Inside the Battery: Critical Minerals Powering Our Autonomous Future

India’s quest for battery self-reliance and why it matters today

In this long deep-dive, we explore the interconnected trends shaping the future of mobility, energy, and geopolitics - powered by one core technology: Batteries. At Singularity, our aim is to take bold bets and help India achieve strategic autonomy in this space. Let’s get started!

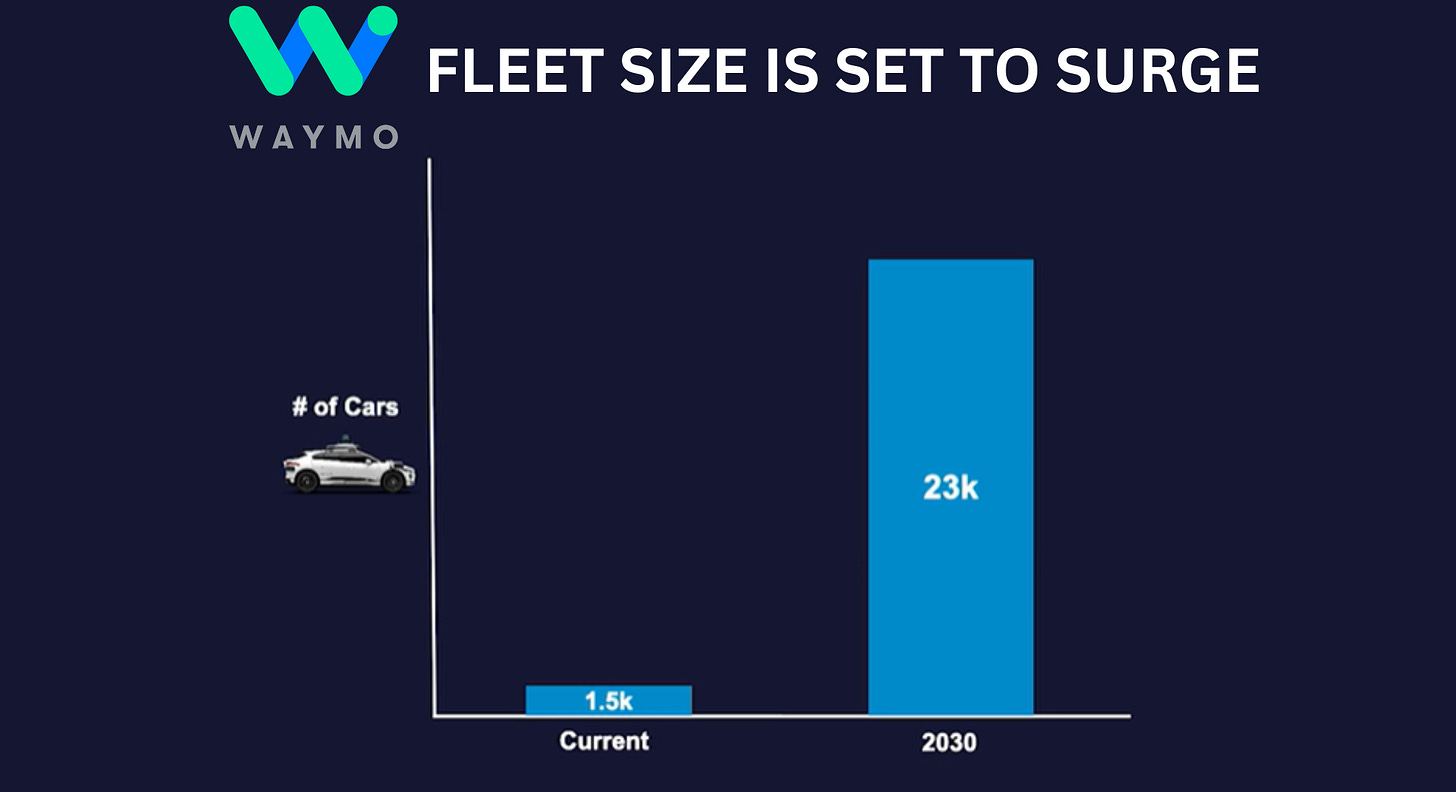

Imagine stepping into a car with no driver on the steering wheel, all-electric vehicle that navigates city streets on its own. This isn’t science fiction; it’s the daily reality for riders of Waymo’s autonomous fleet of cabs in cities like San Francisco, Los Angeles, Phoenix and more. These cars have already completed over 10 million rides in the US, and are doubling every few months in 2025. As of May, these cars have surpassed Lyft to become the 2nd-largest on-road trip provider in the Silicon Valley.

But these look very different from a normal EVs. These are Jaguar I-PACE model cars equipped with an array of 29 high-resolution cameras, 5 lidar sensors, and 6 radar units, which helps them deliver precise 360-degree perception for safe, fully autonomous driving. They contain server-grade GPUs to process real-time data, fusing high-resolution maps with live sensor input, identifying objects and road users, predicting their behavior, and planning safe driving actions - all within milliseconds to fully autonomous operation and ensuring Waymo comes out as the safest autonomous cab present in the market.

And with initial success, Waymo is now launching in many more cities in the US, and also going global by launching in Tokyo where they got the approvals. Estimates from Morgan Stanley suggests that the number of Waymo cars could go up 15X in the next 5 years, for which the company has also partnered with Hyundai to produce all-electric IONIQ 5 SUV cars for them.

Additionally back in 2017, Singularity had also invested in Wayve - a market leader in autonomous driving in UK, which later got funding from Microsoft, Nvidia & Softbank. They also partnered with Uber to drive autonomous taxis in UK.

🚀 What’s Inside

We break down the most important pointers:

How need for on-device compute puts strain on a battery?

Why lithium-ion batteries are at the heart of electric revolution along boosting adoption of renewables?

What exactly goes inside lithium-ion batteries?

Where does India stand & how can we achieve Strategic Autonomy?

How Singularity is making a difference & insights from Summit 2025.

Emerging technologies & the impact of it.

Let’s get started!

🔋 Compute Puts Strain on Your Battery!

In order to power such high accuracy computing, Waymo cars tend to have relatively larger than usual batteries. For example, currently used Jaguar I-PACE model cars are powered by a large 90-kWh liquid-cooled lithium-ion battery in them, which is relatively bigger than most standard EVs like Tesla Model 3 which comes with capacities ranging from 60-kWh to 75-kWh battery.

While no specific details have been shared by Waymo’s team about how much additional power is required to ensure highest level of real time accuracy, few studies performed till now have found that an autonomous car is expected to consume 10%–15% more power in city driving over a normal EV car driving which could also potentially go up to 30% as well, for ensuring highest safety controls are held up. Infact, a study by MIT researchers reported that autonomous vehicle like these, if adopted widely, could consume combined energy that generate total emissions much more than countries like Argentina and even Canada, just because of their computational need.

One key aspect to understand here is the difference between on-device & off-device compute. When ChatGPT or Perplexity search is performed by a user on a smartphone, it has a negligible impact on the user’s own device power consumption as the computational load is handled ‘off-device’ in massive data center located far away. This doesn't really put a strain your mobile the battery of that smartphone.

However, what we see in case of an autonomous vehicle, is actually an example of on-device processing - where inference and computation happens directly on a given device and this has the potential to put stain on the battery because of additional computational needs. While this enhances speed, privacy, and offline functionality, but battery constraint becoming a bottleneck is a real possibility, which could be impacting companies like Apple as well.

Back in October 2024 when Apple launched its most awaited ‘Apple Intelligence’, many users reported a noticeable increase in battery drain, especially when actively used or during initial setup after an update. Infact, battery issues arose even when Apple had not even launched many of its promised new features. And majority of the computationally-heavy AI features only worked because Apple’s online services division had fortuitously conceived a cloud server project that could handle anything the phone couldn’t implying many AI capabilities were shifted from ‘on-device’ processing to ‘off-device’ processing. This could have been one of the reasons which potentially led to delay in the launch of AI powered Siri.

All in all, batteries play a very critical role, and our lives are increasingly becoming dependent on them. As technology progresses, they have constantly evolved & continue to advance at a fast pace. Now, let’s understand batteries in a detailed way - exploring the fundamental reasons behind their rising importance, and why strategic autonomy is the need of the hour for India.

Batteries: The Heart of Electric Revolution 🚗

They have long powered everything from inverters to mobile phones till now. The most commonly used in pre-covid time ‘Lead-Acid batteries’ became a cheap and reliable source for storage of power for starter batteries in cars and UPS systems, and multiple more use cases. But because they were too heavy and not suitable for long-range EVs, the actual eureka moment was waiting for evolution to take place in batteries.

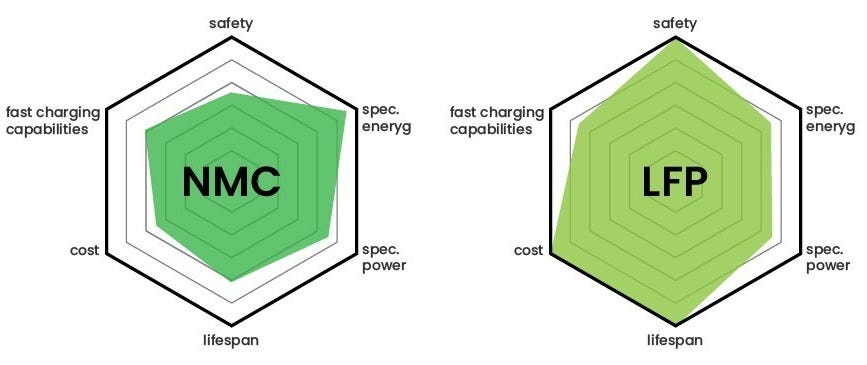

And then came Lithium-ion batteries that changed our prospective forever. Since their commercial debut in the 1990s, they become the backbone of all portable electronics and electric vehicles (EVs). Known for their lightweight design and high energy density, they outclass older battery types like lead-acid or nickel-based alternatives be a huge margin. Among the various Li-ion chemistries, NMC and LFP have emerged as the front-runners.

NMC (Nickel-Manganese-Cobalt) batteries are prized for their high energy density. Ideal for applications where space and weight are at a premium like smartphones, laptops, and lightweight EVs. However, cobalt comes with its own set of problems: it’s costly, faces supply chain constraints, and often involves ethically questionable mining practices. And reducing cobalt content, the battery start to overheat often, and in rare cases, even explode.

LFP (Lithium Iron Phosphate) batteries offer a different set of advantages. They forgo nickel and cobalt entirely, and therefore are cheaper, safer, and more stable under thermal stress. The trade-off has historically been lower energy density, resulting in larger and heavier battery packs. But innovation is quickly changing that. Today’s LFP batteries are closing the performance gap with NMC, while remaining about 30% more cost-effective per kWh. That’s why LFP now powers nearly half of all new EVs sold globally. (Source: IEA)

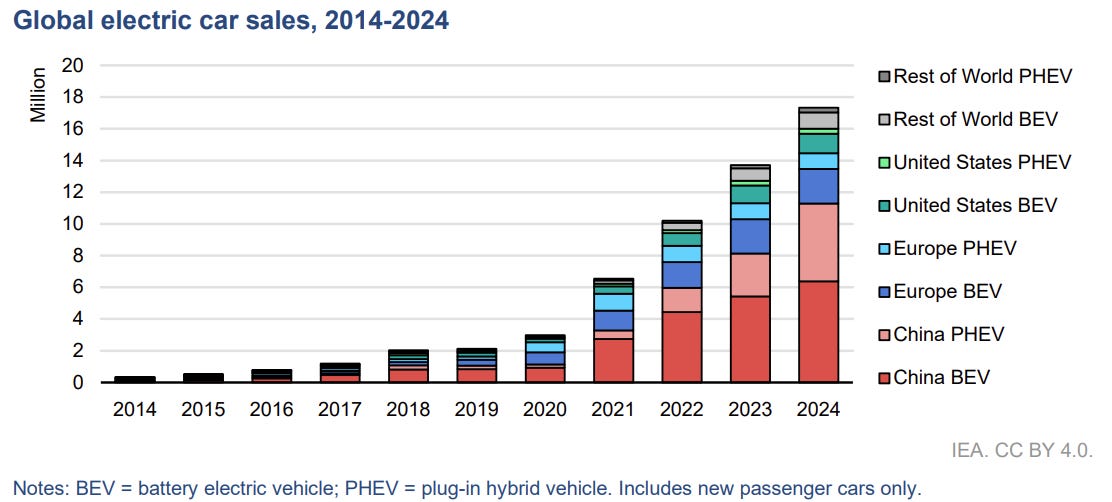

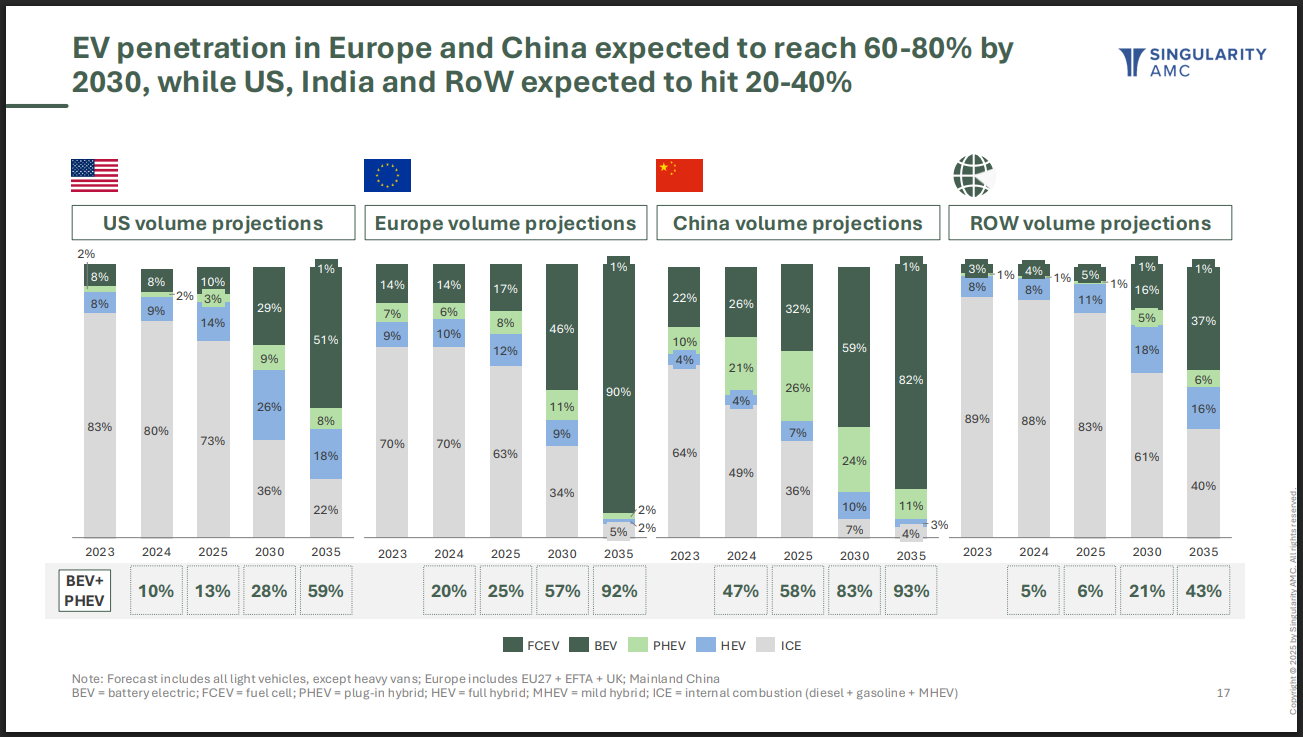

The impact of this advancement has been clearly visible on EV penetration across geographies which continues to move away from combustion engine cars that uses petrol, with aim of a cleaner environment. Regions like Europe and China are expected to reach 60% to 80% EV penetration by 2030!

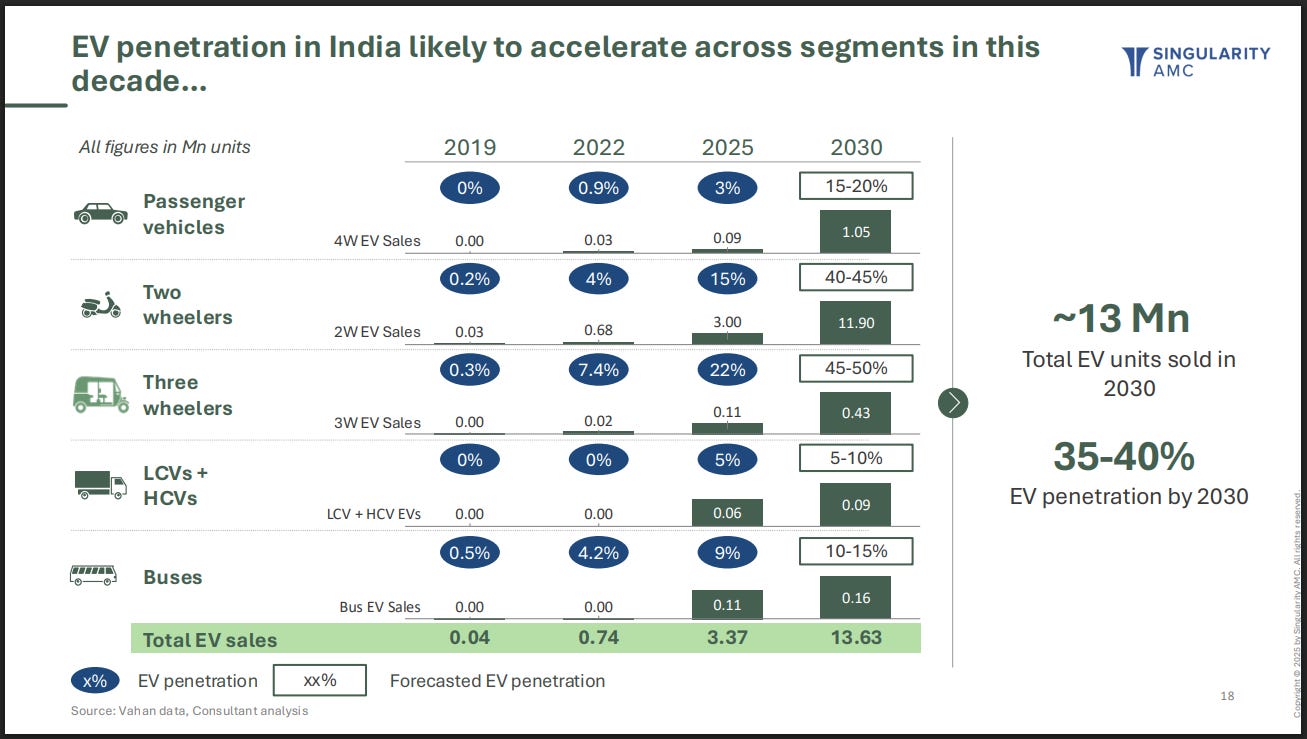

And on the other hand, while India has been slow compared to the developed economies and China in adoption of EVs, we are catching up fast. About ~20% of our cars, ~40% of 2-wheelers and ~50% of 3-wheeler are expected to be EVs by 2030 as the below slide shows:

That’s not all. Along with helping in faster EV transition, latest batteries also helps us meet our renewable goals sooner.

Powering Our Shift to Renewables♻️

While ~75% demand for these advanced batteries is driven by EVs, there is another important use case that advancement in batteries unlocked is the ability to store the renewable source of energy which is generally produced from a renewable source like solar and wind that are inherently intermittent -

“Solar power is so obviously the future for anyone who can do elementary math”

- Elon Musk, Tesla (June 2025)

Solar panels only produce power when the sun shines, and wind turbines only spin when the wind blows. But electricity demand doesn’t follow the weather. To ensure a reliable 24/7 power supply from renewables, we need a way to store excess energy and deploy it when needed. And that’s where grid-scale battery systems, also known as Battery Energy Storage Systems (BESS), come into play.

These systems absorb surplus electricity when generation is high - typically during sunny or windy periods - and release it later, especially during evening peaks or lulls in renewable output. Beyond storage, BESS also plays a key role in stabilizing the grid, responding instantly to fluctuations and helping maintain frequency and voltage balance.

Roughly ~20% of total advanced battery demand is driven by BESS shown above which is crucial for global renewable transition.

Rate of Transition is Accelerating📈

A battery is the single largest cost component in most electric vehicles, typically accounting for 30–40% of the total value of an EV making it a ‘make or break’ part of a vehicle and for the whole EV industry. With advancement of technology and raw material remaining in oversupply zone for last few years, the lithium-ion batteries have become much more effective & efficient over time - making an EV much more suitable for end consumer. Back in 2010, battery packs cost over $1,100 per kWh. In 2025, that’s come down to around $130 per kWh, a nearly 90% reduction over 15 years. Goldman Sachs expects them to plummet further, to $80 per kWh by 2026, unlocking full cost parity with ICE vehicles in many markets

Therefore, the average car price difference of an EV car with that of an conventional cars in developed markets like Germany and USA is just in the range of 20% to 30% in 2025. In fact in countries like Thailand the prices are at par already, with Chinese imported cars even more cheaper than the conventional car powered by fossil fuel.

Falling prices coupled with government incentive in certain countries to adopt EV continuing, has led to a boom in overall sales worldwide as shown in the graph below.

EV launches in India in 2025 are set to surpass petrol and diesel cars. Out of 28 vehicle launches planned for the year, 18 are electric, according to a report by The Economic Times.

🔍But What Exactly Goes Inside Lithium-ion Batteries?

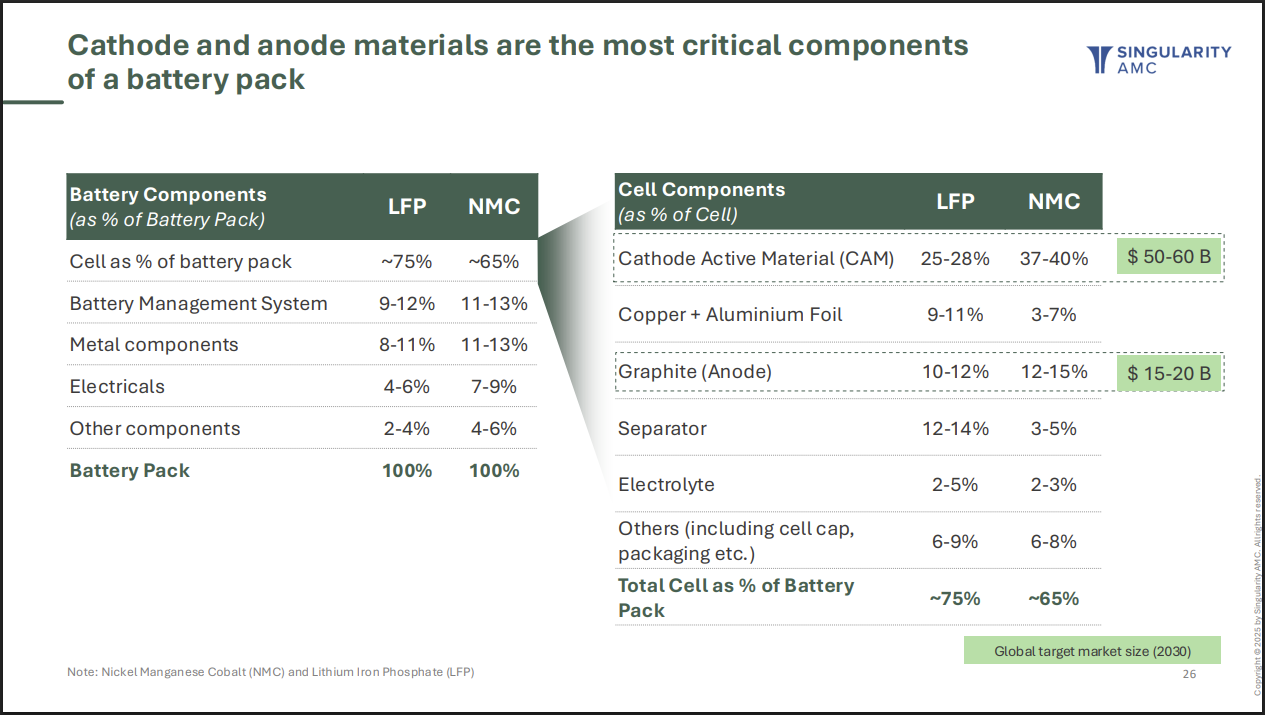

Any battery is made up of several key components, each playing a crucial role in how the battery stores and releases energy. But at its core, there are 2 key components of a battery, taking example of a lithium-ion battery:

Cathode (Positive Electrode): These are usually made from lithium metal oxides such as lithium iron phosphate (LFP), or lithium nickel manganese cobalt oxide (NMC). The cathode is responsible for supplying lithium ions during battery operation and its material largely determines the battery’s energy density, voltage, and cost.

Anode (Negative Electrode): Most commonly composed of graphite, the anode stores lithium ions when the battery is charged and releases them during discharge.

So both Cathode & Anode are basically made up of critical minerals which are mined from earth, refined and then sent to factories where their chemistries are prepared which go inside. We also have a ‘battery management system’ which acts as the brain of a battery for its optimal usage, along with more metal components, electricals in place that play their crucial role.

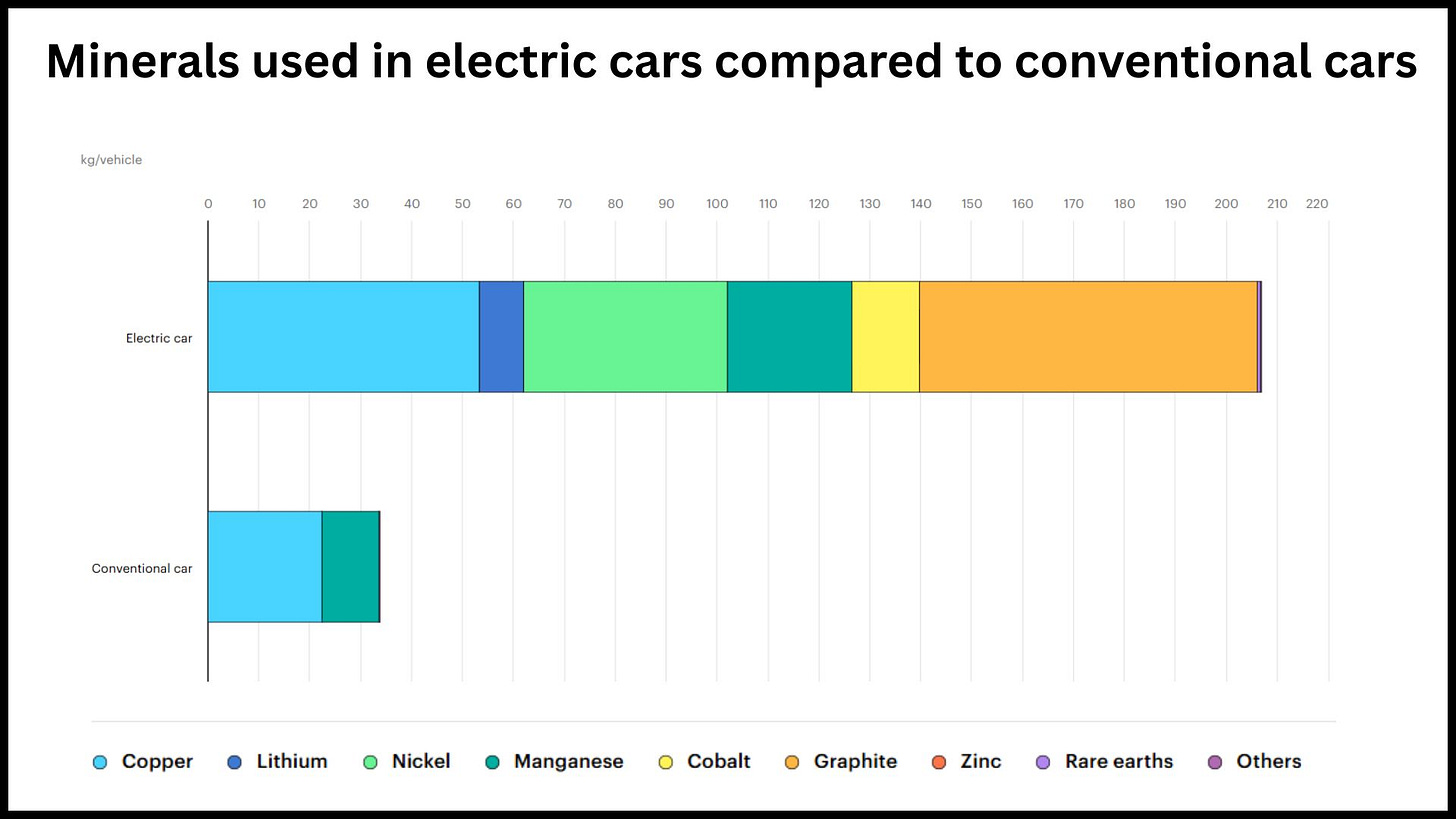

A typical EV contains 6 times more mineral content by weight than a petrol or diesel car. While ICE vehicles rely mainly on steel, aluminum, and small amounts of copper, EVs depend heavily on lithium, nickel, cobalt, graphite, and rare earths to power their batteries and electric drivetrains. For instance, an EV battery alone can contain 50 to 80 kg of copper, 30 to 40 kg of nickel, 10 to 20 kg of manganese, 8 kg of lithium and 50 to 70 kg of Graphite, compared to just a few kilograms of copper and manganese in a conventional vehicle.

Today as of 2024, the EV penetration stands at 20% of total cars sold globally. And for every 1% increase in global electric vehicle (EV) car penetration, the demand for these key minerals would rise by thousands of tons.

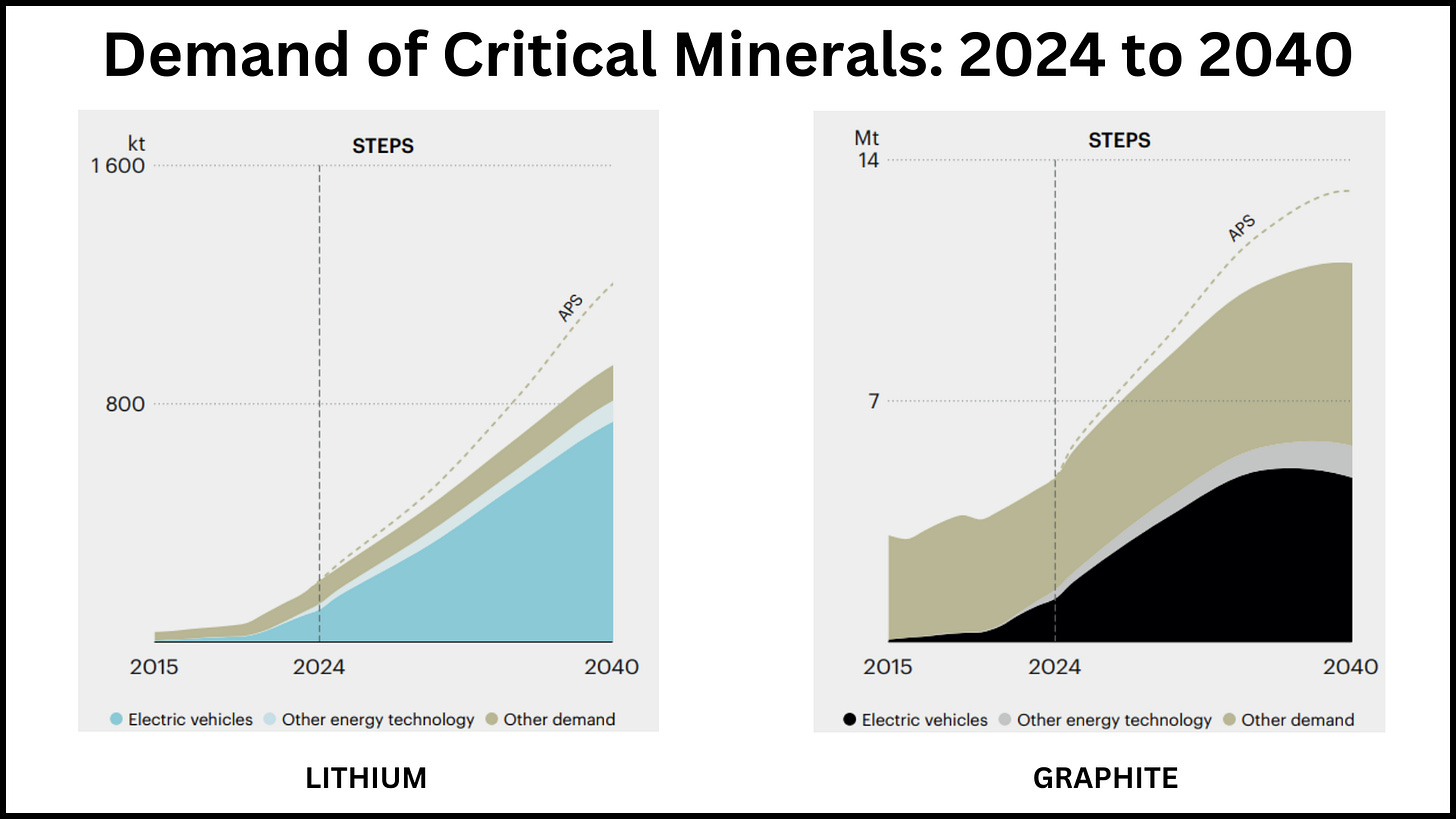

As the EV car sales rose by over 25% in 2024, the most critical mineral in this transition, Lithium, saw its demand expanding by 30% year-on-year. While its demand has already tripled since 2020, it is actually expected to see another tripling over the next decade with EV sector accounting for 90% of this additional demand. Similarly, for Graphite which goes along Lithium in a battery, is actually the most heaviest mineral by weight in a typical EV or energy storage battery today, is expected to remain as most common material for all lithium-ion battery chemistries.

International Energy Agency also expects the global investment in battery storage (BESS) to triple by 2030, which would further give a leg up to demand for minerals that go into lithium-ion batteries.

🌏 Where does India stand?

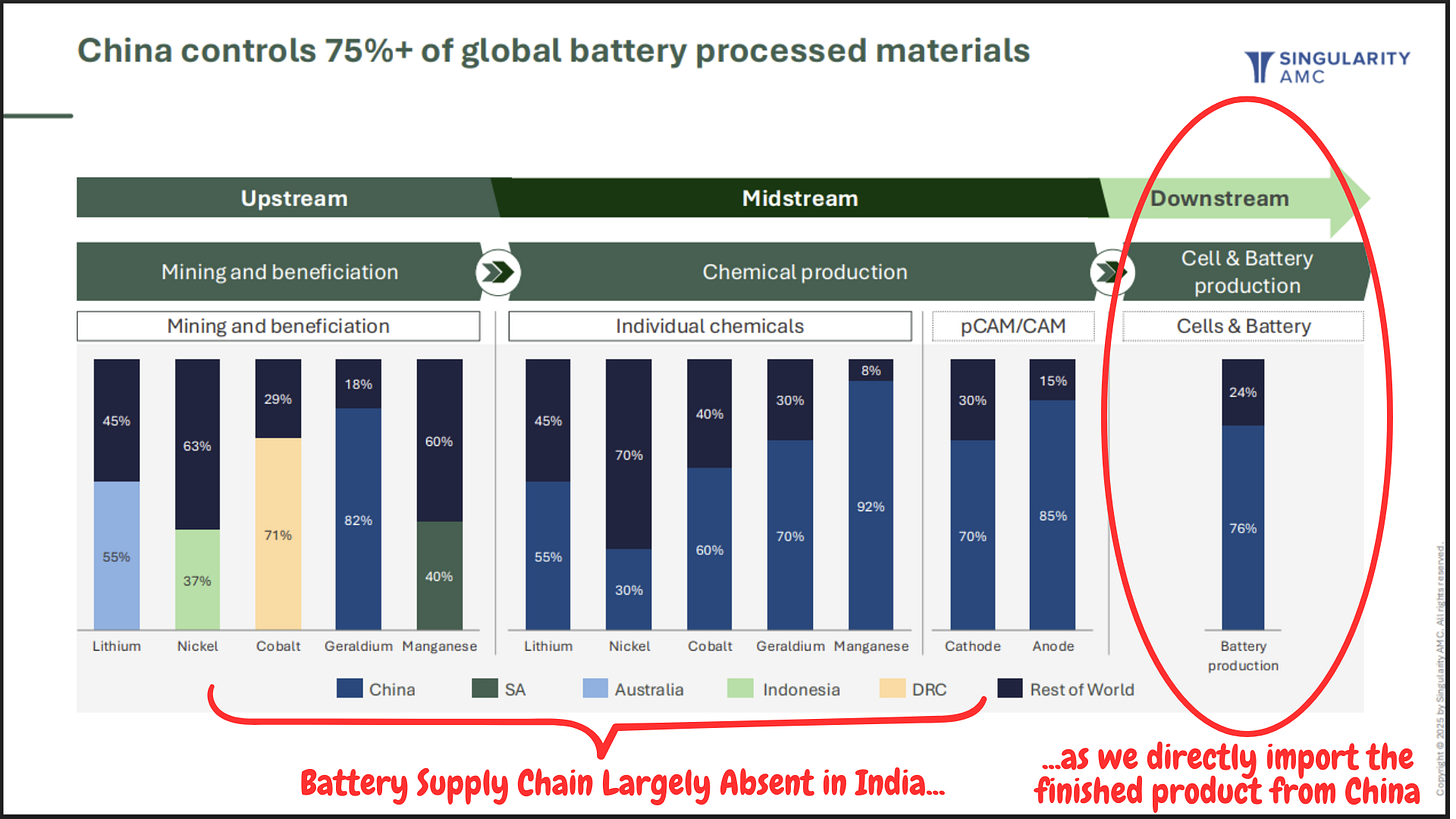

India’s battery supply chain remains heavily dependent on imports for part of supply chain - from raw materials like Lithium, Nickel, Cobalt to chemical production of their useful chemistries to construction of Cathode/Anode and also finished cells! In fact in FY24, over 84% of India’s lithium-ion battery imports came from China and Hong Kong, and the our domestic manufacturing is still largely limited to final stage low-value assembly and packaging, with most high-value cell components and manufacturing equipment sourced from abroad.

Situation is similar in case of Graphite which used as Anode in a Lithium-ion battery and is produced from needle coke (form of carbon).

This is were Strategic Autonomy comes into picture. As India’s clean energy and electric mobility ambitions accelerate, achieving battery autonomy is no longer just a technological aspiration - it is a strategic necessity. Especially as we are fast moving towards an autonomous future where batteries requirement could grow exponentially, relying heavily on imports for everything that goes inside it, exposes our country to global price volatility, supply disruptions, and geopolitical risks, all of which can undermine energy security and economic growth.

“India has 6% of global critical mineral reserve, but less than 0.5% of global output - We don’t know how to use it”

- Rajat Verma, Founder & CEO, Lohum at Singularity Summit 2025

Strategic Autonomy🛡️: Need to Act today!

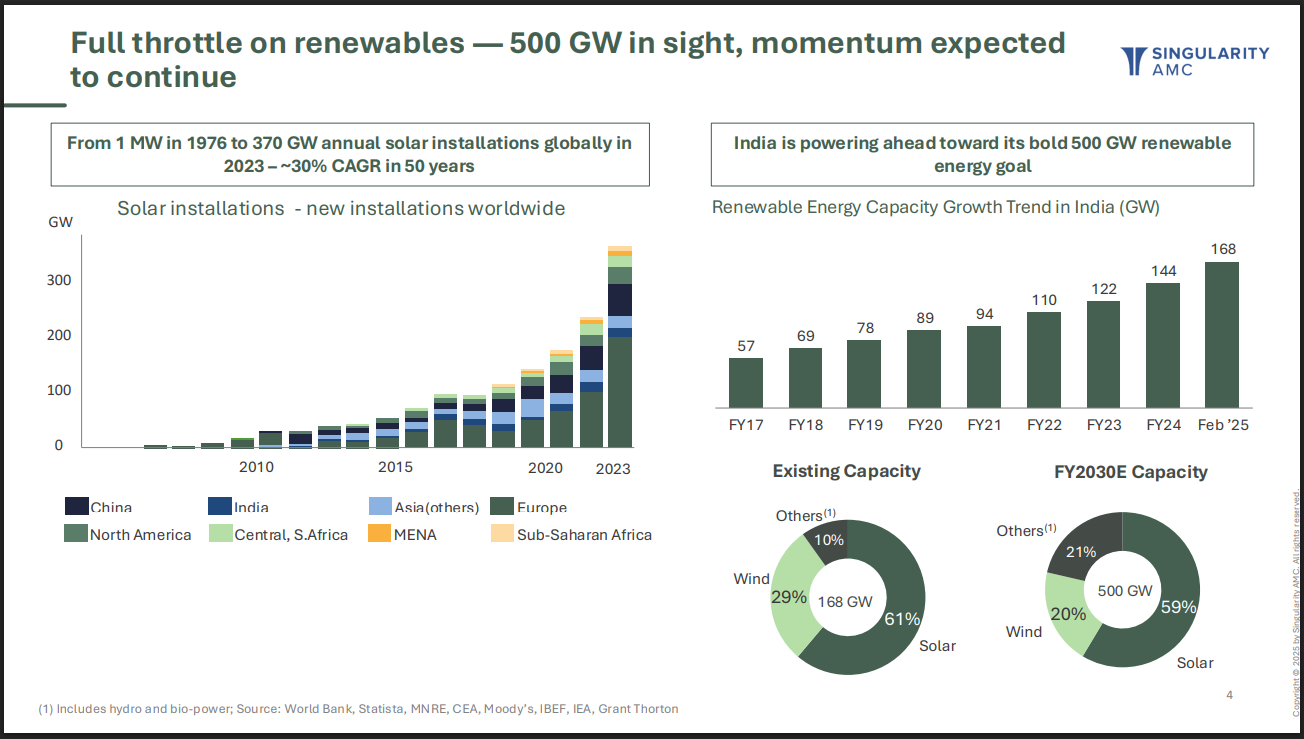

As we move to become ‘Aatmanirbhar Bharat’, we can’t let our self be dependent on import of all our battery requirements. Our annual sales of EV units sold in our country is set to quadruple by 2030 compared to 2024, and our renewable capacity is set to touch 500 GW - we must gain leadership in what is at the heart of this transition, the Batteries!

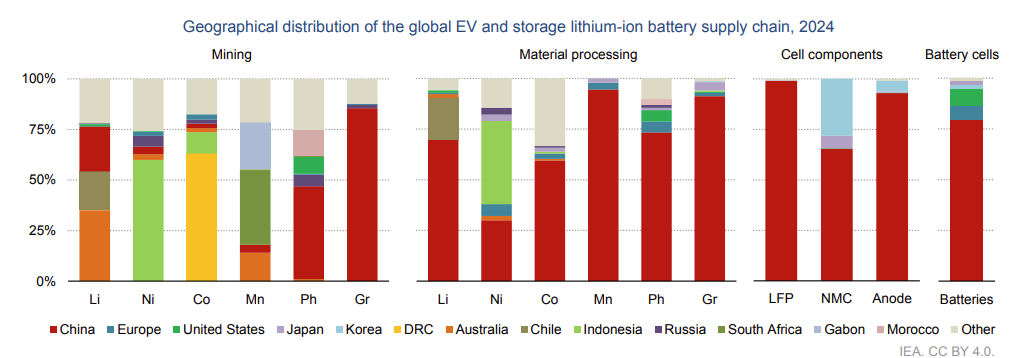

While China doesn’t own many minerals, it actually ‘controls’ up to 70% of global rare-earths mining, 85% of refining capacity and about 90% of rare-earths metal alloy and magnet production. And in June 2025, as China flexed its muscle a bit by curbing exports of these rare earth magnets, the global auto companies came in a 'in full panic' as they feared their factories could come in a grinding halt.

Similarly, tomorrow if China decides to stop the exports of batteries to India, our transition goals set for 2030 would become a distant dream.

🌐 Where to Begin with? Think Diplomacy

Lithium reserves which are at the heart of this transition are concentrated in Australia, Chile and China which combined have over 75% of reserves, and India lacks here. Similar is the case for many more materials.

Diplomacy plays a pivotal role in securing access to critical minerals, which are essential for batteries, renewable energy technologies, and advanced manufacturing. The country should look to forge bilateral and multilateral agreements, invest in overseas mining assets, and participate in global initiatives to diversify and de-risk its supply chains. Effective mineral diplomacy not only reduces vulnerability to supply disruptions and price volatility but also strengthens national security and supports long-term industrial and clean energy ambitions.

“We don’t have many resources in our country (Japan), so we do rely a lot on diplomacy and our trade partners”

- Saburo Nakao, CLO, Panasonic Energy at Singularity Summit 2025

Boosting Domestic Refining🏭

While we may not own reserves for most key minerals - real issue remains that we hardly have any refining capacity in our country. On other hand where China also lacks most key mineral reserves and therefore has much smaller level mining activity - it dominates the midstream and downstream part of supply chain.

Beginning in the 1980s and accelerating through the 1990s, China identified mineral refining as a sector of national strategic importance and backed it with subsidies, low-cost loans, and lax environmental regulations, enabling its companies to undercut global competitors who faced stricter standards and higher costs, allowing them to monopolize the midstream and downstream segments - refining, processing, and manufacturing, where the true economic and strategic value lies. The portion of red bars in middle and right part of chart below tells you all.

India must work on ensuring we have enough refining capacity to process the raw material so that we could fulfil our domestic demand and not be dependent on import of final produce from China. In Jan 2025, Government of India did approve ‘National Critical Minerals Mission’ with outlay of ₹34,300 crore in 7 years with similar aim.

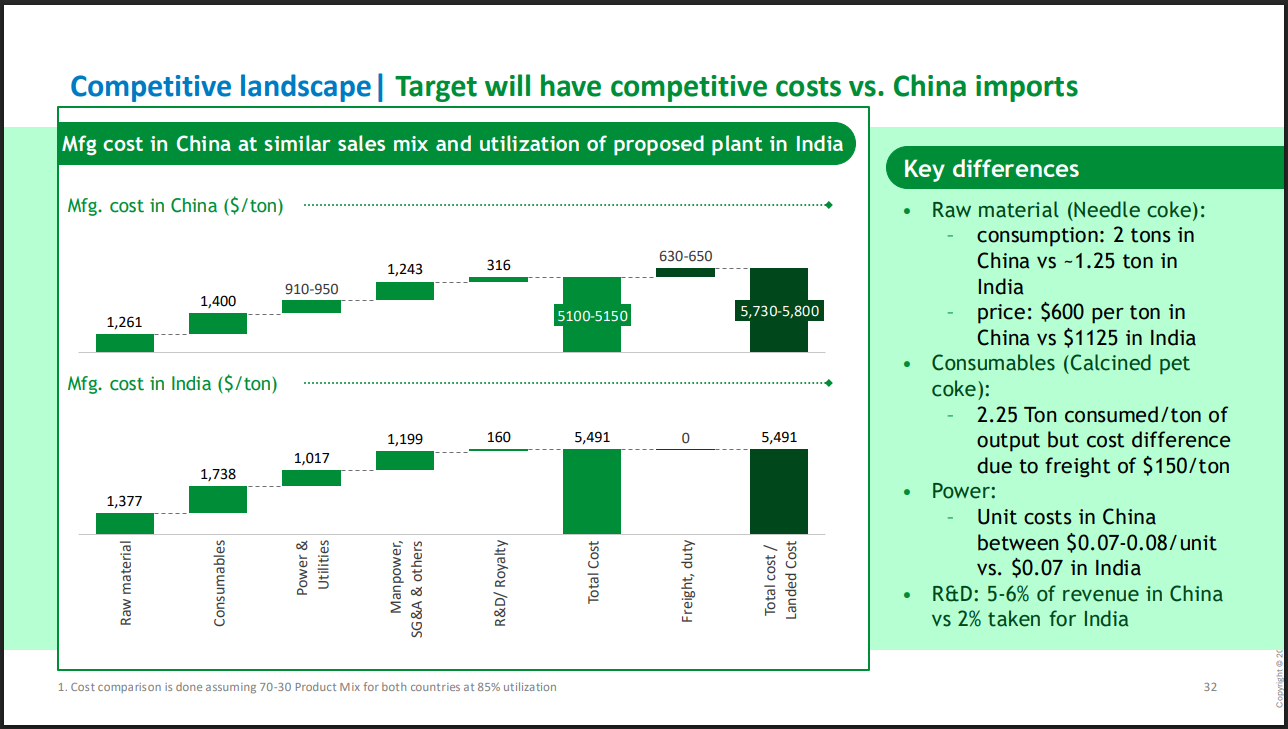

And one might think India would take decades worth of concentrated effort to reach the level of low cost refining that happens in China (which is indeed true), but there are some low hanging fruits as well like Graphite where the landed price of final processed output produced in India doesn’t really differ when the same is manufactured in India as per our analysis after talking to industry experts suggests.

At Singularity, we have the privileged of investing in HEG Ltd which is into Graphite (Anode) and Lohum which is into lithium-ion battery recycling (Cathode). We believe strategic autonomy in battery components is the need of the hour and we want to lead this from the front.

As the world gets older & AI starts impacting our physical world - there is fast shift towards autonomous future. We are currently seeing the rise driverless cars and it won’t be a day far enough where we would have our own personal robots doing work for us.

🤖Autonomous Future = More Batteries?

OpenAI’s CEO, Sam Altman, said in an interview that people are underestimating the potential impact of humanoid robots. While we haven’t had that pivotal moment yet, but he doesn’t think it’s far away.

“Everything that moves will be robotics someday and it will be soon”

- Jensen Huang, Nvidia

A Tesla Optimus Robot, their flagship humanoid robot has 2.3 kwh lithium-ion in battery and the company plans to produce 500,000 robots in 2027. A typical two-wheeler EV also has a similar kwh battery in it and the cost of robots is drastically falling globally.

Citi Group also expects there could a rapid increase in energy demand of AI models integrated into robots, and without significant advancements in battery technology, the gap between energy supply and demand will continue to widen, potentially limiting the capabilities of AI-powered robots. They also expect we would have over 600 million humanoid robots by 2050.

So there could be whole host of new autonomous devices which depend on real time on-device coming up which the global demand estimates for battery critical minerals might not have incorporated yet.

⚠️Technology Risk

One key factor that makes investors nervous while investing in this space is the level of disruption could happen in chemistries of minerals. For example, while demand from lithium-ion batteries triples from 1.8 Mt to over 6 Mt by 2035, IEA expects starting from 2030, rising silicon content in battery anodes could reduce the share of ‘Graphite’ gradually from the EV sector.

Similarly, one of main Chinese battery manufacturers, CATL, have announced mass production of sodium-ion batteries for EVs and energy storage, which reduces the dependence on Lithium and doesn’t require expensive metals like cobalt or nickel. While we are yet to see how the adoption of such batteries in real world takes place, it becomes crucial for all manufactures & investors to keep track of such developments.

This is precisely why India must act now. In a world where battery technologies are rapidly evolving and mineral dependencies are shifting, India cannot afford to be a passive observer or a late adopter. Whether it’s lithium today or sodium tomorrow, the race is not just about securing raw materials, but about controlling the full value chain, from refining to cell manufacturing to end-of-life recycling.

Achieving strategic autonomy in batteries will not only shield us from global supply chain disruptions and price shocks but also strengthen our position in the emerging green economy. With our ambitious goals of 500 GW renewable capacity and millions of EVs by 2030, batteries are no longer just a component - they are a national imperative. Investing in this space today ensures that India isn't just buying the future - it is building it.

Therefore, we at Singularity are fully committed to accelerate India’s autonomy in this space. If you find this blog valuable, share it in your community & let us know your thoughts in comments below.

Read our recent post:

Read more about us below: