Inside India's Data Center Build-Out

Deep Dive: How Policy & AI are Scaling Compute Infrastructure

We welcome ~350 subscribers who joined us since our recent post on how battery component ecosystem is evolving in India (read here). At Singularity AMC, our mandate is to invest in India’s path to strategic autonomy & through these Singularity One blogs we aim to share the insights, frameworks, and sector intelligence behind our investing, combining perspectives from seasoned investors, former entrepreneurs, and domain specialists into practical takeaways for decision-makers. We hope these insights help readers think more clearly about businesses, markets, and long-term value creation. With that brief note, let’s get started with today’s deep dive, where we focus on the forces driving the accelerating data center (DC) build-out in India & how we are playing this theme.

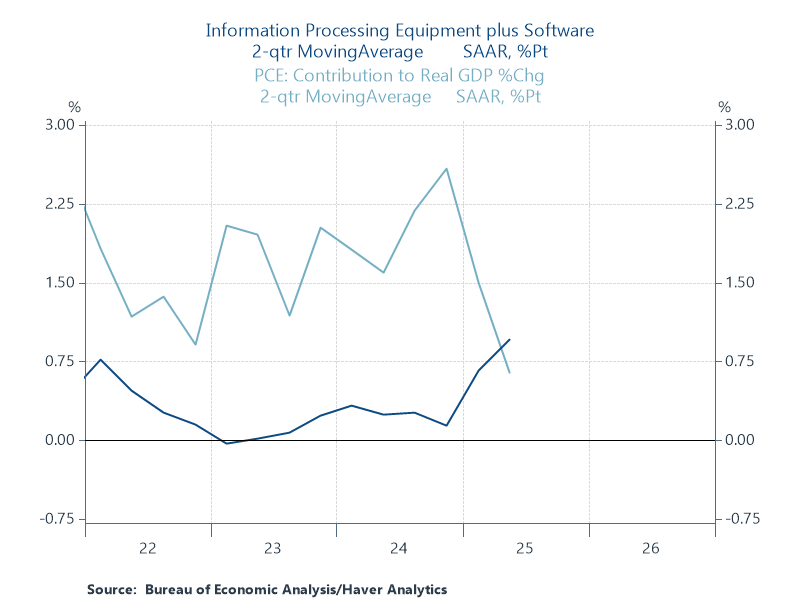

Moving the Macro Needle

America runs on consumer spending. Personal Consumption Expenditures (PCE) accounts for roughly 70% of its total GDP. Therefore the biggest part of incremental GDP growth in their country every year is generally defined by this PCE/consumer spending trajectory. But the year 2025 has turned out to amongst strangest one - where the contribution to GDP growth by Information Processing Equipment + Software (famously called AI Capex) has added more to the GDP than consumer spending in H1.

Infact, estimates from S&P Global even suggest that 80% of the growth in USA’s final private domestic demand (i.e. GDP less net exports, government and inventory ) came from DCs and high-tech-related spending.

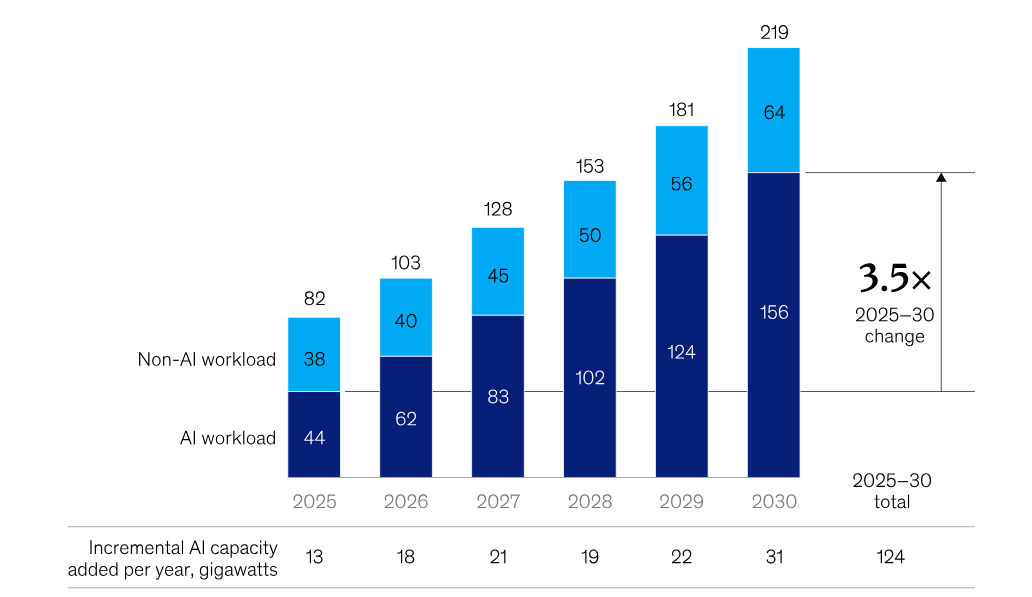

Ever since 30th November 2022 - the date since when ChatGPT got launched by OpenAI, the need for AI computation has been exponential compounding worldwide which is propelling the need for DCs. Back then only 10% of global DCs were actually dedicated for AI computation.

But now in 2025, more than half of centers (~53%) are built to handle the AI workload globally. Going forward, the AI capacity is expected to rise a further 3.5 times between 2025-2030. Mckinsey calculates that companies across the compute power value chain will need to invest $5.2 trillion into DCs by 2030 to meet worldwide demand worldwide for AI alone. They project total 156 gigawatts (GW) of AI-related DC capacity demand by 2030, with 124 incremental GW added between 2025 and 2030.

How will that Capex be Spent?

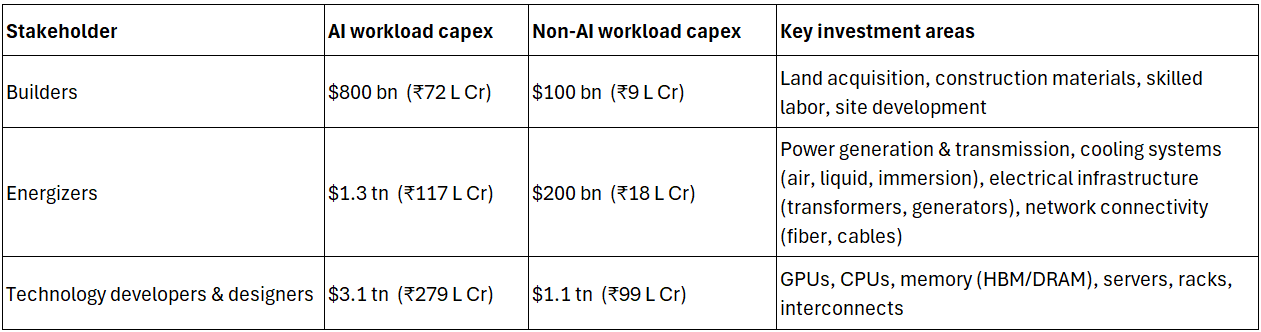

For the $5.2 trillion of expected capex to be spent between 2025 - 2030, there are 3 types of stakeholders where this spending will be allocated:

Builders (~15%): real estate developers, design firms, and construction companies that build, expand and upgrade DCs, such as global companies like DPR Construction, Mercury Engineering, and Indian companies like STT GDC India, Yotta Infrastructure, NTT Global DCs; and EPC players like AECOM, Sterling & Wilson.

Energizers (~25%): companies that supply the electricity and cooling systems essential for DC operations include global utilities like Duke Energy and Entergy, as well as infrastructure and equipment providers such as Schneider Electric. Onsite power generators like Bloom Energy (USA) also fall into this category, and their suppliers like MTAR Technologies (India) are also part of the value chain.

Technology developers & designers (60%): semiconductor companies that develop the chips powering AI workloads, such as NVIDIA and Intel, and computing hardware suppliers such as Foxconn and Flex

Apart from above mentioned 3 stakeholders, we also have Cloud Operators like Amazon Web Services, Google Cloud, that own and run large-scale DCs; and also AI Architects like OpenAI & Anthropic who are developing AI models. These 2 stakeholders represent the demand-side pull, whose computation requirements are driving significant spending.

Where is India in this AI Race?

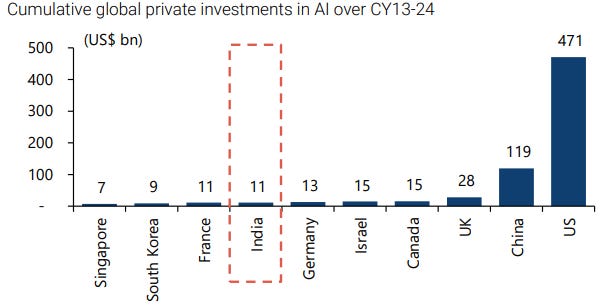

Between 2013-24, global AI investments totalled over $1.3tn, with $0.6tn by private firms. US did $471 Bn in cumulative private AI investments, leading in most layers of the AI stack. China ranked second with $119 Bn, closing the gap in AI models.

India was at a distant #7 ($11 Bn)

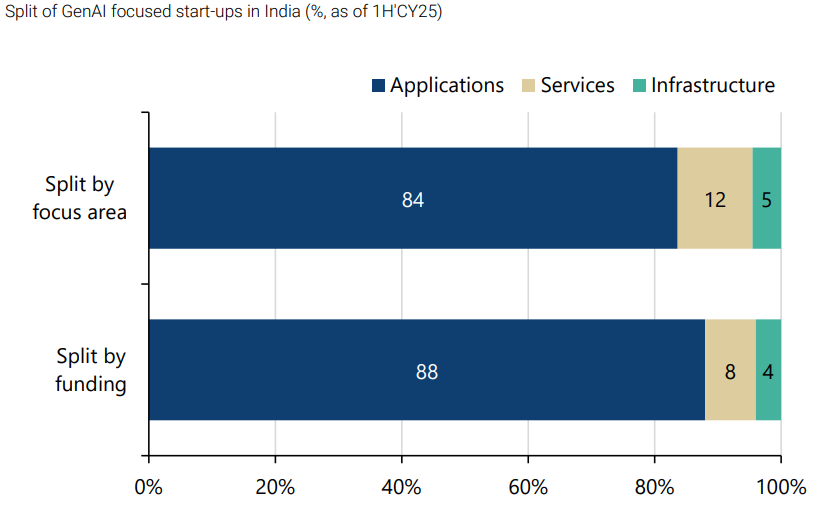

US companies dominate the hardware as well as the cloud, making them indispensable in the AI ecosystem. Even in India, GenAI focused start-ups have started to emerge in this global backdrop, with ~900 startups as of June 2025, which was ~250 as of June 2024 and just ~50 as of June 2023.

But about 84% of investments in India are focused on application development, and c.88% of funding is flowing into application first ventures.

The infrastructure (cloud, compute) and services (data, MLOps, LLMOps) layers of the AI stack remain comparatively underfunded.

While application layer does match the country’s structural strengths (due to services orientation of our economy), infrastructure investments are rare due to their capital-intensive nature that requires certain scale. Foundational layers continue to be dominated by global hyperscalers and model providers, where as startups in India tend to build on top rather than compete head-on.

So, will India invest in Data Center Infrastructure?

Short answer: yes, it has to.

India constitutes 20% of the world’s population & produces 20% of the world’s digital data but only one-tenth of it is stored here in the country. Most of our data is actually sold to us in dollars after being processed by tech giants outside the country. Government has taken a note of this.

Therefore, while in countries like the USA the rising need for AI computation is the primary driver of rapid data center build-out, in India one of the key drivers today is regulation, which is pushing companies to set up infrastructure within the country:

Regulatory push for data sovereignty: RBI (2018) and SEBI (2023) mandates require payments and financial-sector data to be stored and processed within India.

Stricter control over cross-border data flows: DPDP Act (2023) strengthens personal data protection while empowering the government to restrict cross-border data transfers, reinforcing long-term data localisation trends.

Policy-led infrastructure build-out: MeitY’s Data Centre Policy (2020) anchors India’s ambition of a $1 trillion digital economy by enabling large-scale investments in reliable power, connectivity, and domestic IT and power equipment manufacturing.

In fact, non-compliance of rules led to ban on Mastercard and Amex by RBI in 2021, which triggered a surge in demand for domestic DCs as firms rushed to localize data.

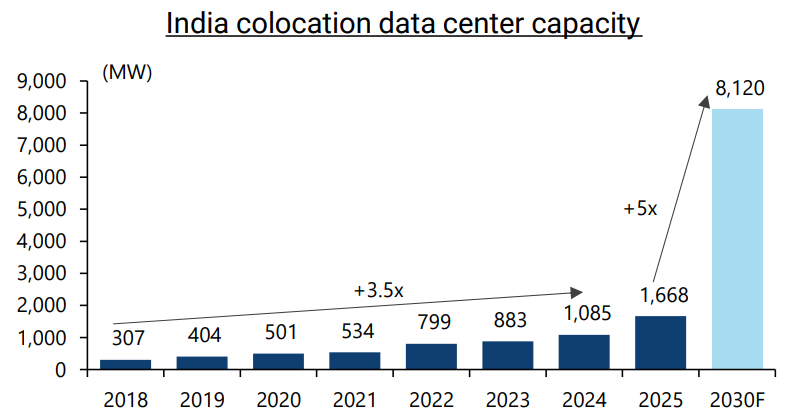

With ever rising data traffic that has grown (30x since FY17) driven by rising internet penetration as well as growing data usage + smartphone adoption, and the need to lower the latency by having the center near to customers makes it crucial to invest into this infrastructure.

Hence, India’s data center capacity is set to jump 5x to 8GW by 2030 over 2025, which could require facility capex of $ 30bn (ex. servers) fueling 5x jump, as per Jefferies.

Some Big Bang Announcements

Hyperscalers have made many big investment announcements into India in 2025. Microsoft & Amazon announced plans to invest a combined $52.5 Bn in India over the coming years, with Microsoft committing $17.5 Bn to strengthen the country’s AI ecosystem & Amazon pledging $35 Bn to accelerate AI-driven digitisation to be spent by 2030.

Google as well has announced a $15 Bn investment to build an AI data hub. Intel has committed support for Tata’s semiconductor manufacturing plans, and Meta is reportedly exploring a data centre partnership in India linked to its Waterworth subsea cable project. It remains to be seen how much of these announcements will translate into actual on-ground investments.

But What Exactly goes Inside a Data Center?

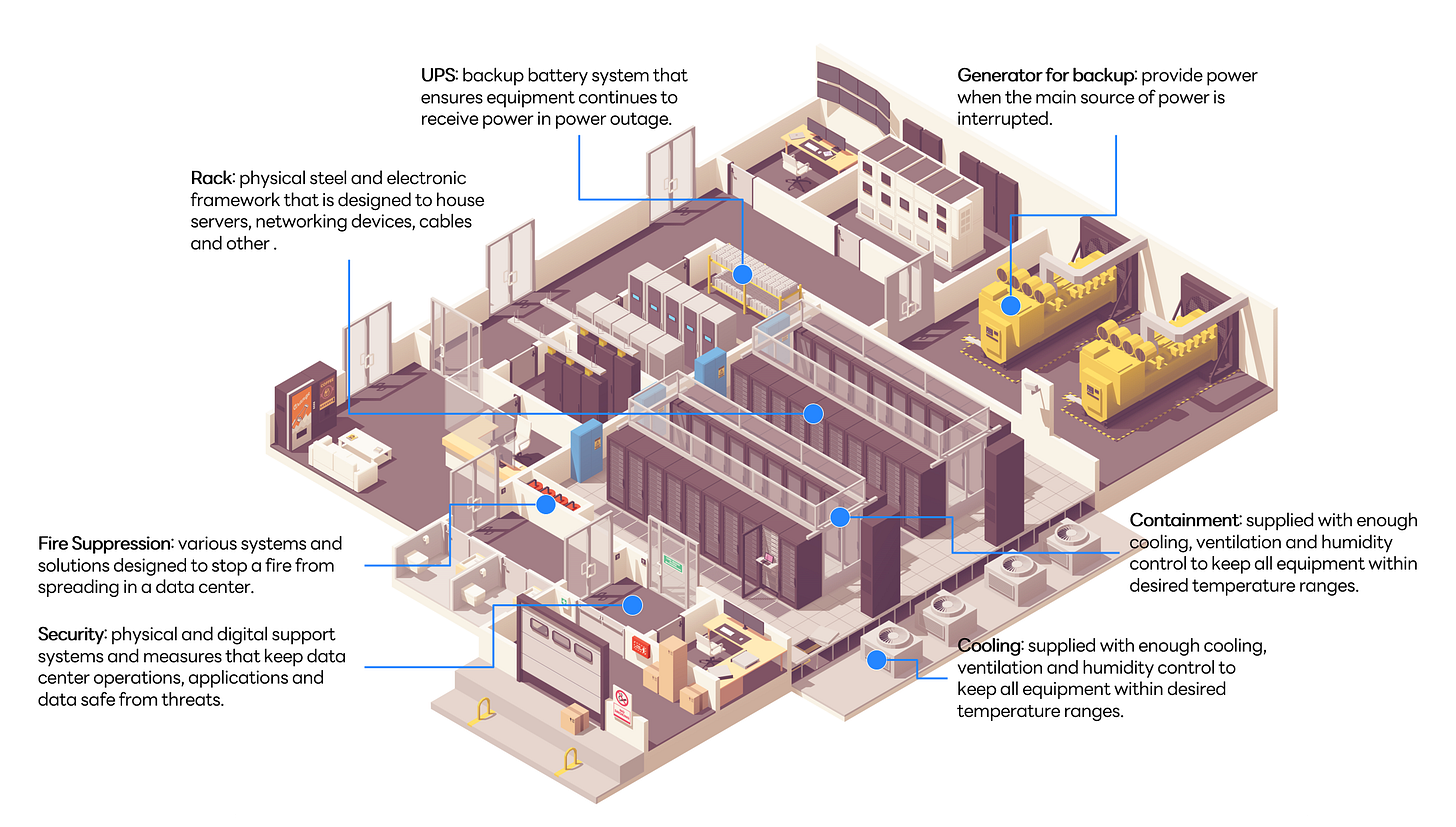

A DC can be broadly categorised into two main segments:

Non-IT infrastructure (the building and support systems)

IT hardware (the computing equipment)

The non-IT infrastructure, which forms the physical shell and support systems of the DC, refers to the real estate, fundamental construction materials like steel and concrete, and basic electrical systems such as wiring and transformers. Furthermore, services like architectural design, engineering, and final system integration are primarily handled by domestic Indian firms.

Whereas, the high-value, performance-critical IT hardware that constitutes the core function of the DC, also called the servers. The single largest area of reliance is in advanced microelectronics, where essential components like CPUs, GPUs, and specialized AI processors are almost exclusively sourced from global suppliers in the US, Taiwan, and South Korea. While India has made early strides by setting up the right policies including PLI to bring investment in building this critical components/chips, we are still few year away from actual large scale commercial production of server components in India.

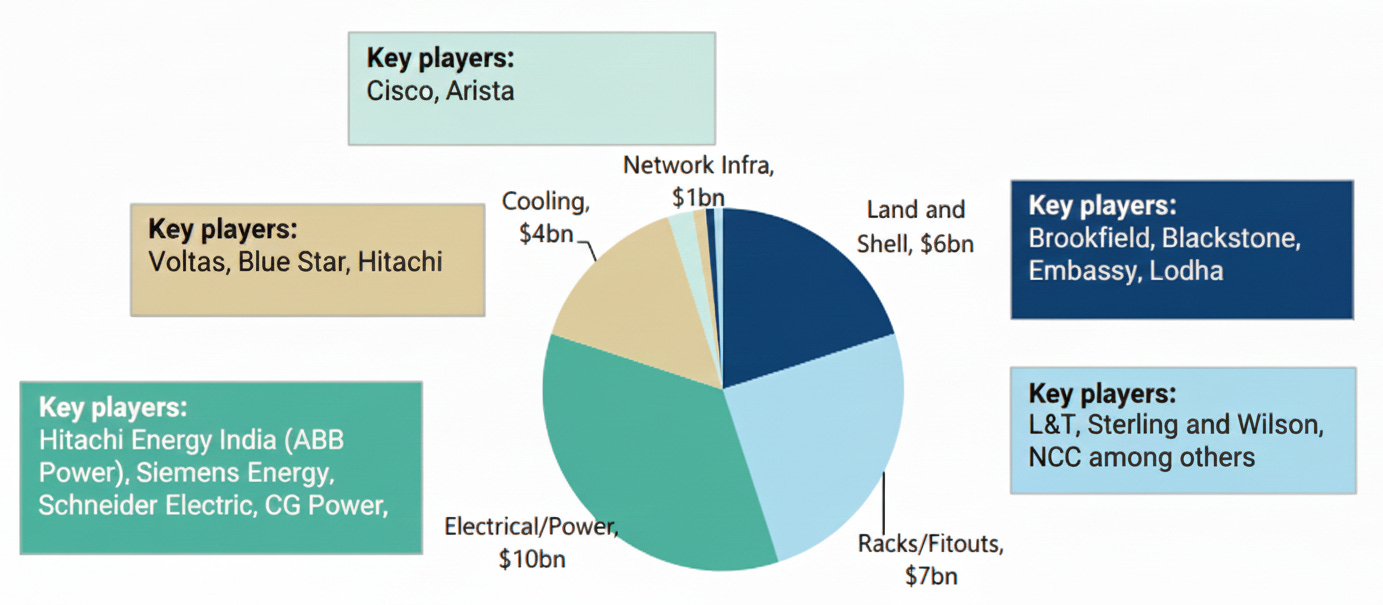

While India ramps up its DC capacity by 5x in the next 5 years, Jefferies expects about $30 Bn would be spent on Non-IT infrastructure. This will create downstream opportunities for companies related to Real estate, Electrical and power systems, Racks/Fitouts, Cooling systems and Network Infrastructure. The pie chart below gives a clear image of how the opportunity poor is split between players handling key component⬇️

Here comes the role of an EPC player that is focused on end-to-end execution, from design to commissioning. We shall discuss this next.

EPC - What Critical Role does it Play?

An EPC (Engineering, Procurement, Construction) company is responsible for turning a hyperscaler’s or enterprise’s design and capacity requirement into a live, operational facility, on time and within uptime specifications. In other words, they basically build the DCs for their clients & hand it over to them after commissioning is complete. Key roles of an EPC company includes:

Engineering: translating uptime requirements into design

Procurement: managing complex, long-lead supply chains

Construction & integration: execute & ensure redundancy paths work exactly as designed

Testing, commissioning & handover

The skill sets required for a data center EPC company are different from traditional ones. These companies are differentiated by their deep understanding of the technology and its subcomponents, strong design capabilities, established OEM partnerships, program management skills, with near-zero tolerance for error, and a proven track record of delivering such projects.

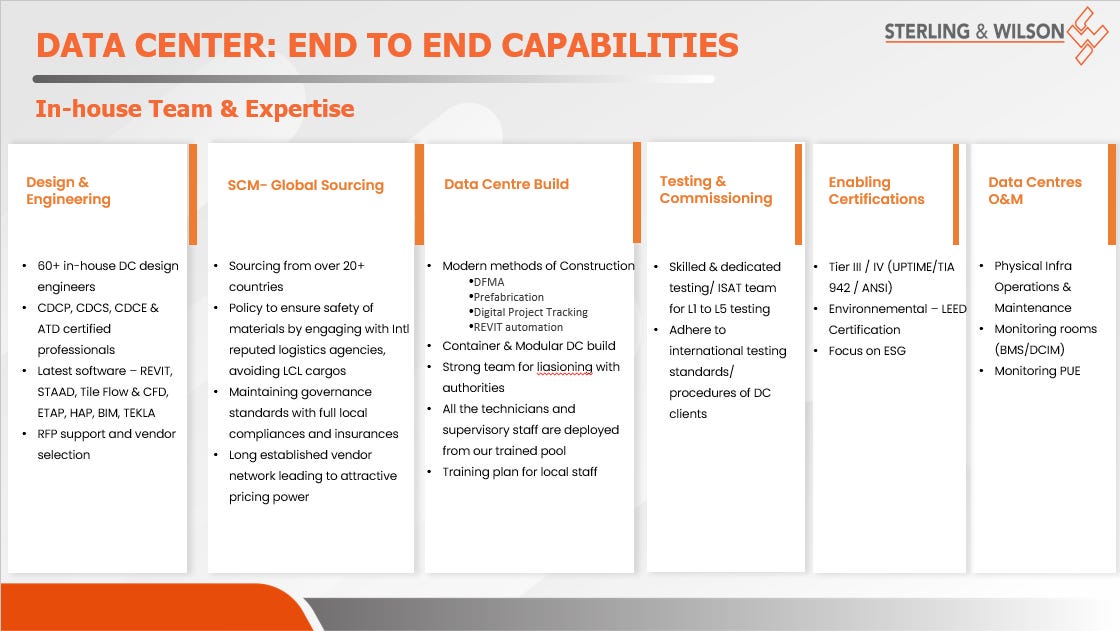

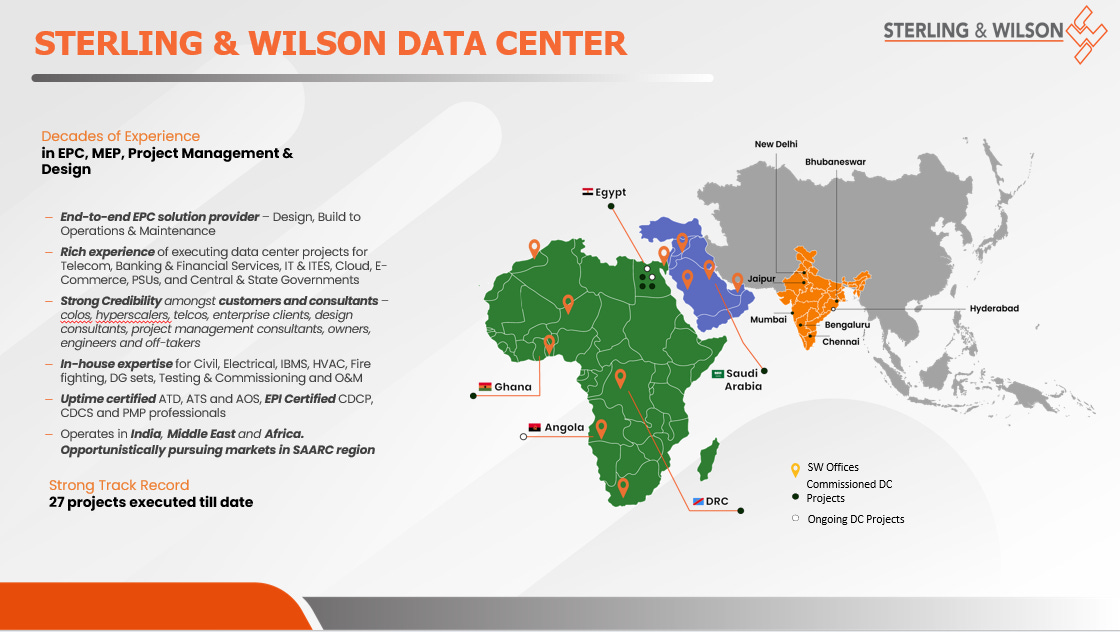

Singularity AMC’s investment in Sterling & Wilson DC is driven by the rapid expansion in DC capacity and the critical need for reliable execution capability to deliver it. Simply put, regardless of who builds the capacity or where it is located, a proven DC EPC player stands to benefit from the scale of this opportunity.

Why Sterling & Wilson Data Centers fits this Moment?

Sterling & Wilson DC is among a very small set of EPC players in India that can deliver end-to-end turnkey DCs, covering civil works, power, cooling, mechanical systems, integration, testing, and commissioning under a single execution umbrella. This matters because modern DCs are no longer modular construction projects stitched together by multiple vendors. They are tightly integrated systems where power, cooling, redundancy, and control layers must function flawlessly from day one.

S&W DC operates in a segment of the value chain that is both critical and capacity constrained. Over time, this has created credibility with hyperscalers, colocation providers, telecom operators, and enterprise customers, where delivery track record often matters more than price. In our view, once a data center EPC player is trusted to deliver a live facility at scale, repeat business and larger mandates tend to follow.

DC EPC is no longer about lowest-cost construction; it is about executing under compressed timelines with future scalability, along designing for uptime and redundancy. Global Hyperscalers are willing to pay a premium if an EPC contractor demonstrates deep in-house design capability, familiarity with global standards, and the ability to coordinate across OEMs, consultants, and hyperscaler specifications. These are not capabilities that can be built overnight.

Why EPC offers a Cleaner Bet on DC Growth

From an investor’s lens, the EPC layer offers a cleaner exposure to DC growth relative to owning capacity or betting on utilisation assumptions. EPC players benefit from capacity addition, regardless of who ultimately owns or operates the DC. This becomes particularly relevant in India, where DC capacity is expected to expand rapidly due to regulatory requirements, hyperscaler investments, and latency-driven localisation. Additionally, it is the only Indian DC EPC company with international execution experience, while others exist but generally do not undertake projects overseas.

The business tends to be asset-light, working-capital efficient, and driven by engineering skill rather than balance sheet size. Execution quality, not capital intensity, becomes the key differentiator here.

While India would continue to be dependent on imports of chips/servers which is the biggest cost component of a DC for sometime at least till the ecosystem develops, we believe an equivalent role an efficient EPC player plays in accelerating the ecosystem development & localization.

Bottom Line

The AI + cloud cycle is reshaping global infrastructure priorities. In the US, it is being driven by compute intensity. In India, besides AI, it is being accelerated by data sovereignty + regulation, leading to big hyperscaler commitments. Both forces point to one outcome: a sustained, multi-year build-out of data center infrastructure.

While much of the attention sits on chips, models, and cloud platforms, the physical layer that enables compute at scale is where capital is quietly being deployed today. Within that layer, companies that can reliably convert capital into live, compliant, high-uptime infrastructure stand to compound value over time.

Sterling & Wilson DC represents this execution capability. It is not a bet on any single customer, technology, or geography, but on the inevitability of DC build-out and the scarcity of proven execution partners.

That, ultimately, is why this category matters, and why this company fits our investing lens.

Checkout our recent posts:

The stock has taken a hit and is sitting at rock bottom for a while now. Leaving that aside even the balance sheet looks pretty messed up so what parameters does one bet on?