toward speed and visibility, early signals of a quieter, quality-led shift have begin to emerge. As per Forbes, just like in the rest of the world, quiet luxury in India is a form of social shorthand, a discreet signal recognizable only to those within the same elite circles.

“It’s often said that only the wealthiest 1%, the crème de la crème, can afford the quiet luxury aesthetic. In India, the top 1% accounted for over 40% of the country’s total wealth in 2023, up from about 25% at the start of this century, according to the World Inequality Database.” (source)

This backdrop opens up a compelling opportunity for premium apparel businesses offering custom-fit propositions, addressing a clear gap in the market by solving for fit while layering in personalisation & differentiated in-store experiences, with a focus on quality over visible logos. The result is deeper customer engagement, higher repeat behaviour, and the ability to build long-term wardrobe relationships rather than one-off transactions. This is where we are focusing on in today’s post.

We recently hosted a fireside chat with Bombay Shirt Company’s founder Akshay Narvekar as part of the ‘Singularity One’ series. The discussion offered a grounded look at how a consumer brand can be built patiently in India, with a focus on unit economics, customer trust, and repeatability rather than hyper growth.

Founded in 2012, Bombay Shirt Company (BSC) began with a differentiated proposition: making custom-made shirts accessible at scale. Over the last 14 years, the company has evolved from a pure made-to-measure brand into a multi-category menswear platform serving the modern urban Indian male. Today, it operates at the intersection of craftsmanship, data-driven decision making, and disciplined offline retail execution.

BSC’s positioning is deliberately conservative. Narvekar describes the brand as one that reinvents classics for the modern Indian. Rather than pursuing fast fashion or transient trends, the company works with established silhouettes and upgrades them through fabric quality, detailing, and customisation. This approach has allowed BSC to age with its customer. What began as an affordable alternative to bespoke tailoring has gradually shifted into a mid-to-premium offering as customer expectations around materials, fit, and experience increased. Pricing moved up not by design, but as a function of evolving quality standards.

The core customer today is the urban Indian male, typically aged 30 & above, spanning professionals, business owners, and senior executives. The product mix has expanded from formal shirts into occasion wear, wedding-focused collections, and everyday apparel, widening usage without diluting brand identity.

Historically, BSC paid limited attention to seasonality. Over the last two years, that has changed. Data began to show a consistent demand spike between October and February, driven largely by weddings and festive occasions.

The company in response launched a dedicated festive collection titled The Best Dressed Guest, explicitly targeting wedding-related consumption.

Instead of counting on broad demand pickup, BSC started building products specifically for this moment, matching what it puts on the floor with what customers are actually looking for, showcasing how the company now uses data to shape product decisions, not just track outcomes.

From 100% Custom to a Hybrid Model

One of the most significant strategic shifts at BSC has been the transition from a fully made-to-order business to a hybrid model that includes ready-to-wear.

For most of its history, 100% of BSC’s products were custom-made. Over the last year alone, ready-to-wear has scaled rapidly and now accounts for ~40% of total revenues. Management expects this share to increase further and potentially reverse the mix over time.

This shift is driven by changing consumer expectations. In an era shaped by quick commerce and instant fulfilment, a growing segment of customers prefers speed over process. BSC’s advantage lies in its data. Millions of historical measurement data points allow the company to design ready-to-wear sizes using empirical fit data rather than intuition. This reduces inventory risk while preserving customer trust.

Importantly, the shift is strategic rather than reactive. The company recognises that every business must evolve with its customer, even when it requires a fundamental change in operating DNA.

An Offline-Led Business with Strong Economics

Unlike many digital-first apparel brands, BSC is firmly offline-led. Roughly 80% of sales come from physical stores, with online contributing the remaining 20%.

This mix is intentional. Custom and semi-custom apparel requires consultation and validation. Customers prefer engaging with stylists, discussing fit and fabric, and receiving reassurance before purchase. The offline channel enables this service-led interaction.

What sets BSC apart is how its stores perform on the ground. Mature locations are consistently profitable and tend to stabilise quickly. Low returns and refunds reflect the trust customers place in the product and the in-store experience.

These store-level outcomes give the team confidence to grow thoughtfully. Expansion decisions are driven by how well a store works in practice, rather than by the pressure to scale fast, allowing the brand to prioritise consistency and long-term sustainability.

A notable example is the decision to upgrade existing stores instead of expanding footprint. In Bandra and Kemps Corner, BSC chose to move into larger, more prominent locations rather than entering new geographies prematurely.

These were capital-intensive calls, but they were driven by incremental revenue logic and payback discipline rather than expansion optics.

Operating Discipline & Leading Indicators

Narvekar remains deeply involved in monitoring business health. Even after more than a decade, he reviews individual orders regularly. While this may appear excessive, he argues that looking at every sale provides immediate insight into demand trends, product performance, and service quality.

At a structured level, three metrics stand out:

• Net Promoter Score (NPS) as a leading indicator of customer satisfaction

• Revenue growth, tracked conservatively rather than aggressively

• Contribution Margin 2 (CM2), which captures profitability after marketing costs

CM2 is particularly important because it reflects the true health of the business post customer acquisition and servicing. Combined with disciplined fixed-cost control, it ensures profitability scales alongside revenue.

This approach reflects a clear understanding that BSC is as much a service company as a product business. The sales cycle does not end at checkout. Customers often receive products 7–10 days post order, followed by alterations if required. Satisfaction is only achieved when the entire cycle is complete, reinforcing the importance of operational consistency.

Founder-Investor Collaboration Beyond Capital

Narvekar highlighted the role of long-term investor partnership in shaping BSC’s trajectory. His association with Singularity began in 2015, with participation across every funding round since.

The most critical moment came in 2023, a difficult year for consumer businesses emerging from Covid amid tight capital markets. Singularity participated in BSC’s largest fundraise to date when external confidence was scarce. While capital was important, the larger impact came from operational input.

Drawing on experience from scaling consumer businesses from Mithun & Avnish, the partnership introduced sharper data discipline, clearer KPIs, and more structured operating processes. Narvekar candidly admitted that he initially resisted external advice, losing valuable time before accepting its merit. Once adopted, the business entered a different operating rhythm.

Two years on, operations now run with high predictability. The company is close to “autopilot” from an execution standpoint, allowing leadership to focus on strategic decisions rather than firefighting.

Measured Growth, Not Hypergrowth

BSC does not pursue hypergrowth. Growth has been consistent rather than explosive, supported by healthy margins and strong unit economics. Management is explicit that rapid scaling often compromises service quality, store selection, and brand integrity.

Currently operating around 34 stores, BSC plans to expand to approximately 100 stores over the next 3-4 years. Capital from the upcoming fundraise will be deployed primarily toward offline expansion, following the same store-level economics discipline that has worked so far.

Repeat customers already account for over 60% of sales, making CRM and cohort tracking central to growth strategy. Teams are empowered to prioritise customer satisfaction over short-term efficiency, reinforcing long-term lifetime value.

A Brand Built for Permanence

Perhaps the most defining insight from the conversation was Narvekar’s view on longevity. Bombay Shirt Company is not being built for a near-term exit. The ambition is institutional: to create a brand that outlasts its founders, rooted in trust, craftsmanship, and operating discipline.

Even the brand name reflects this intent. In an ecosystem often driven by speed and valuation milestones, BSC offers a contrasting case study. Sustainable consumer brands, the conversation suggests, are built by respecting unit economics, evolving with customers, and making hard decisions early.

For founders and investors alike, Bombay Shirt Company stands as a reminder that endurance, not acceleration, is often the true competitive advantage.

Check out our latest posts below: