India's Defence Manufacturing Revolution

From Operation Sindoor to a $130 Billion Market

In the pre-dawn hours of May 2025, as precision strikes illuminated terrorist camps across nine locations in Pakistan during Operation Sindoor, something remarkable happened beyond the tactical success. For the first time in decades, India wasn’t entirely dependent on foreign suppliers for its military capabilities. The indigenous command systems guiding those strikes, the locally manufactured components in critical systems, and the integration capabilities that made it all possible – none of this existed five years ago.

What This Blog Covers

This analysis explores India’s transformation in defence manufacturing across six key dimensions:

Strategic imperative driving India’s self-reliance push

India’s journey in the last decade

Where India stands today & where it wants to be

Pathways to Success: How Companies Are Getting There

Success Stories: Companies That Have Made It

Global Context: India’s Competitive Advantages

The Decade of Transformation Ahead

The Geopolitical Imperative

Picture this: You’re running a business worth $78.7 billion annually, but 70% of your critical supplies come from external vendors who might cut you off at any moment. That vendor in Europe suddenly prioritizes their domestic customer during a crisis. Your supplier from North America gets caught up in their own geopolitical calculations. The partner you’ve relied on for decades turns unreliable precisely when you need them most.

This isn’t a hypothetical scenario – it’s been India’s reality for decades. The Russia-Ukraine conflict crystallized what defense planners had long feared: in times of crisis, every nation prioritizes its own survival above foreign contracts. For India, with its unique security challenges spanning multiple borders and threat vectors, this reality check was both sobering and catalytic.

Economic Stability and Negotiation Power

Defence manufacturing provides more than just military capability – it delivers economic stability and negotiation power on the global stage. When a nation controls its defense production capabilities, it gains:

Strategic Independence: Freedom from supply chain disruptions during conflicts

Economic Multiplier Effects: High-value manufacturing that drives innovation across sectors

Export Revenue: Defense exports create substantial foreign exchange earnings

Technology Spillovers: Military R&D often drives civilian innovation

Negotiation Leverage: Domestic capabilities reduce dependence on foreign powers

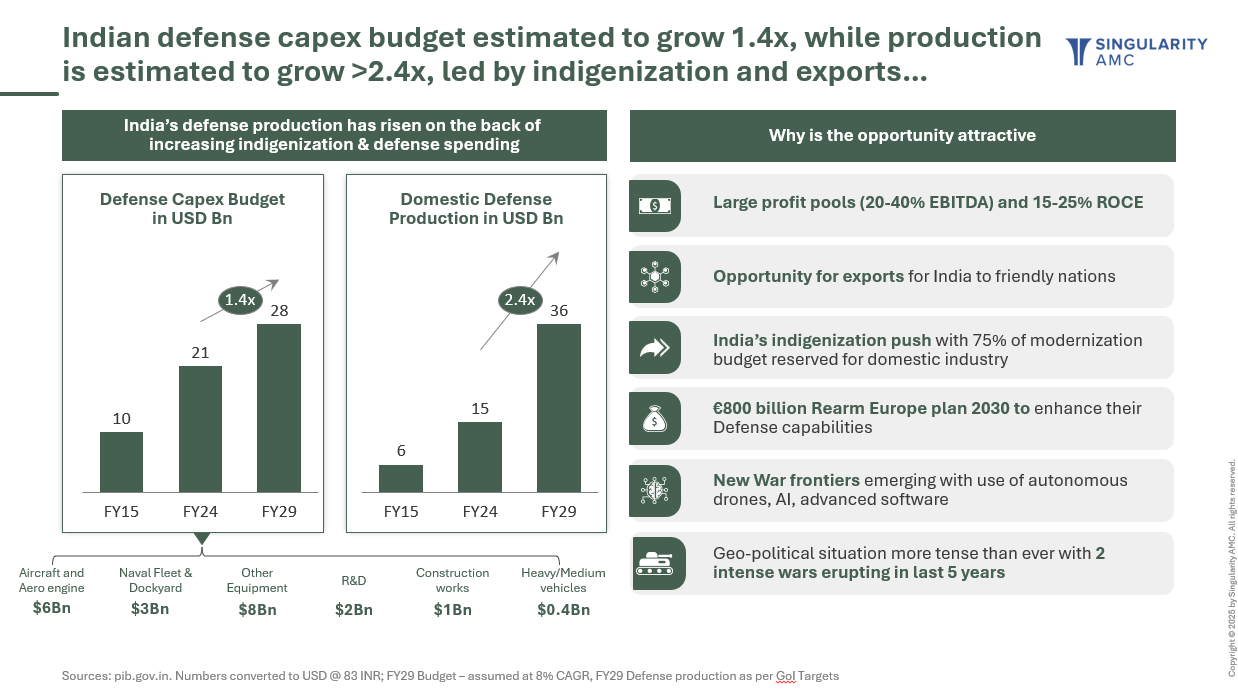

The government’s commitment to spend $130 billion on modernization over the next 5-7 years, with 75% earmarked for domestic procurement is supported by official budget allocations, isn’t just a policy statement – it’s a strategic imperative wrapped in a massive market opportunity.

India’s Journey in the Last Decade

1. IDEX: The Innovation Catalyst

Perhaps the most transformative development has been the Innovations for Defence Excellence (iDEX) program, which has already signed 430 contracts with startups, ranging from ₹1.5-25 crore. These aren’t just grants – they’re validation from the Indian Armed Forces that specific technologies solve real operational problems.

iDEX represents a fundamental shift from traditional defense procurement to innovation-driven development. By engaging startups and MSMEs directly, the program has:

Accelerated technology development cycles

Reduced dependence on large defense contractors

Created a pipeline of validated defense technologies

Established proof-of-concept for private sector capabilities

2. Defence Acquisition Policy (DAP): Streamlining Procurement

The Defence Acquisition Policy has undergone multiple iterations to prioritize indigenous manufacturing:

Make in India categories with mandatory technology transfer requirements

Simplified procurement procedures for domestic suppliers

Strategic partnerships to combine foreign expertise with Indian manufacturing

Buy Indian categories that mandate domestic sourcing for specified equipment

The recently announced Defence Procurement Manual (DPM) 2025 further streamlines the revenue procurement process, covering approximately Rs 1 lakh crore in the current financial year. This complements DAP by addressing operational and maintenance needs, creating additional opportunities for domestic suppliers.

3. Transfer of Technology (TOT): Bridging Capability Gaps

Government has actively encouraged Transfer of Technology (ToT) agreements – a pragmatic approach that combines immediate capability acquisition with long-term indigenous development. ISRO, along with IN-SPACe and NSIL, has executed over 98 TOT agreements till date, demonstrating the model’s effectiveness.

These TOT agreements serve multiple purposes:

Immediate access to proven technologies

Gradual capability building in domestic industry

Risk reduction for private investors

Foundation for future indigenous innovation

Where India Stands Today

1. Scale and Growth Metrics

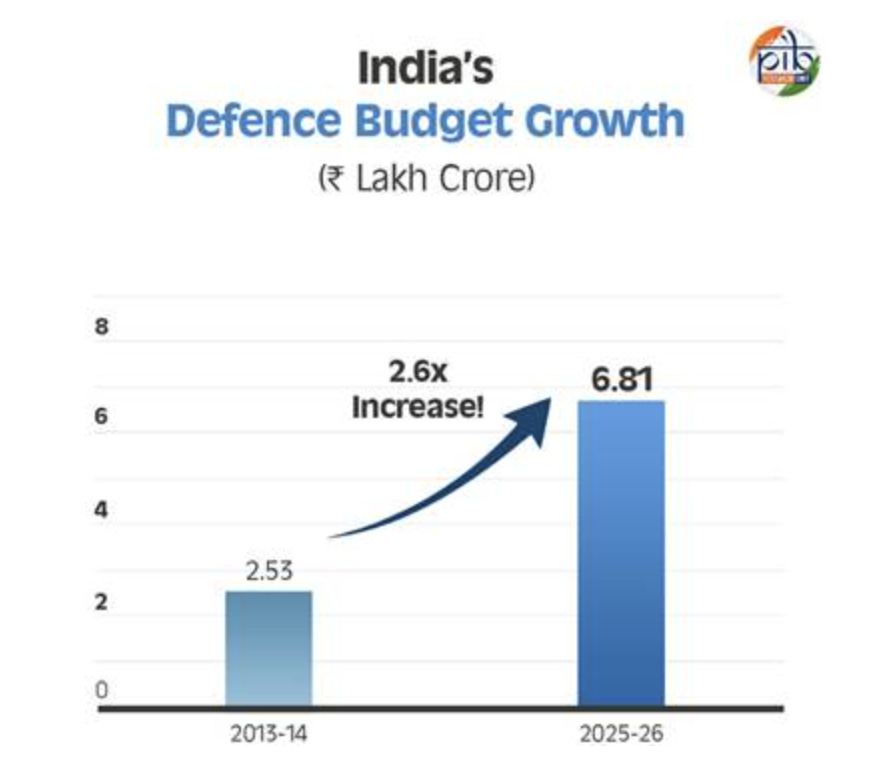

India’s transformation in defense manufacturing over the last decade has been extraordinary:

Defense production has surged from ₹43,000 crore a decade ago to ₹1.51 lakh crore in FY 2024-25 – a 250% increase

Exports have grown 35-fold to ₹24,000 crore, reaching over 100 countries, with a stated goal of reaching ₹50,000 crore by 2029

From being the world’s largest defense importer to an emerging exporter

2. Industry Structure

The defense manufacturing ecosystem now includes:

10,000-12,000 MSMEs engaged in defense manufacturing

Approximately 2,000-3,000 companies with proven technical capabilities and stable cash flows

Companies typically generating ₹50-500 crore in revenue at healthy 15-25% EBITDA margins

509 items on the government’s positive indigenization list providing clear demand visibility

3. Global Benchmarking

When benchmarked globally, India’s position becomes clearer and also that have a lot more to achieve and at a much shorter time.

United States: Spends $850+ billion annually with 2,500+ prime contractors

China: Allocates $471+ billion with state-sponsored manufacturing giants

India: Currently spends $78.7 billion, representing significant growth opportunity

4. Proven Capabilities

India’s advantage lies in cost innovation: Indian companies are consistently delivering 70-80% of required capabilities at 30-40% of traditional European and North American costs. This isn’t corner-cutting – it’s frugal engineering, the same approach that put an Indian spacecraft into Mars orbit for less than the cost of a Hollywood space movie.

Global aerospace companies have recognized India’s capabilities: A global aerospace manufacturer currently sources $1.25 billion annually from India, leveraging precision engineering capabilities that meet international aerospace standards. Many Indian companies serve as subcontractors to global leaders while simultaneously building domestic capabilities – creating proven track records that reduce investment risk.

Where India Wants to Be – The Vision

1. The $130 Billion Opportunity

The government’s modernization budget provides unprecedented demand visibility for:

1.4 million army personnel requiring modern equipment

150+ naval ships needing advanced systems

800+ aircraft requiring indigenous components and systems

2. India’s Right to Win

India enters defense manufacturing with several structural advantages:

Cost Innovation: The ability to deliver 70-80% capability at 30-40% cost isn’t just about labor arbitrage – it’s about frugal engineering and systems thinking that originated in India’s space program.

Software Integration: India’s IT prowess enables leapfrogging traditional hardware-centric approaches. Modern defense systems are increasingly software-defined, playing to India’s strengths.

Scale Potential: A domestic market requiring comprehensive modernization provides unmatched scale for suppliers to achieve economies of scope.

Export Credibility: India’s non-aligned positioning makes it an attractive alternative supplier for countries seeking to diversify procurement away from traditional powers. Most countries lack manufacturing capabilities due to insufficient scale (e.g., Israel) or resources (developing nations). They want to work with India as a stable, predictable, and neutral option.

Pathways to Success: How Companies Are Getting There

Three Strategic Paths to Value Creation

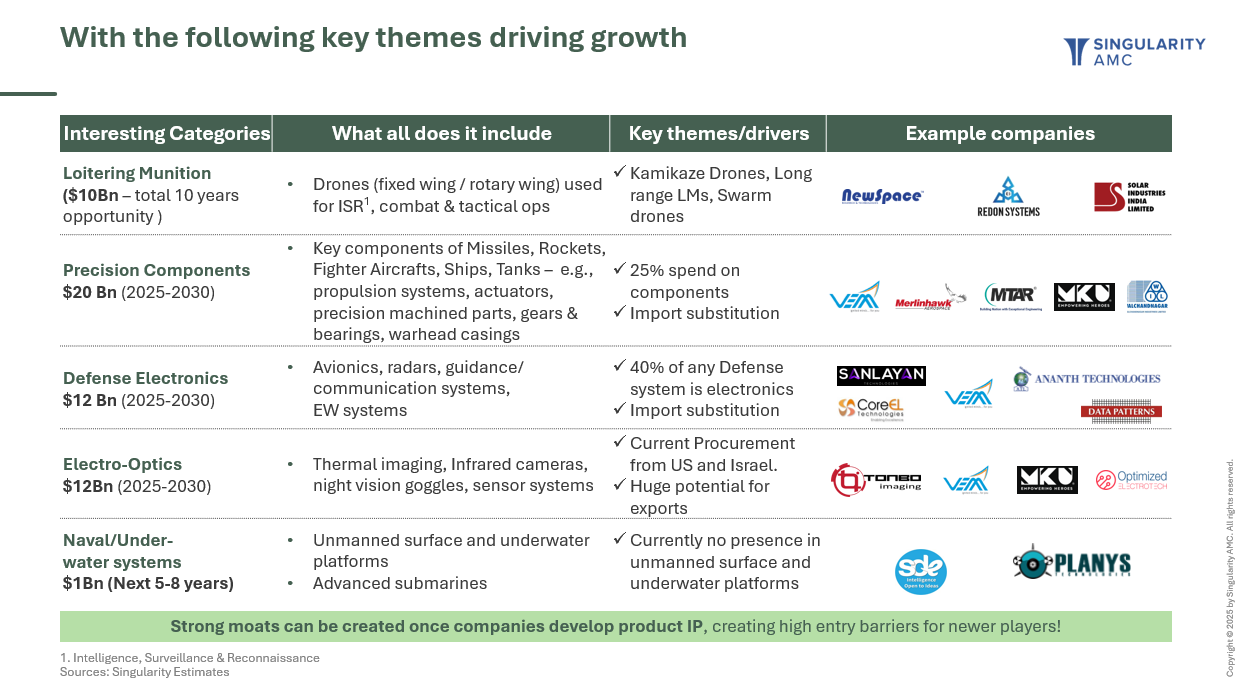

The Subsystems/Subcomponent Specialists: Essential but Specialized

Companies manufacturing critical subsystems occupy perhaps the most attractive niche in defense manufacturing – essential to multiple platforms yet specialized enough to avoid commoditization. E.g. Communication systems can be used across radars, UAVs, aircraft, etc. By virtue of subsystems catering to multiple platforms, they address a larger Total Addressable Market (TAM) and secure themselves from the lumpiness of defense contracts.

Once qualified, these businesses benefit from sticky customer relationships and often enjoy multi-decade revenue streams with predictable margins. The key is identifying companies with genuine technological capabilities rather than simple assembly operations.

Furthermore, these companies can evolve from being subcomponent manufacturing companies to eventually building platforms thereby increase their value-add as well as differentiating themselves.

System Integrators: Complexity as a Moat

The high end of the value chain belongs to System Integrators who manufacture large platforms like Control Systems and Avionics and can command 25-35% EBITDA margins while developing sticky customer relationships that span multiple procurement cycles.

The complexity of modern defense systems favors capable integrators. As platforms become more sophisticated, the value of integration expertise increases. Companies that can successfully deliver high-value complex systems become indispensable to their customers.

The Dual-Use Innovators: Best of Both Worlds

A proven approach to protect business from lumpiness is to have dual-purpose applications for end solutions. An electro-optics payload can be used for ISR (Intelligence, Surveillance, and Reconnaissance) as well as on drones for agriculture, mining, and other enterprise use cases. This ensures optimal capacity utilization and smoother revenue profiles.

This dual-market approach often leads to faster growth and more attractive exit valuations, as companies can leverage both defense demand and commercial market opportunities.

Success Stories: Companies That Have Made It

1. The Hidden Champions: Beyond the Headlines

While media attention often focuses on large public sector enterprises like HAL and BEL, the real transformation is happening among companies most investors have never heard of. These companies have been delivering complex systems to defense clients. Take Vinyas, an electronic system design and manufacturing company that delivers highly complex, build-to-spec solutions. They combine deep technical expertise with established customer relationships, representing the type of capability that exists throughout India’s defense ecosystem. The opportunity extends beyond manufacturing to other categories like skill development as well. For example, Aimtrex is another company that specializes in offering infrastructure for live training & simulation for the armed and defence forces on an ongoing basis. Goes to prove the opportunity is significant for companies who are focused, differentiated and delivering impact.

2. Scaling Success Stories

With proper capital support and professional management, many companies in the ₹50-500 crore revenue range could scale to ₹1,000+ crore enterprises. The companies that entered this sector five years ago are now scaling rapidly, with many achieving public market valuations that reflect their growth potential.

3. The Consolidation Opportunity

The fragmented nature of India’s defense supplier base presents compelling consolidation opportunities. Unlike consumer sectors where scale often means commoditization, defense manufacturing rewards specialization combined with breadth. This template already exists in global markets, and signs of this are emerging in India as well.

Global Context: India’s Competitive Advantages

1. Structural Differentiators

India enters defense manufacturing with several advantages that differentiate it from other emerging defense producers:

Technology Integration Capabilities: Modern defense systems require seamless integration of hardware and software components. India’s proven capabilities in both domains provide a unique advantage in developing next-generation defense platforms.

Engineering Talent Pool: India’s large pool of skilled engineers, combined with established R&D institutions, provides the human capital necessary for complex defense manufacturing.

Established Industrial Base: Unlike countries starting from scratch, India has a mature industrial ecosystem that can support complex manufacturing requirements.

Non-Aligned Position: India’s strategic autonomy makes it an attractive partner for countries seeking to diversify their defense procurement away from traditional powers.

2. Export Market Potential

India’s defense exports have already reached 100+ countries, demonstrating global acceptance of Indian defense products. The combination of cost competitiveness, proven quality, and strategic neutrality positions India well for continued export growth.

The Decade of Transformation Ahead

1. The Historic Inflection Point

India’s defense manufacturing sector stands at a historic inflection point. The convergence of strategic necessity, policy support, and private sector capability creates what may be the most compelling structural opportunity in the Indian economy.

2. The Investment Opportunity

This won’t be a sector that delivers quick wins. Defense manufacturing rewards patience, expertise, and long-term thinking. But for investors who understand both the strategic importance and commercial potential, India’s defense manufacturing revolution offers the opportunity to participate in building the country’s strategic autonomy while generating substantial returns.

The ₹130 billion modernization budget provides unprecedented demand visibility. Structural reforms are reducing traditional barriers. Most importantly, early movers are proving that building globally competitive defense capabilities in India isn’t just possible – it’s highly profitable.

3. The Path Forward

As Operation Sindoor demonstrated, India is ready to defend its interests with indigenous capabilities. Building the ecosystem to sustain such operations independently, while creating globally competitive businesses, represents the real opportunity. It requires commitment, expertise, and patience. But for those who understand the game, the potential rewards justify the effort.

The transformation is underway. The question isn’t whether India will become a major defense manufacturer – it’s which investors and companies will capture the value being created in this historic transition.

This is a long journey, but one that must be travelled, and with a sense of urgency.

The decade ahead will be transformative for India’s defense manufacturing sector. The companies and investors who commit to this journey today will be the ones who define India’s strategic autonomy tomorrow.

Read our recent publication on Energy Transition theme: