Rewiring Grid For A Brighter Tomorrow

The Case for Investing in India’s Transmission & Distribution

In this deep dive, we explore the hidden backbone of our energy future: the electricity grid. As renewables surge, EVs accelerate, and AI drives up demand, the grid is no longer just wires and substations. It has become the nervous system that holds the energy transition together. At Singularity AMC, our aim is to take bold bets and help India achieve strategic autonomy in this space.

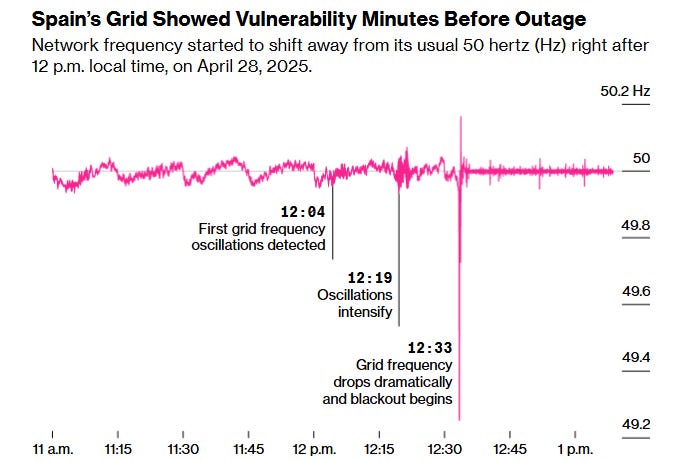

🌑Spain’s Blackout of 2025

On April 28, 2025, a sudden power outage swept across the Iberian Peninsula and left much of Spain and Portugal without electricity. In just five seconds around 12:33 p.m. CEST, about 15 gigawatts of capacity went offline, equal to nearly 60 percent of Spain’s demand. The blackout brought transport, communications, and daily life to a standstill for tens of millions of people.

The blackout lasted for nearly 10 hours and power returned after multiple reliable source of electricity like the Europe’s largest pumped-storage hydroelectric power complex, Cortes-La Muela, located in the Valencia region of Spain came for rescue.

Investigations later confirmed that the blackout was triggered by a combination of voltage surges, weak system planning, and inadequate control capacity rather than a cyberattack. Plants disconnected improperly, and limited backup support from thermal stations made recovery harder. Spain’s limited interconnections with neighboring European systems added to the fragility, turning a local fault into a nationwide crisis. Electricity system had failed after the grid witnessed sharp fluctuations in the network frequency.

As an auto trigger caused due to that fluctuation, the solar power plants were cutoffs from the grid & there was no reliable source of electricity like thermal or nuclear which could act as a backup source of power.

🚀 What’s Inside

We explore the grid and its transmission and distribution (T&D) network. In a world chasing cleaner energy, their role has never been more critical, even if their presence often goes unnoticed.

We break down the most important questions:

Rising adoption of Renewable Energy

Why renewables require modern grid?

How EV transition is putting pressure on our grid?

How old is global grid & the impact of AI

Why Grid Investment Supercycle Has Begun!

Where does India stand and how we plan to upgrade our grid?

Is India self reliant? Why Strategic Autonomy is important in T&D space?

Let’s get started!

☀️Rising Adoption of Renewable Energy

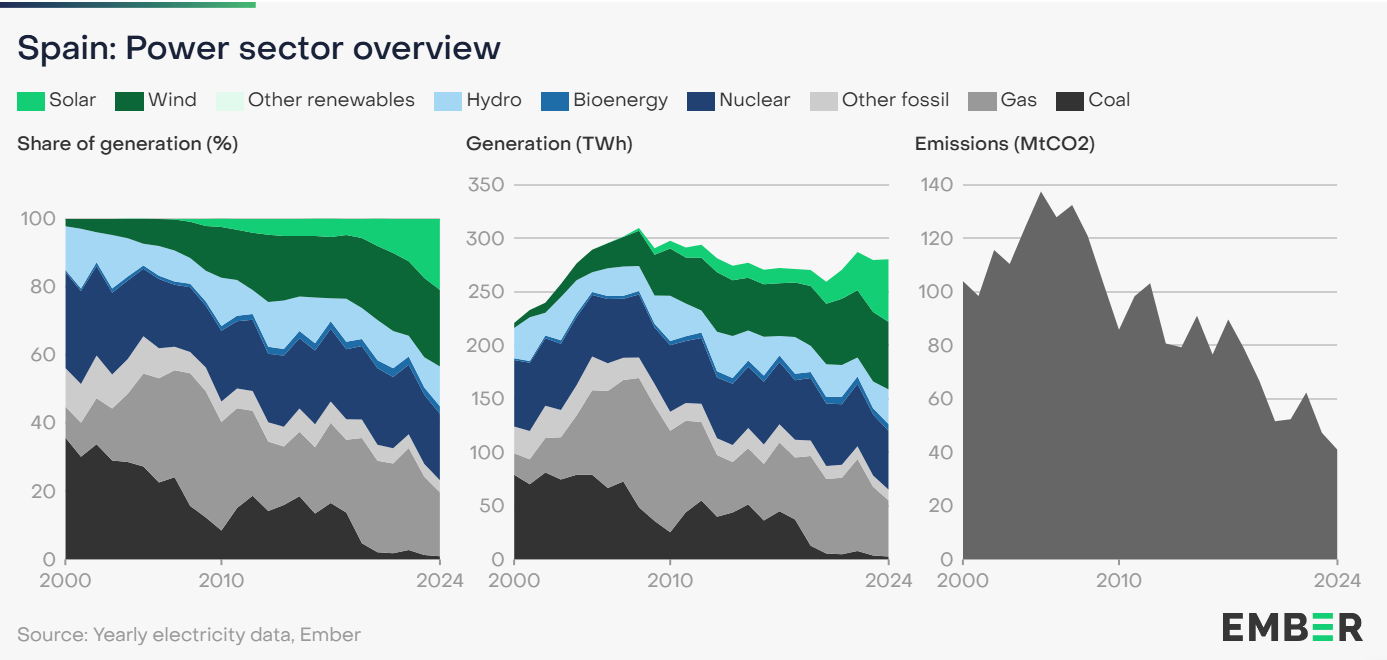

Spain has one of the highest % of electricity generated from low-carbon sources in 2024. The largest source of clean electricity is wind (22%), although solar (21%) and nuclear (20%) also have similar shares. Its share of wind and solar has grown very fast in recent years, now over 43%, well is well above the global average (15%).

This is also exactly the reason why during the day the country often witnesses negative prices as the solar power production is at its peak leading to excess supply situation. Therefore, the sharp rise of renewables contribution is starting to impact the economics of the business along impacting something much bigger - stability of its grid.

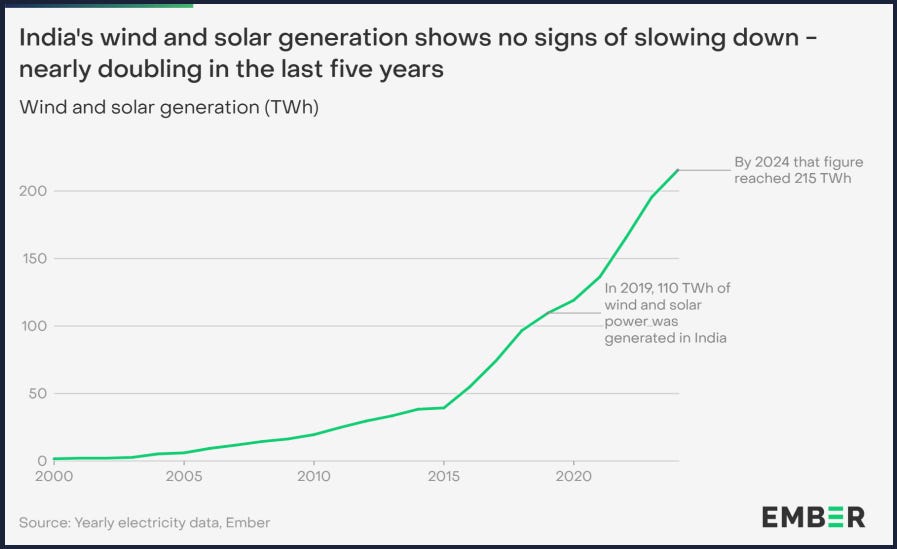

In recent years, even India has recorded robust number of solar/wind projects coming up. It had the fourth-largest increase in solar generation of any country in 2024 at 20 TWh (+18%), more than the total solar generation of the United Kingdom. This was driven by record capacity additions in 2024, more than double the additions in 2023. India also overtook Germany to become the world’s third largest generator of electricity from wind and solar. (source)

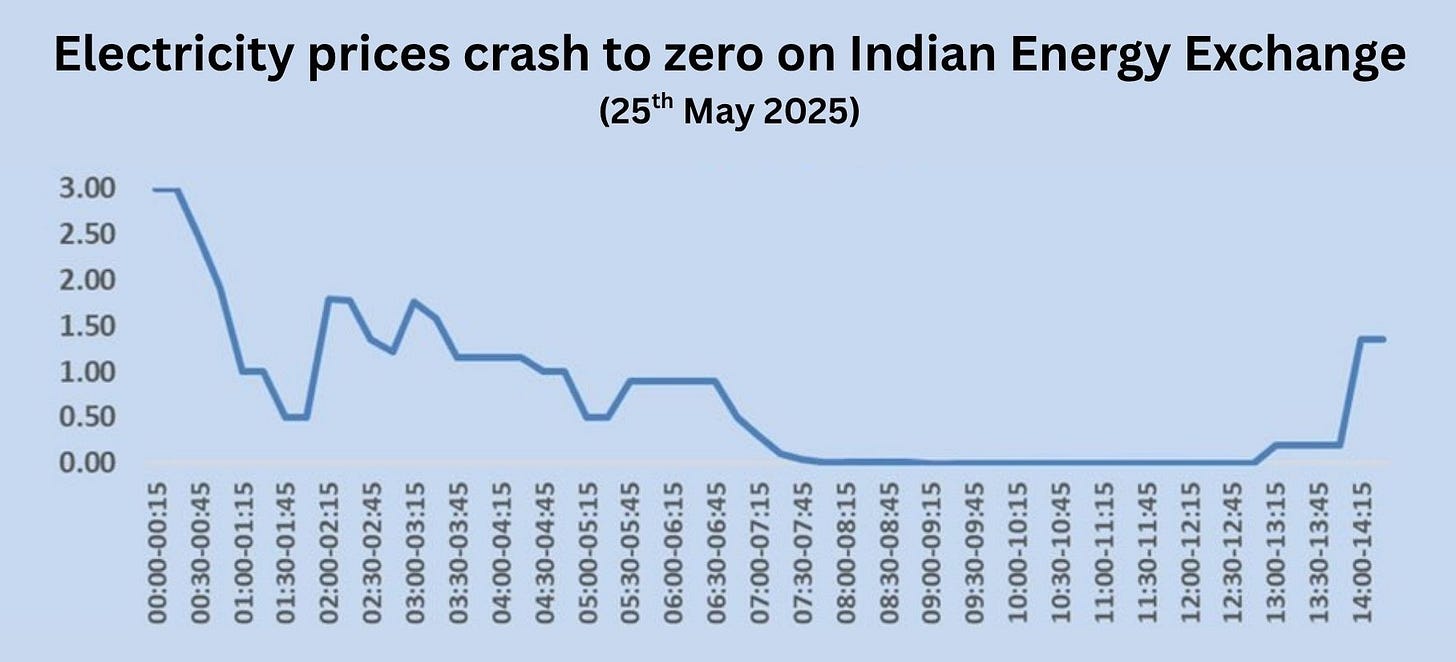

As an impact, India saw its electricity prices dropping to zero for the first time on 25th May 2025. Power was available for free during the day, something which has been very normal in Spain in recent years with rising share of Solar. A mix of cooler weather, unexpected rains, thermal power production and solar generation created a perfect mix of excess supply and subdued demand that day. And it wasn’t a brief anomaly but surprisingly lasted for hours between 9:15 AM and 2:30 PM.

If one also considers the transaction charges on trading electricity, the price was actually negative for a power seller!

Clearly, India’s energy landscape is changing fast and moments like these are just the beginning of what lies ahead.

But with renewable share rising, blackout risks due to grid failure are bound to increase due to supply fluctuations, which can’t be controlled. In case of Spain, the investment in their electricity grid has been much lower compared to the European region on an average investment basis when measured per user or per kilometer. And the outcomes are today in front of the world.

⚡Why Renewables Require Modern Grid?

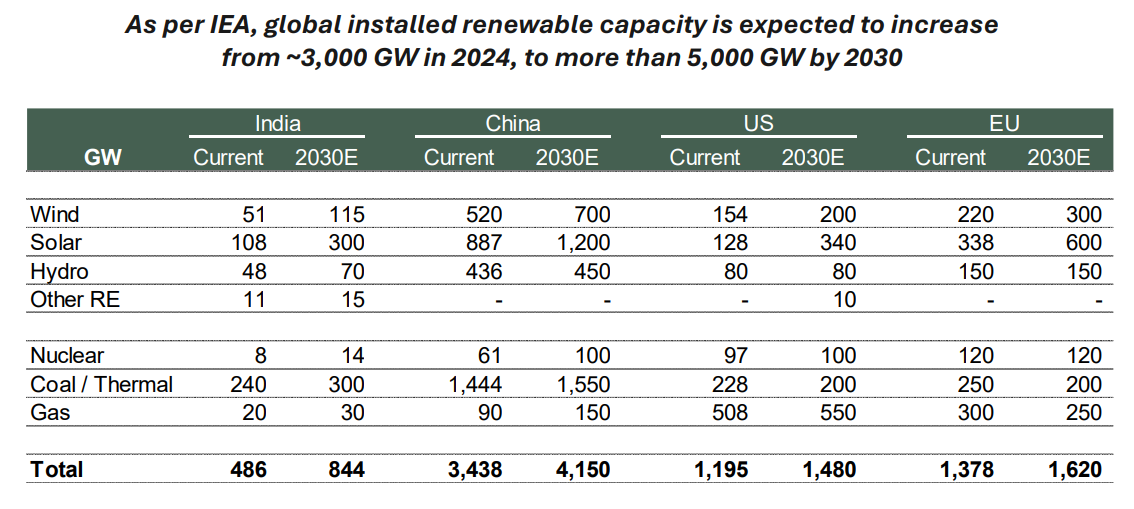

As per India’s Power Ministry projections, the country’s installed power capacity is set to grow at a 10% CAGR, rising to 777.1 GW between FY24 to FY30. A significant portion of this growth will be driven by clean energy. Renewables (excluding hydro) are expected to make up 55% of the total capacity, while hydropower will contribute around 7%. Solar will lead the charge, with capacity rising to 300 GW at a strong 22% CAGR, followed by wind, which is expected to grow from to 115 GW at a 13% CAGR.

And India’s energy transformation is unfolding alongside an unprecedented global shift. According to the IEA, global installed renewable capacity is projected to rise from around 3,000 GW in 2024 to over 5,000 GW by 2030. China will continue to lead, with its total capacity expected to grow from 3,438 GW to 4,150 GW, including 1,200 GW of solar and 700 GW of wind. The United States is also set for major expansion, with solar capacity jumping from 128 GW to 340 GW, and wind rising to 200 GW by 2030. In the European Union, solar is forecasted to nearly double to 600 GW, while wind grows from 220 GW to 300 GW.

But renewables like solar and wind are fundamentally different from traditional power sources, they are:

Intermittent (solar isn’t available at night)

Weather-dependent (less windy = lower wind energy)

Often located far from place of consumption

These create unique challenges for grid management. Unlike coal or gas plants that provide steady, controllable output, renewables can fluctuate sharply within minutes, depending on sunlight or wind conditions.

To handle this variability & maintain reliability, the grid must be far more flexible, digitally monitored, and geographically integrated than it was in the past.

A strong modern grid ensures that clean energy can be absorbed, balanced across regions, and dispatched efficiently, without wastage and reduced risks. Simply put, without a smarter, modernized grid, renewables can’t reach their full potential. Under-investment in modernization our grid’s components along increasing focus on renewables, makes us vulnerable to any potential pan-country blackouts.

🚗 How EV Transition is Putting Pressure on Our Grid?

Compared to conventional cars which run on petrol/diesel, electric vehicles (EVs) run on charged up batteries. Charging an EV at home typically increases a household’s electricity consumption by a substantial margin. For example, research from Sweden indicates that adopting a Battery Electric Vehicle (BEV) can raise a household’s hourly electricity consumption by ~20%.

And one of the biggest challenges is the timing and clustering of EV charging. Most drivers tend to plug in their vehicles after returning home in the evening, a period that already coincides with peak residential electricity usage. This can lead to sharp spikes in local demand, risking overloads on neighborhood transformers, substations, and distribution lines, components that were not originally designed for such high, simultaneous loads.

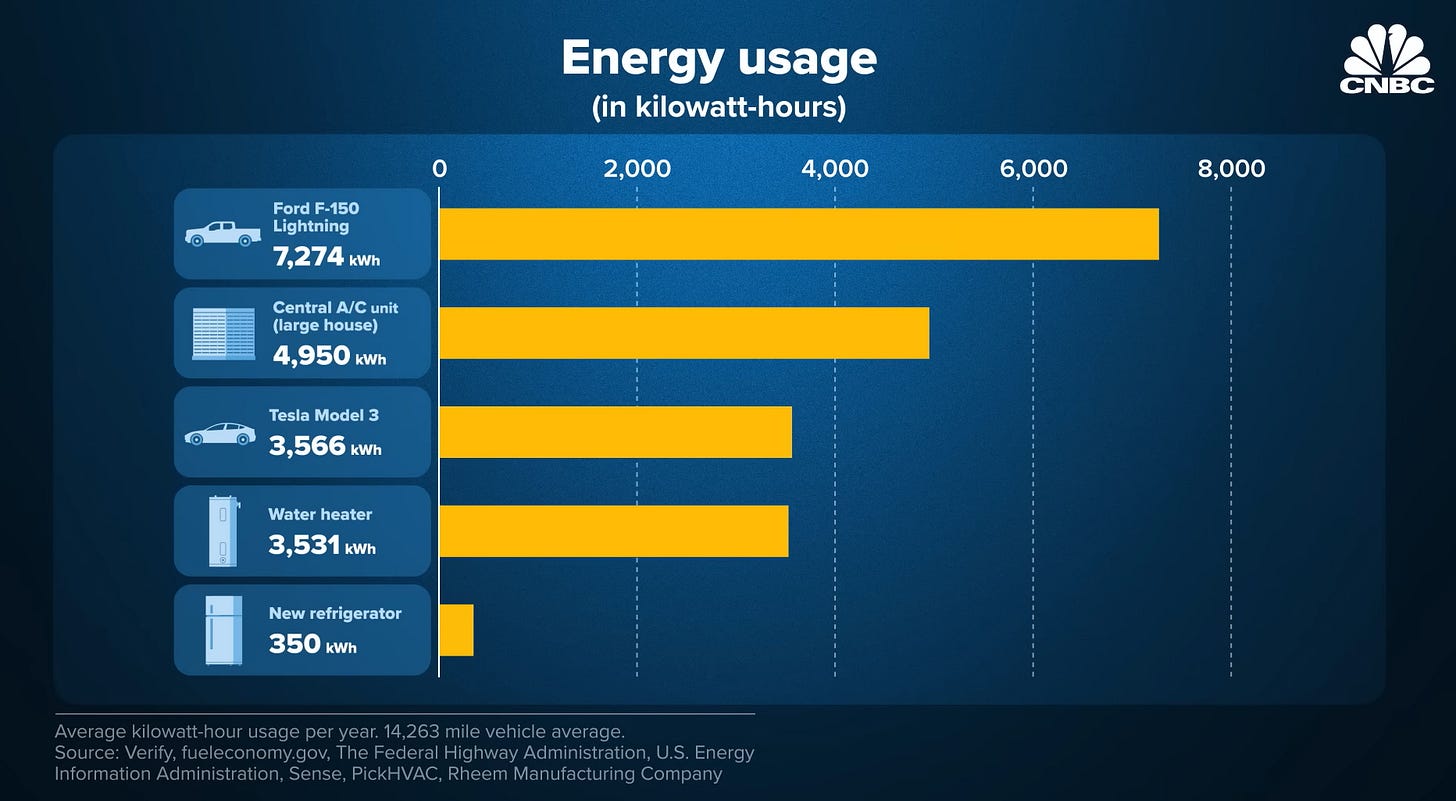

Charging a single EV, such as a Tesla Model 3 or Ford F-150 Lightning, can consume as much or more electricity annually as major household appliances like central air conditioning units or water heaters. For instance, a Ford F-150 Lightning draws over 7,200 kWh per year, far surpassing the energy usage of a large home’s central AC or several refrigerators combined. This concentrated, high-volume demand is not just a matter of increased total consumption; it fundamentally changes the load profile utilities must manage.

Existing electricity grid distribution in India and worldwide was never originally designed to handle such massive, concentrated loads introduced by widespread EV adoption by households. Most of the infrastructure, especially at the medium- and low-voltage distribution levels, was built decades ago to support predictable, relatively stable residential and commercial demand, not the sudden spikes and high power draws associated with home and public EV charging.

🕰️How Old is Global Grid?

Over the past several decades, global investment in T&D infrastructure has not kept pace with the rapid growth in electricity demand and the evolving needs of modern economies. While there have been periods of significant investment, especially during the post-war boom and the early 2000s, much of the world’s grid infrastructure dates back to the mid-20th century. Most countries prioritized generation capacity and urban electrification, but upgrades to aging grid components often lagged behind. As a result, much of the existing infrastructure was built for the demands and technologies of a different era, with limited foresight into today’s challenges like renewable integration, digitalization, and the electrification of transport.

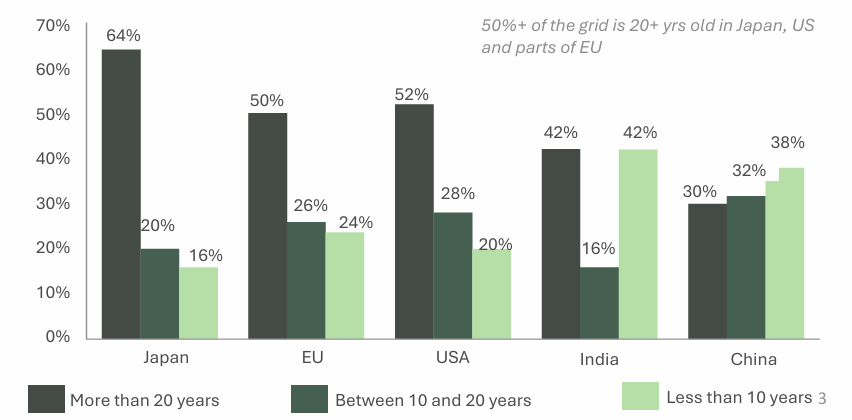

In Japan, a staggering 64% of the grid infrastructure is more than 20 years old, with only 16% being less than a decade old. The situation is similar in the US and parts of the EU, where over half of the grid is two decades old or more (52% in the US, 50% in the EU). While developing regions like India and China are relatively better place, but a significant portion of the grid is aging, 42% of India’s grid is over 20 years old, while in China, 30% falls into this category, though China notably has a larger share of newer infrastructure (38% less than 10 years old). So in many advanced economies, the backbone of the grid is aging, while emerging economies are gradually modernizing but still contend with legacy components.

Older infrastructure is more prone to outages, less efficient, and often incompatible with modern smart grid solutions. As the world accelerates its energy transition, the need for massive reinvestment in grid modernization is clear, not just to replace outdated equipment, but to build a flexible, resilient, and future-ready power system that can reliably support the next wave of electrification and innovation.

🤖Next Big Driver of Electricity Demand: AI

It is not just the increasing penetration of renewables & electric vehicles (EVs), but also AI servers powered by GPUs that is driving up electricity demand in ways our existing infrastructure wasn’t designed for. As data centers continue to be built across USA & Europe in a big way, we are seeing a surge in power requirements because modern AI workloads require more energy and generate more heat than traditional computing tasks.

The explosive growth of artificial intelligence and cloud computing in the United States is set to increase grid demand by ~50 gigawatts (GW) by 2030, primarily driven by new, energy-intensive data centers required for AI workloads. This rapid surge, projected by major studies from EPRI and Lawrence Berkeley National Laboratory, represents one of the fastest and most concentrated load increases in modern grid history and equates to more than 12% of total national electricity usage by 2028. Such a leap in demand is far outpacing the built-in expansion and resilience of the aging U.S. grid, particularly stressing existing infrastructure in regions like Texas, Northern Virginia, and California.

According to the U.S. Department of Energy's 2025 Grid Reliability report, scenarios that include continued plant retirements and slow replacement of dependable generation can lead to an average annual loss of load hours (LOLH) surging from 8 per year today to over 800 hours per year in stressed regions - a hundredfold jump.

🚀Grid Investment Supercycle Has Begun!

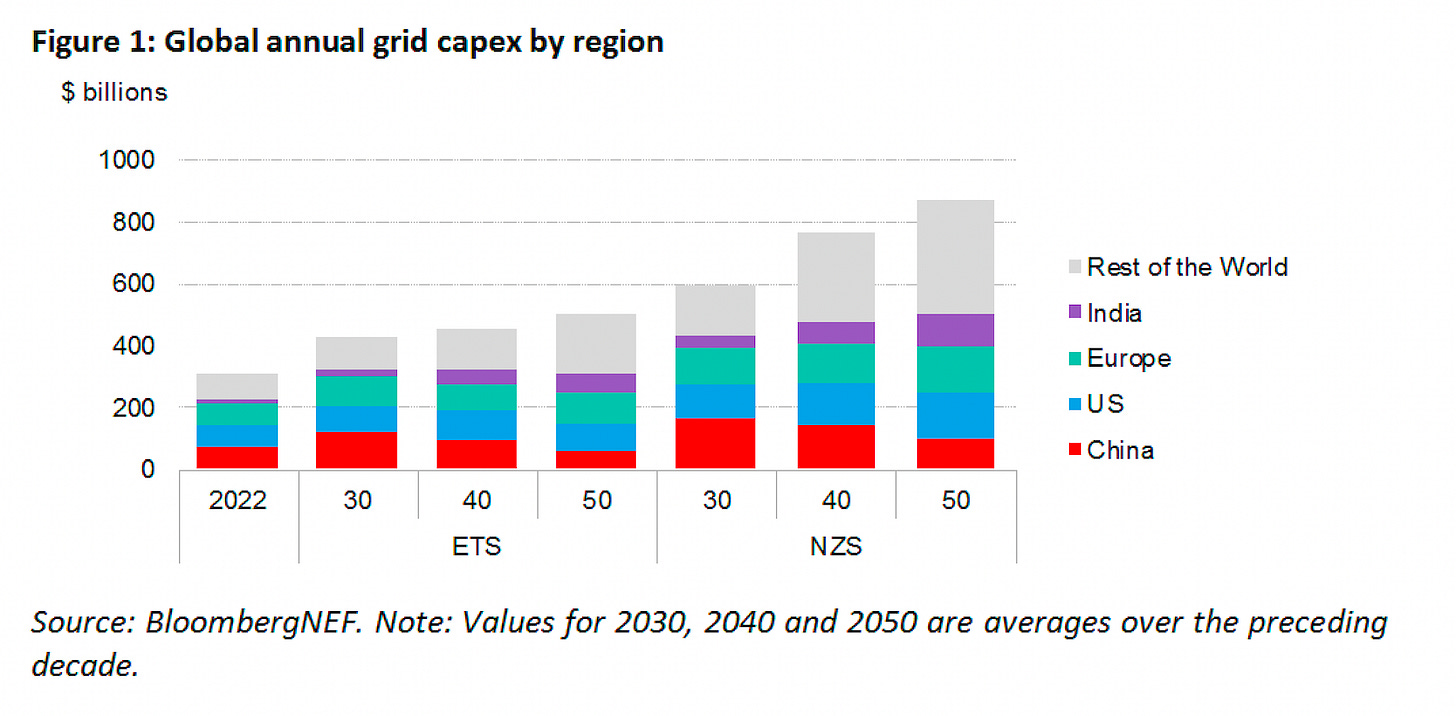

At least $21.4 trillion needs to be invested in the electricity grid by 2050 to support a net-zero trajectory for the world, as per BloombergNEF report. The total investment comprises $4.1 trillion to sustain the existing grid and $17.3 trillion to expand the grid for new electricity consumption and production. World is estimated to have 80 million kilometers in grid growth between 2022-50, more than enough to replace the global electricity grid built till 2022.

Alongside with advancement in AI and ongoing data centers boom, world needs to upgrade multiple components of the electrical systems, implying installing new circuits, heavier-duty wiring, and bigger transformers to safely handle the extra load and prevent outages.

“It was very easy to predict that the next shortage will be voltage step-down transformers. If you've got 100-300 kilovolts coming out of a utility and it's got to step down all the way to six volts, that's a lot of stepping down.”

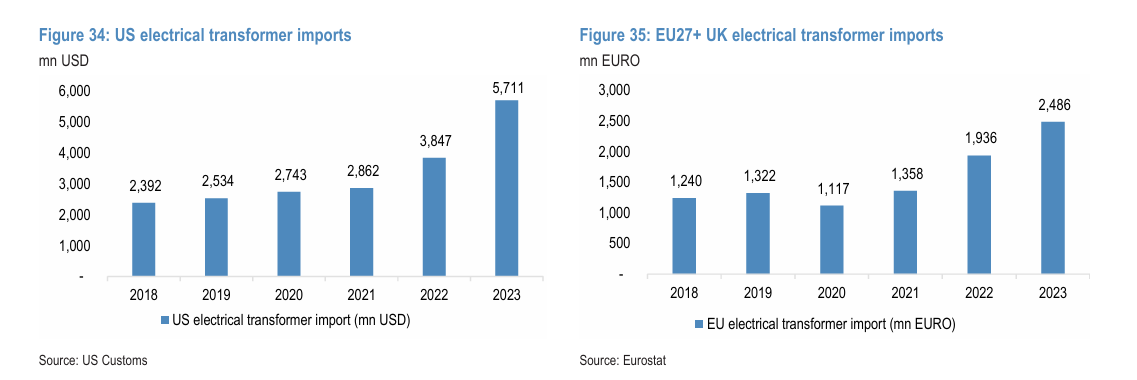

With this structural pick-up in demand, electrical transformer imports in the developed markets have been gaining steam. Notably, growth started to accelerate post-pandemic, and in 2023, US/EU transformer imports were up >100% vs. pre-2020 levels.

The level of urgency is high and the wait time to get a grid connection in the USA has reached unprecedented levels, with new energy projects, especially wind, solar, and battery storage, facing average delays of four to five years, and in some regions, up to 7 or even 9 years. As of the end of 2023, there were about 2,600 gigawatts of proposed generation and storage projects stuck in interconnection queues, more than double the country’s current installed capacity. The backlog is so severe that only about 10% of projects in the queue are expected to come online within three years, while around 80% are ultimately withdrawn or canceled due to long waits and rising costs.

This is what happens when your grid is the old and rate of adoption of new technologies is the highest which requires advanced grid components.

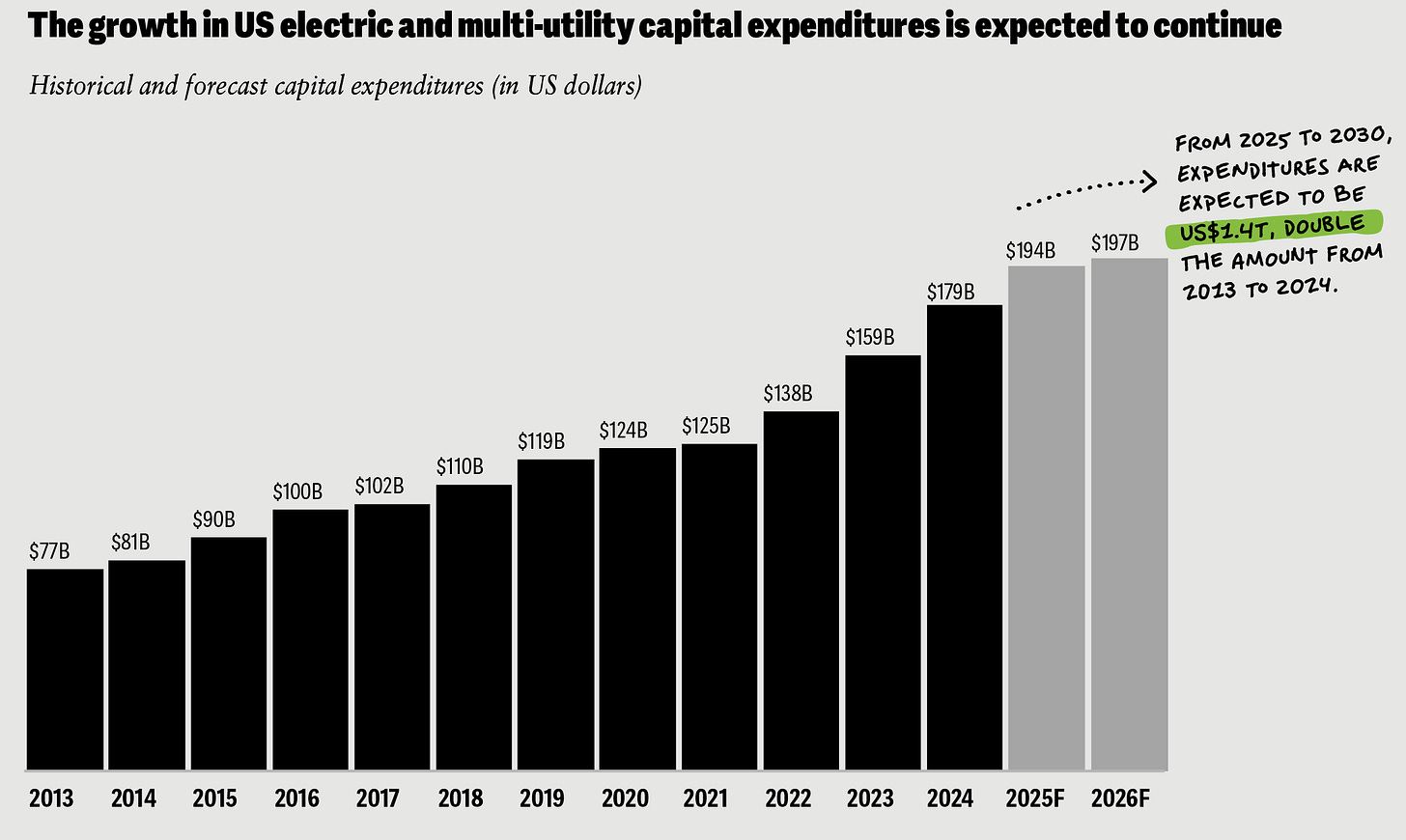

In response, the U.S. is undertaking a once-in-a-generation investment supercycle, both from the public and private sectors, to boost and future-proof its grid. Federal initiatives like the Department of Energy’s $10.5 billion Grid Resilience and Innovation Partnerships (GRIP) program are funding critical upgrades, while state and corporate actions are ramping up investments in advanced transmission, substation automation, and digital tools. Deloitte expects total investment needs for the U.S. power sector are projected to reach as much as $1.4 trillion in just this five-year window of 2025-2030.

This level of investment for 2025–2030 is roughly equal to what the U.S. power sector spent over the previous twelve years combined, and similarly high annual expenditure is expected to continue in the following decades as well. For nations exporting grid components and smart grid technologies, such as China, Japan and South Korea, these current bottlenecks in developed word becomes a big opportunity. India must also actively look to participate in this multi-decadal opportunity.

🌏Where Does India Stand Today?

On the electrification parameters in the country, India achieved 100% village by 2018, bringing power to more than 28 million additional households. This universal grid connectivity was accompanied by a sharp reduction in nationwide power shortages, bringing the annual deficit down from 4.2% in 2013–14 to just 0.1% by 2024–25. With robust grid expansion and policy reforms, per capita electricity consumption soared by nearly 46%, also reflecting increased industrial activity across the nation. As of 2025, rural areas now enjoy an average of 20.6 hours of electricity supply daily, while urban regions benefit from even greater reliability at 23.8 hours per day.

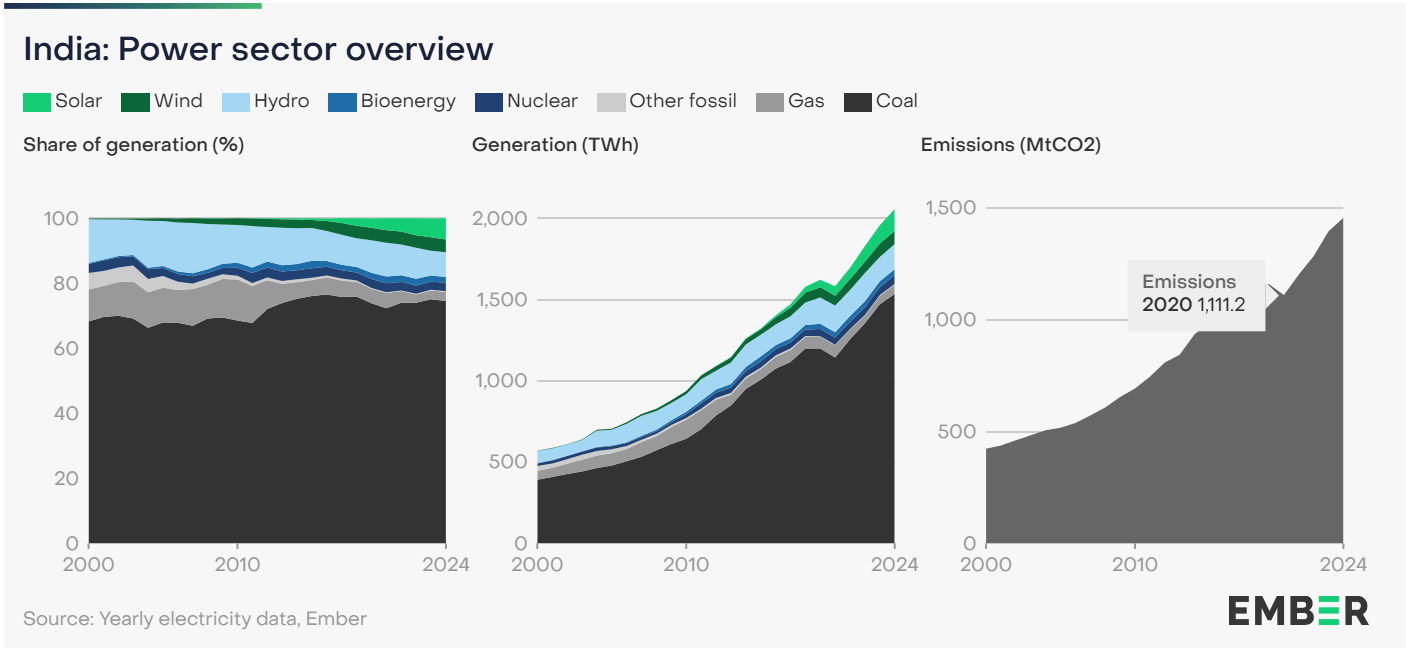

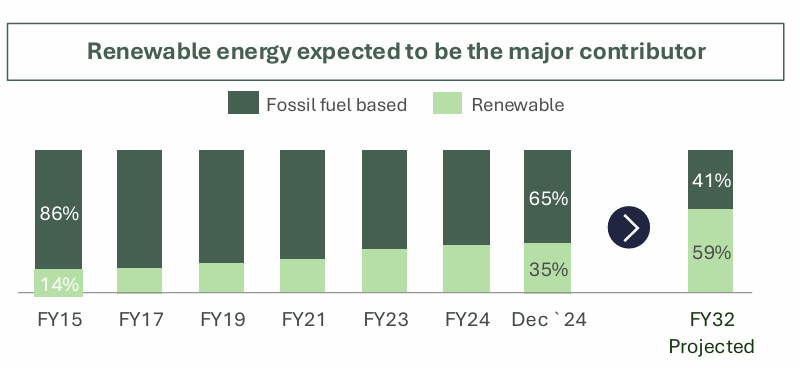

When it comes to electricity generation, fossil fuels still account for 78% of generation in 2024, making India’s power sector its largest emissions contributor. But India is one of only ten countries planning to triple renewable generation capacity from 2022 levels by 2030. By October 2024, the country had achieved 200 GW of installed renewables capacity en route to its 2030 goal of 500 GW. This suggests that the country would reach 42% renewable electricity generation by 2030 under current plans.

Out of the targeted 500 GW of renewable capacity by 2030, about 300 GW is expected from solar, and rest from Wind & other sources. At this pace of transition, we shall be at roughly 60% of power capacity from renewables by FY 2032 and will keep India on track for its long-term commitment of achieving net-zero emissions by 2070.

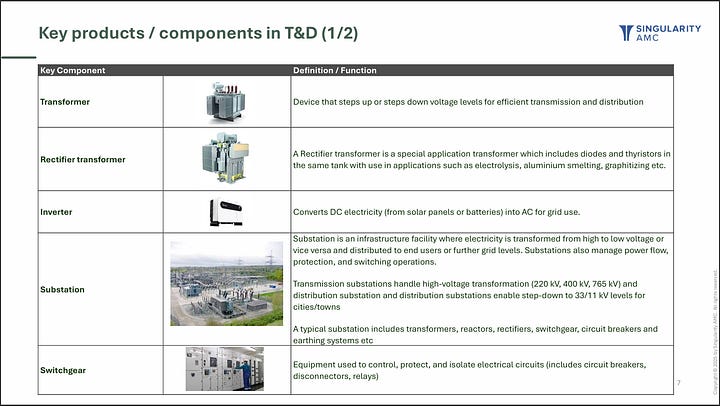

But the issue here is that most of renewable energy sources like solar photovoltaic (PV) panels and battery storage systems generate electricity in direct current (DC) form, while traditional power sources such as thermal (coal, gas), hydropower, and nuclear plants typically generate alternating current (AC) electricity through turbine-based generators. However, the entire power grid and nearly all household or industrial devices are designed to operate on AC, as it transmits efficiently over long distances and is easy to transform between voltage levels.

Because of this fundamental difference, renewables require inverters to convert DC to AC before integration. This is more than a simple conversion - scaling up renewables demands significant investment in advanced inverters, upgraded transformers, and digital grid controls to ensure safe and stable operation. As renewable capacity grows, so does the need for modern AC-DC conversion infrastructure along with long distance transmission as renewables are more efficient in certain parts of the country where investments tend to happen like solar in Gujarat, Rajasthan, and wind in Andhra Pradesh.

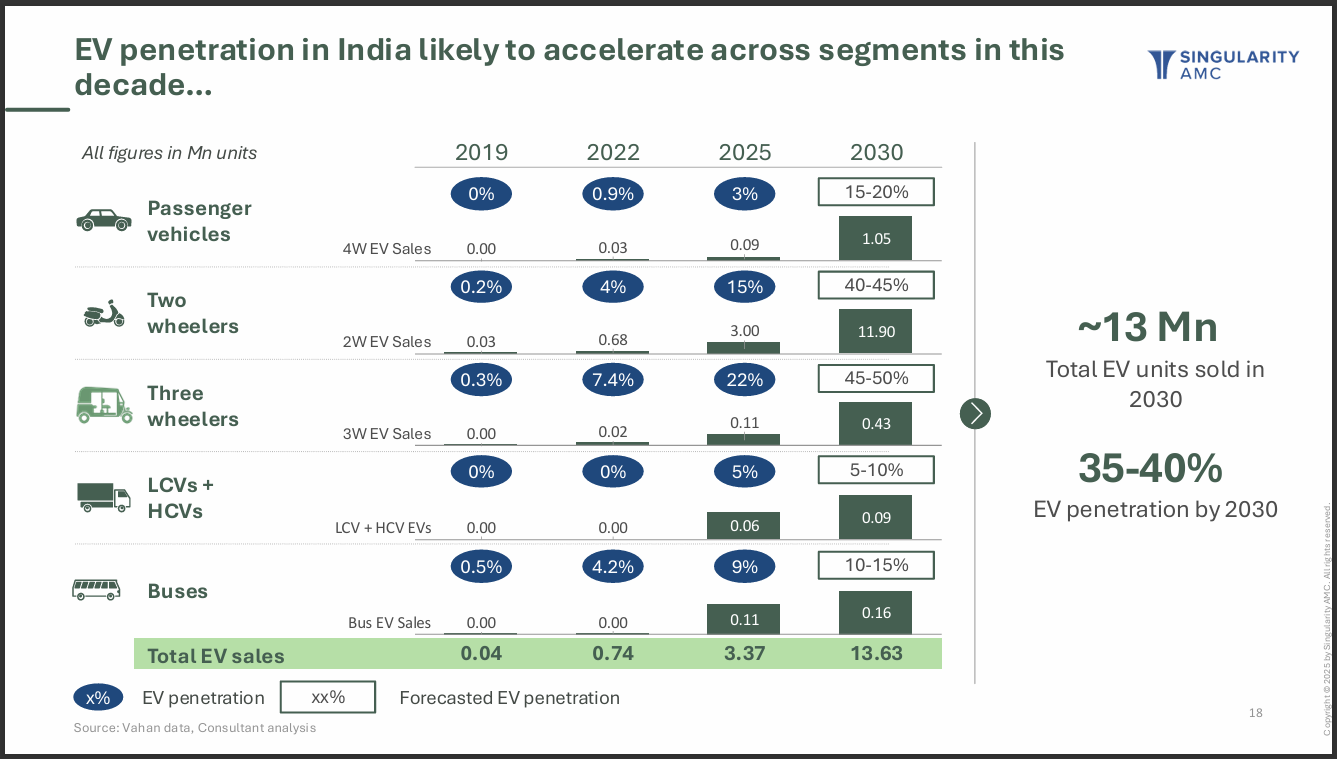

Along side, India is witnessing a sharp acceleration in electric vehicle (EV) adoption, with total registered EVs crossing 6.4 million and EV sales representing a record 8% of total auto sales in Q2 2025. Driven by government initiatives, tax incentives, and expanding model choices, the country is rapidly moving toward its ambitious target of 30% EV penetration by 2030.

As EVs become mainstream, their collective charging habits will shape future grid dynamics. The additional electricity demand from EVs, projected to reach up to 40 TWh annually by 2030 (about 2% of total national demand), may appear modest at a macro level, but the real challenge lies in the timing and location of charging as we discussed above. Without smart management, uncontrolled large-scale charging could strain the distribution network, accelerating the wear on old components and increasing the risk of outages. These all factors make advancements of grid very important.

🔌How India Plans to Upgrade its Grid?

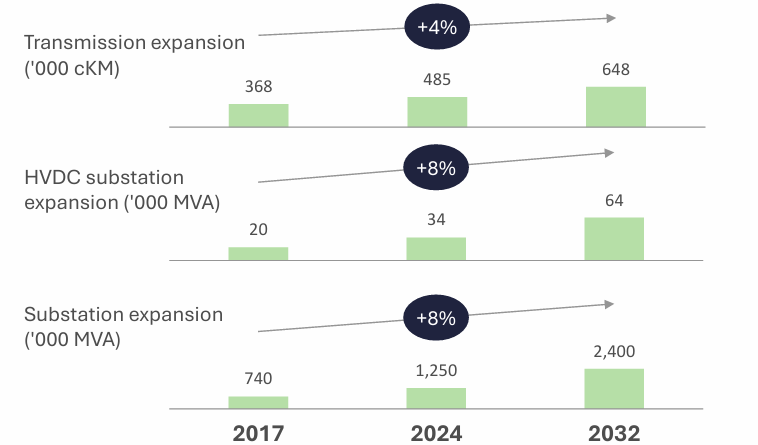

India’s National Electricity Plan (NEP) 2023–32 lays out an ambitious roadmap for grid expansion to meet rising power demand and integrate massive amounts of renewables. The plan targets a 34% increase in transmission lines, from 4.85 lakh cKM in 2024 to 6.48 lakh cKM by 2032, growing at about 4% CAGR.

On the capacity front, the build-out is even more striking. HVDC substations are set to more than double, from 34,000 MVA in 2024 to 64,000 MVA in 2032, an 8% CAGR. Similarly, overall substation capacity will expand from 1,250,000 MVA to 2,400,000 MVA in the same period, also at an 8% CAGR. This expansion includes nine new HVDC transmission systems (33 GW capacity), which will nearly double India’s HVDC transfer capability.

With about ~40% of India’s grid is at least over 20 years old which implies major upgrade requirement is bound to happen.

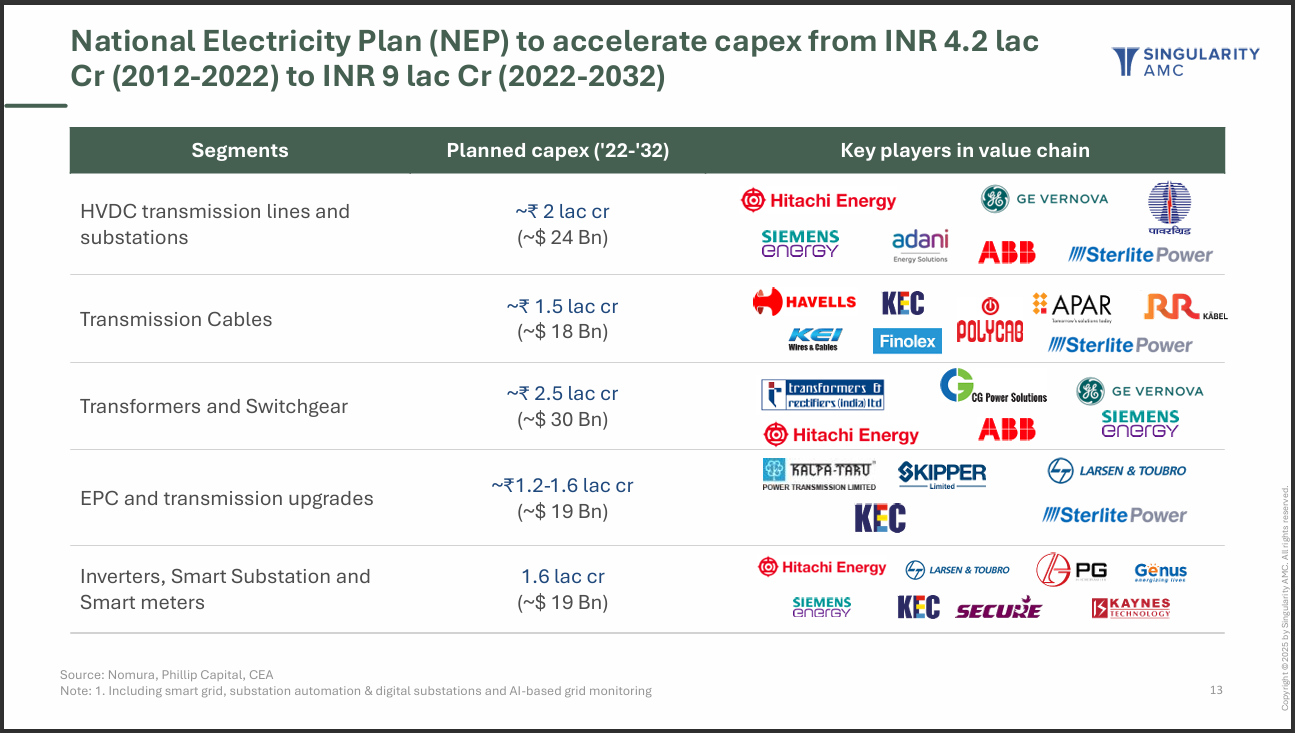

The plan guides for major spending on grid expansion, renewable integration, transmission upgrades, and technology enhancements, outlining targets for reducing technical losses, improving access, and maintaining energy security in line with India’s broader economic and environmental goals. For the next cycles 2022 to 2032, roughly ₹ 9 Lac crore are expected to spend by the government and government owned entities.

The focus spans new HVDC lines, expanded transmission, upgraded transformers and switchgear, and the rollout of digital solutions like smart meters and substations. Major Indian and international players are active across these segments, making India’s grid expansion one of the most ambitious anywhere - aimed at boosting reliability and preparing for the future of clean energy and digital demand.

But as we continue to invest in our grid, what becomes crucial is whether we are still dependent on other countries for the grid equipment?

🤔Is India self reliant?

In May 2025, whole world was alarmed when US agencies reported how few of the solar inverters that play a critical role in rolling out renewable energy infrastructure, were found to have unexplained communication equipment was found inside some of them. These power inverters used throughout the world to connect solar panels and wind turbines to electricity grids, with China as its biggest manufacturer.

Despite firewalls in place by the utility companies, rogue communication devices which was not listed in product documents where actually found within. This opened the possibility of grid related data transfer to China and could also mean possibility of control access in hands of a foreign nation.

Here in case of India as well, about 80% of its installed solar inverters actually as from China. This led to immediate new guidelines from the government requiring all inverters to be connected to a national software platform managed by a government agency, with data transmission controlled through secure SIM cards.

Now this is only one instance.

India has developed strong self-reliance in key sectors of the power grid, particularly in distribution infrastructure and mid-level grid equipment. A robust domestic manufacturing ecosystem supported by government initiatives like “Make in India” enables the production of distribution lines, transformers for medium voltages, and most substation components locally. This has helped India meet much of its growing demand for grid expansion and modernization with homegrown technology.

But when it comes to more critical and technologically advanced areas - such as ultra-high voltage (UHV) equipment, large-capacity power transformers, and cutting-edge digital grid technologies - India remains dependent on imports and foreign collaborations. Here is more details on this:

High-voltage and ultra-high-voltage transformers (400 kV and above) are often supplied by major global firms headquartered in Germany, Japan, Switzerland, and the US such as Hitachi Energy, Siemens, ABB, and GE. These companies leverage their global engineering and testing capabilities, with key manufacturing done outside India due to the technical complexity and scale required.

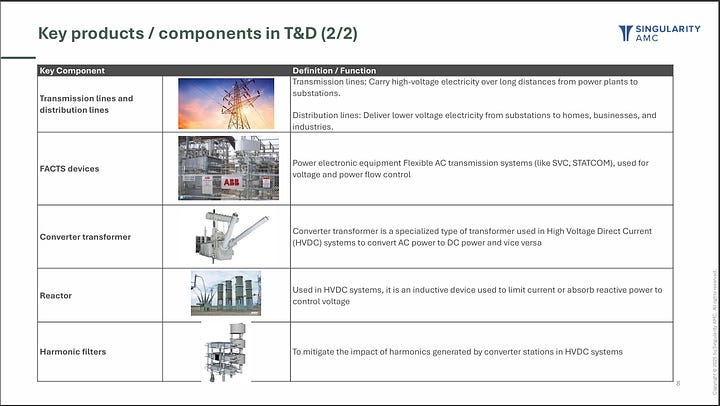

HVDC equipment and FACTS (Flexible AC Transmission System) devices, essential for long-distance, high-capacity transmission and renewable integration, remain primarily supplied by these global leaders with advanced manufacturing facilities outside India.

Digital grid controls, relays, and smart automation systems are increasingly critical but often imported or depend on foreign partnerships, reflecting the concentration of semiconductor and advanced electronics capabilities abroad.

Inverters for grid-scale solar and energy storage - such as GE Vernova’s FLEX inverter - are manufactured largely in the US, highlighting import reliance for utility-scale renewable integration technologies.

And because modernization of electricity grids is not just an Indian challenge, but a global megatrend - this opens up a huge opportunity for exporting ‘Made in India’ equipment to the world.

The Indian arm of GE Vernova that operates multiple factories in India has increased its focus on exports. Their Vadodara plant produces 765 kV class transformers and shunt reactors, Chennai facility manufactures HVDC and FACTS components, and its Pune site assembles wind turbine components for international projects. They widened their portfolio and have witnessed huge export demand concentrated in regions undergoing grid modernization and renewable integration, especially Europe, Asia, and the Middle East.

“First, the Europe opened and then Australia and then now even Middle East is also opening up. So yes, definitely the TAM for the export potential is also growing.”

- Sandeep Zanzaria, CEO & MD, GE Vernova India (source)

India, with its growing domestic ecosystem, is well placed to capture a share of this multi-decade export opportunity. Global companies like Siemens, Hitachi Energy, and ABB are already using their Indian manufacturing hubs for advanced grid technologies. This opens a huge white space for domestic companies to step up and take a lead by capturing this global opportunity.

🤝Backbone that Completes Energy Transition

The story of the energy transition is often told through the lens of solar panels, wind farms, and electric cars. But without transmission, these technologies cannot deliver on their promise. The grid is the quiet enabler that carries renewable power from distant deserts and windy coasts to our cities, balances fluctuations in supply, and ensures that new demand from EVs and data centers does not tip the system into crisis.

In many ways, investing in generation without modernizing transmission is like building engines without roads. A resilient, smart, and future-ready grid is the true foundation of clean growth. For India, achieving strategic autonomy in T&D is not just about energy security, it is about capturing a global export opportunity and shaping the future of power systems worldwide. The energy transition will only be complete when the backbone that supports it, our grid, is strengthened for the decades ahead.

At Singularity, we are committed to advancing India’s grid independence by ensuring the nation controls its energy destiny in technology, security, and economic opportunity.

If this vision resonates with you, consider sharing this blog in your circles and join the conversation in the comments below. Together, we can build a grid that powers not just today’s India, but the India of tomorrow.

Read our recent publication on Energy Transition theme: