Zero Gravity, Infinite Potential

Deep Dive: Why Space is Gaining Relevance & How India is Positioned

Internet has quietly become the backbone of how the world works today. It connects people, powers businesses, and keeps governments running. What started as a simple way to communicate has turned into the foundation of the global economy, where data moves faster than goods. And it is our telecom network that has made this possible. Each jump in connectivity, from 2G calls to 5G data, has reshaped how we live, enabling everything from digital payments and online learning to cloud computing and even running ChatGPT on your phone.

But the next big disruption in telecom isn’t happening on Earth - it’s happening in SPACE!

In today’s blog, we explore why space is gaining relevance and how India is positioned in this evolving landscape, covering the following aspects:

A Happening Space! - Agriculture, Satcom & more.

Thrust to Support - What role has government played?

Past, Present & Future

Foundation 2015-2025: Earning Trust in Space

Road Map 2025-2035: Learning to Live & Work in Orbit

Vision 2035-2045: From Presence to Leadership

States Leading India’s Flight to Space

Global Funding Landscape

Convergence of Space & Defence

Today’s deep dive is a long one, recommended to read on our website here.

A Happening Space!

From communication to Earth observation to small launch vehicles, space is transforming how nations connect, monitor, and plan. As data from satellites becomes cheaper and more precise, it is powering new applications in agriculture, logistics, climate monitoring, and urban planning. In agriculture, satellite imagery combined with AI is helping lenders assess crop health and soil moisture in real time - enabling instant, low-risk loan disbursements to farmers within minutes, directly tied to ground data (which used to take many weeks earlier). ICICI bank was the first bank in country to use satellite data to power credit assessment of farmers. SBI’s chairman also confirmed recently about the bank exploring to use satellite imagery-based inputs for making its agri lending processes more efficient.

“40% of the Indian population are agriculturists and the annual farm lending alone is a USD 550 Bn opportunity with a lot of it cornered by the informal sector lenders”

- Manish Gupta (Google DeepMind) on ‘digital agri stack’ via satellite imagery

And India is also all set to have satellite communication as a telecom service very soon. Global leader Starlink which has 8,811 satellites in orbit as of 30th Oct, 2025 with plans to scale it to 42,000 satellites, is also now all set to start satcom services in India. They recently started hiring in Bangalore before their service launch.

“India will not only deliver the fastest satellite rollout in the world, we will also redefine what satellite communication means for humanity.”

- Telecom Minister Jyotiraditya Scindia (8 Oct, 2025)

Along Starlink, Bharti-backed Eutelsat OneWeb, and Reliance Jio-SES have also received GMPCS licences to start satellite broadband services in India. Together, these advances are turning space from a science-led domain into a commercially viable and strategically vital industry.

Thrust To Support

The role of government has been very crucial and supportive in nurturing innovation in this sector in recent years. Private participation in space is now institutionalized, with the Indian National Space Promotion and Authorisation Centre (IN-SPACe) acting as a single-window, independent nodal agency which functions as an autonomous agency in Department of Space (DOS).

Foreign Direct Investment has been allowed up to 100% in few sub-sectors, opening satellite manufacturing and components to global capital and supply chains. Two state-backed capital pipes are now live or announced, including a dedicated ₹1,000 Cr sectoral VC fund for space and a ₹10,000 Cr vehicle led by IN-SPACe to back 40 companies over five years, both aimed at directly supporting larger pre-seed and seed rounds and compressing the time to meaningful hardware milestones.

The startup base has scaled beyond the ‘dozens’ phase, with more than 200 space tech startups since 2020 and government citing 350+ startups as of mid‑2025. Few leaders have demonstrated initial success including Skyroot’s Vikram‑S suborbital launch, Agnikul’s semi‑cryogenic 3D‑printed engine progress and private launchpad, and Pixxel’s hyperspectral constellation backed by a strategic cheque from Alphabet of about US$36 Mn.

The space budget has almost tripled - from ₹5,615 crore in 2013-14 to ₹13,416 crore in 2025-2026, reflecting the government’s commitment to fostering growth in the space sector. India’s space economy was valued at US$8.4 Bn as of 2022, just 2% of the US$440 Bn global pie. But projections estimate this figure will grow fivefold to ₹3,75,320 crore (US$44 Bn) by 2033, capturing 8-10% of the global share (source).

Let’s have a look at how has the journey been in the last decade, and what lies ahead.

2015-2025: Earning Trust in Space

Over the past decade, India shifted from being admired for frugal ingenuity to being trusted for repeatable, complex missions, stringing together Mars Orbiter Mission’s landmark success, the Aditya‑L1 solar observatory launch, and Chandrayaan‑3’s soft landing that made India the first nation to reach the Moon’s south polar region and only the fourth to achieve a lunar soft landing at all.

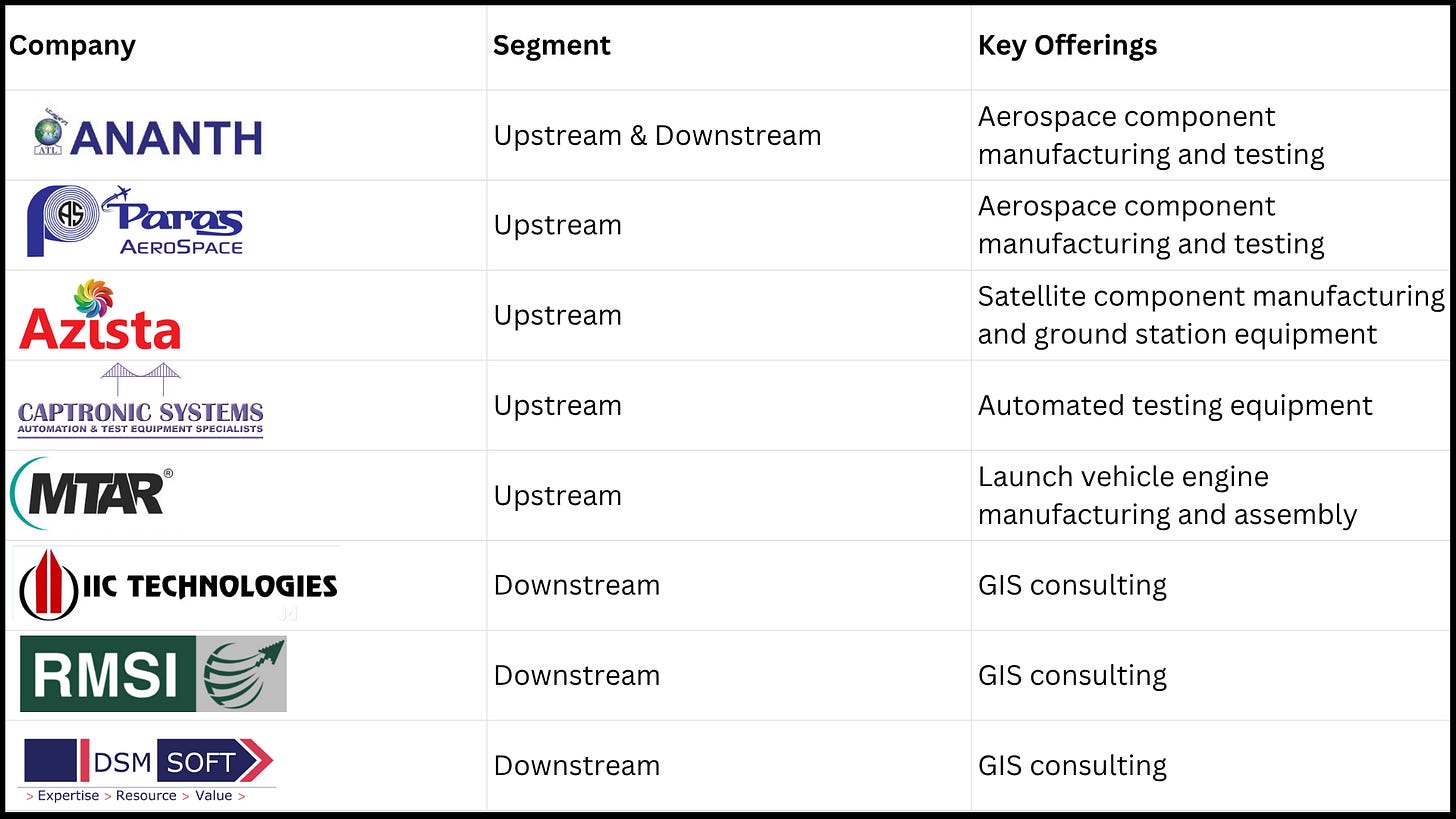

As these headline moments played out, India also became a reliable launch partner for the world, with the PSLV family putting hundreds of foreign satellites into orbit and the heavier LVM3 flying increasingly ambitious communications payloads, expanding both technical range and commercial credibility. Behind the scenes, capabilities widened from pure launches and probes into operations that knit spacecraft together, with 2024-2025 docking demonstrations validating rendezvous and control of two satellites as a single entity, a building block for future servicing and space station work. A list of companies have now emerged which are acting as backbone of Indian space tech supply chain:

Policy thinking kept pace, elevating private innovators alongside ISRO and signalling that national self‑reliance would come from a blended ecosystem of public labs, private builders, and international partnerships rather than a single institution acting alone.

2025-2035: Learning to Live & Work in Orbit

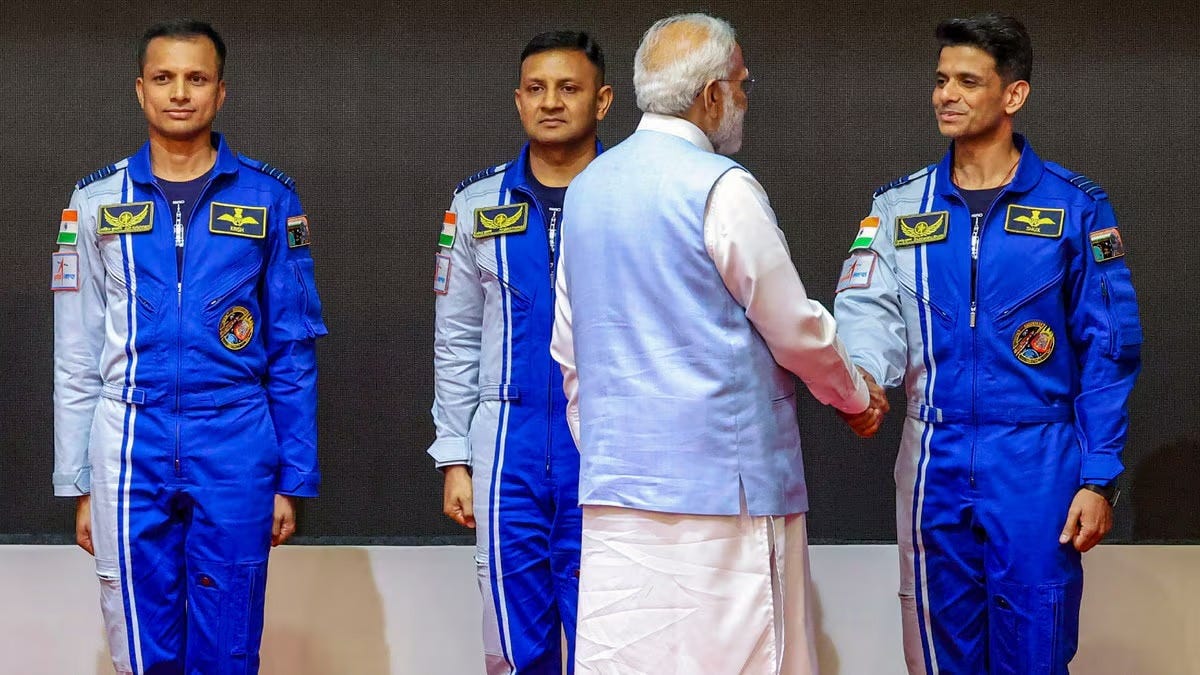

India’s next phase in space is shifting from proving technologies to sustaining human presence and operations. The Gaganyaan mission, targeted for around 2027, is progressing through a series of abort tests, drop tests, and uncrewed trials aimed at systematically reducing risk before sending astronauts to space. Group Captain Shubhanshu Shukla’s space mission in June 2025 has already given India valuable operational experience in astronaut training, life-support systems, docking procedures, and in-orbit experiments. These learnings now form a practical playbook that ISRO can apply directly to Gaganyaan’s upcoming uncrewed and eventual crewed missions.

If timelines hold, India’s own space station ‘Bharatiya Antariksh Station’ is planned to come online by 2035, turning today’s docking trials into everyday operations like berthing, resupply, and microgravity research that serve science, industry, and diplomacy from low Earth orbit. Alongside human spaceflight, expect follow‑on lunar missions and advanced Earth‑observation programs to mature, while private companies take on a larger share of manufacturing and services so space becomes a broader industrial base rather than a sequence of one‑off feats.

India also aims to build a comprehensive space defence architecture anchored by an indigenous ‘Intelligence, Surveillance, and Reconnaissance (ISR)’ constellation, co-orbital capability demonstrations, and a centralized command and control centre for space operations. This integrated system will enhance India’s ability to monitor activity across borders and oceans, safeguard its satellites, and respond faster to emerging threats in orbit.

2035-2045: From Presence to Leadership

Once a national station runs at full scale, orbital life becomes a habit rather than an exception, with India positioned as a hub for micro-gravity science, commercial testing, and international crews that tap a routine pipeline of launches, logistics, and on‑orbit servicing.

ISRO’s long‑range aims include landing Indians on the Moon in the early 2040s and building the gateway capabilities that make deep‑space research and, eventually, interplanetary missions more practical, which is why today’s docking and human‑rating work matters so much. Building a space station for experiments and a gateway for interplanetary exploration, including landing Indians on the Moon, is a key goal.

Leadership in this phase is not just about flags and footprints, it is about setting norms and frameworks so space stays open and sustainable, which is why India’s expanding collaborations and policy voice are already treated as part of the mission plan rather than an afterthought.

States Leading India’s Flight to Space

State governments are taking a federal approach to leverage their competitive advantages to attract startups to set up facilities. In Sep’25, Andhra Pradesh awarded the contract to develop a ‘Space City’ to Skyroot Aerospace (expert in designing cost-effective launch vehicles for small satellites & founded by former ISRO scientists), who would set up India’s first space city in Tirupati (close to the Satish Dhawan Space Centre) with an investment of ₹400 crore. This follows the Andhra Pradesh’s Aerospace and Defence Policy, which was unveiled in June of 2025.

Karnataka state, on other hand, with its deep aerospace legacy and ISRO’s presence in Bengaluru, is firmly positioning itself as India’s space tech powerhouse. Through the draft Karnataka Space Technology Policy 2024-29, the state aims to capture 50% of India’s space market and 5% of the global space economy. To achieve this, it plans to attract investments worth ₹25,590 crore (about US$3 Bn), create a dedicated space production cluster, and support over 500 startups and MSMEs with funding, intellectual property assistance, and quality certification. The policy also focuses on workforce development, targeting the training of 5,000 professionals, including 1,500 women, to prepare for future roles across the domestic and global space sectors. Built on Bengaluru’s leadership in new space startups, research institutions, and ISRO-linked infrastructure. These state policies cover aspects related to key segments of the space:

Downstream - applications & services on Earth that use data or signals from space

Midstream - involves operations in space through managing satellites & maintaining communication networks

Upstream - design, manufacture & launch side of space activities, everything required to get into space

Within these, Manufacturing (includes payloads, subsystems, components), Launch Vehicles (includes rockets, propulsion, testing) along with Earth Observation (EO) are amongst the biggest categories. India plans to have ~119 Earth-observation satellites by 2040 with an estimated investment of ₹40,000-70,000 crore (~US $5-8 billion) in manufacturing and launch. Ground Station as a Service (GSaaS) is another emerging area, a cloud-based model that allows satellite operators to access and control their satellites without building or maintaining physical ground stations.

Tamil Nadu has also joined the race with equal ambition through its newly approved Space Industrial Policy 2025, which aims to establish the state as a manufacturing and innovation hub for the space economy. The policy targets ₹10,000 crore (US$1.17 Bn) in investments and the creation of 10,000 high-value jobs across manufacturing, space-tech services, and downstream applications. A key element is the development of dedicated ‘Space Bays’ in Madurai, Thoothukudi, Tirunelveli, and Virudhunagar - specialized industrial clusters designed to support both early-stage startups and established companies across the space-tech value chain. With incentives such as quick approvals, capital subsidies, and proximity to ISRO’s upcoming launch and propulsion facilities at Kulasekarapattinam, Tamil Nadu is building strong competitive advantages. Industry players like LMW, L&T, Agnikul Cosmos, and GalaxEye already anchor this ecosystem, reinforcing the state’s strategy to become a high-tech aerospace and satellite manufacturing hub.

Global Funding Landscape

SpaceTech has continued to outperform the broader global VC landscape. The Seraphim Space Index, a key barometer that tracks global venture investment activity in the space sector on a 12-month trailing basis, confirms this trend. While overall VC funding has partially rebounded in recent quarters, driven largely by big AI-related rounds, deal activity continues to decline, reflecting fewer but larger investments. Capital flowing into space tech is now approaching levels last seen during the 2021 SPAC boom.

While funding is trending upwards, it is crucial to note that Indian startups are yet to make a mark in terms of big funds backing them with significant capital. For example, of the top 20 deals that happened in H1 2025, none of the investments took place in India. In US, listings of Voyager Technologies on NYSE in June’25 and Karman Holdings earlier in 2025, have showcased that public markets are now once again open to space companies and therefore has encouraged more funds chasing returns in select global markets.

Big Tech names are also investing in this space. Amazon is investing up to US$10 Bn in their Project Kuiper and aims to begin commercial internet service later this year. Google has launched Project Suncatcher to build scalable machine learning compute systems in space, harnessing more of the sun’s power - as AI continues to suffer from sustainable power supply. Meanwhile, China is accelerating its own efforts to compete in the satellite internet race. The state-backed ‘Guowang Network’, envisioned as China’s answer to Starlink, is targeting a 13,000-satellite constellation. They launched the third and fourth batches in Q2 2025.

Convergence of Space & Defence

Space is no longer a separate frontier from defence, it is becoming the digital and operational backbone of how modern militaries function. Real-time surveillance, secure communication, and orbital monitoring now depend on satellite-based systems, turning space into the new high ground for strategic advantage. This shift is also reshaping global defence investments, with more funding flowing into technologies that connect land, air, sea, and orbit.

In Nov’25, ISRO launched India’s heaviest communication satellite CMS-03 from their ‘Baahubali’ rocket LVM3-M5 and placed in the intended orbit with precision. Made for Indian Navy, a 4,410 kg multi-band communication satellite with coverage over a wide oceanic region, including the Indian landmass, designed for providing communication services for at least 15 years.

Globally in recent quarters, companies such as Anduril, which raised $2.5 Bn at a $30.5 Bn valuation, and Saronic, which secured $0.6 Bn at a $4 Bn valuation, have shown how defence innovation increasingly relies on space infrastructure. While not purely space companies, their partnerships with firms like Impulse Space and Apex highlight a growing overlap between defence and spacetech.

Anduril is developing orbital surveillance and threat detection systems, while Saronic aims to use satellite-enabled mesh networks to coordinate autonomous fleets.

Together, they show that space is no longer a supporting layer of defence but a core part of it, enabling faster decisions, persistent awareness, and resilient communication in a world that demands both speed and precision.

Bottom Line

Space is fast emerging as the next big frontier for innovation and economic growth. What was once a domain of government-led exploration is now opening up to private enterprise, new technologies, and global collaboration. India’s space journey has evolved rapidly, with policy clarity, stronger institutional support, and a growing ecosystem of startups building capabilities across launch, satellites, and data applications. The coming decade could see India transform from a reliable launch partner to a full-scale space economy driving innovation, commerce, and national capability.

We at Singularity AMC are deeply committed to advancing India’s strategic autonomy in space by supporting ambitious companies that have the courage to innovate and create lasting impact in this domain. We shall be coming up with a follow-up blog (Part 2) covering our perspective from an investor’s lens soon - stay tuned!

If you find this blog valuable, share it in your community & let us know your thoughts in comments below.

Read our recent deep dive blogs: