India’s EV Curve is Accelerating!

High-Potential, Underpenetrated Categories Ready for Takeoff

When the World’s First EV Day was celebrated in 2020, India’s EV penetration was only about one-fifth of the global level, with around 3.3 lakh electric vehicles sold annually. Last month, as we marked its sixth year in 2025 and crossed 20 lakh annual EV sales, we still stand at just over two-fifths of the global penetration, implying that the momentum is gaining steam and there’s a huge runway ahead.

At Singularity AMC, we’re actively capitalizing on opportunities in the electric commercial vehicle (E-CV) sector through our investments.

We believe that for growth stage investors like us, attractive challenger OEM (Original Equipment Manufacturer) opportunities lie in high-utilization E-CV segments such as buses, light and heavy-duty trucks, and tractors.

Here is a quick snapshot of our thesis:

Our portfolio companies are demonstrating execution at scale. PMI Electro Mobility has secured a top three position among peers, with more than 2,500 e-buses deployed across 31 Indian cities, covering over 20 crore electric kilometers annually. At the same time, Qucev is seeking to lead electric trucks category with both a 3.5-ton Light CV and a 55-ton Heavy CV. Strategic partnerships and technology transfer arrangements with global players such as Foton, BYD, and CALB further strengthen the right to win for both PMI and Qucev.

Today’s blog is a bit more detailed, recommended to read it on our website here.

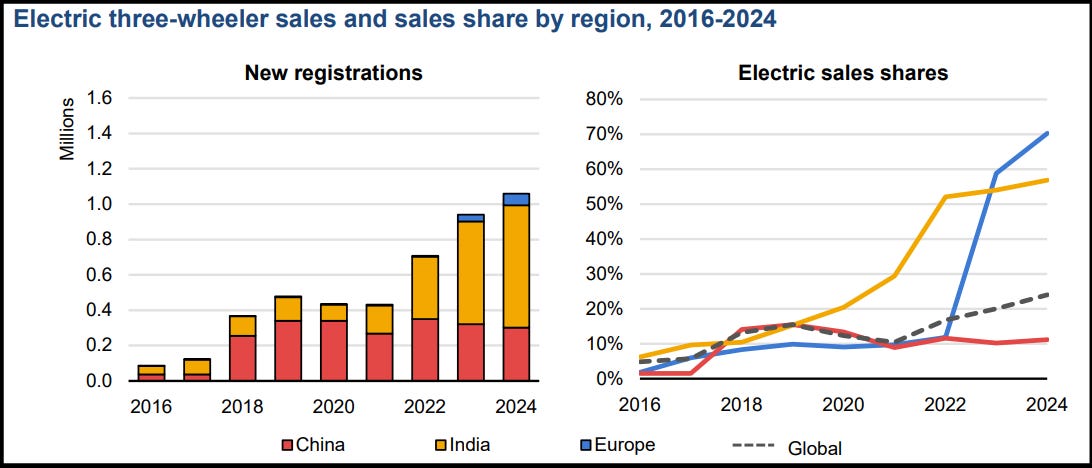

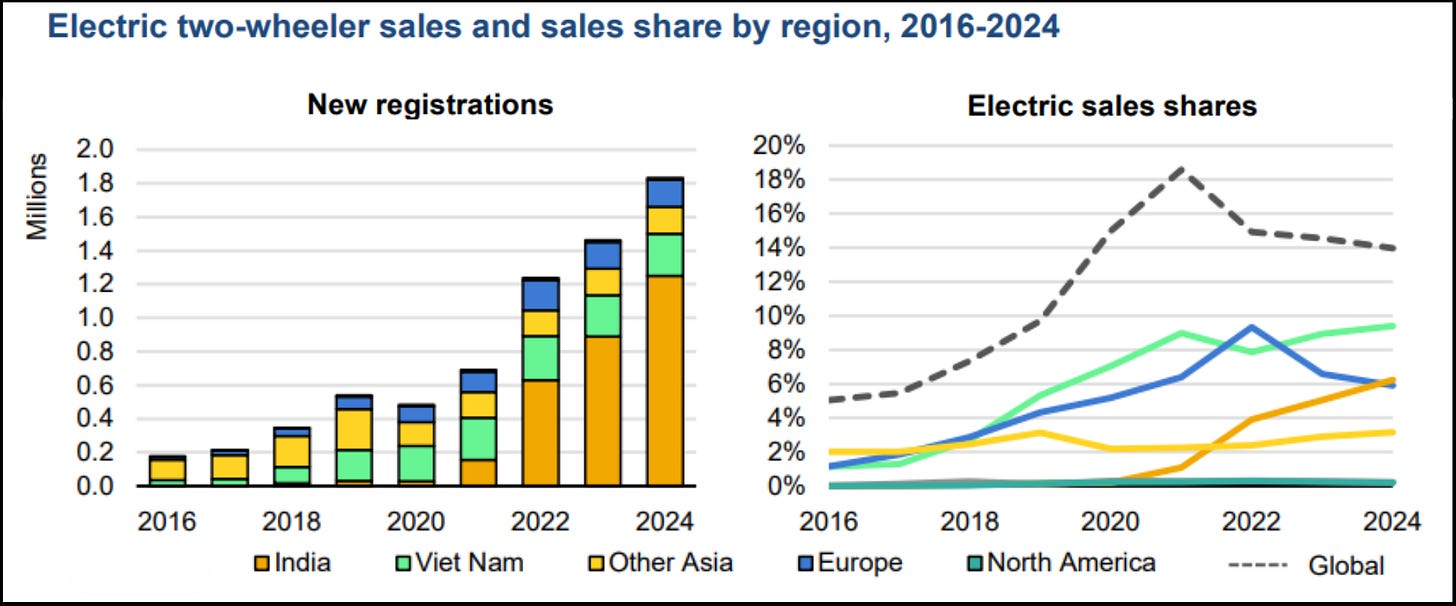

When it comes to categories like electric 2/3 wheeler, India along with China & Southeast Asia, is one of the world’s largest markets, accounting for around 80% of 2024 global sales. Electric 2/3Ws stand out as the most affordable and accessible entry point into electric mobility and serve as primary mode of private passenger transport in India and Southeast Asia. But on other side, electric penetration levels are less 3% when it comes to Light Goods Vehicles (LGVs)/ Heavy Goods Vehicle (HGVs). This blog explores how adoption is evolving across key categories.

India’s Leadership in Electric 3Ws🛺

In 2023, India overtook China to become the world’s largest market for electric 3Ws, and it maintained this position in 2024, with sales growing ~20% YoY. This translated into a record 57% electric sales share in the country.

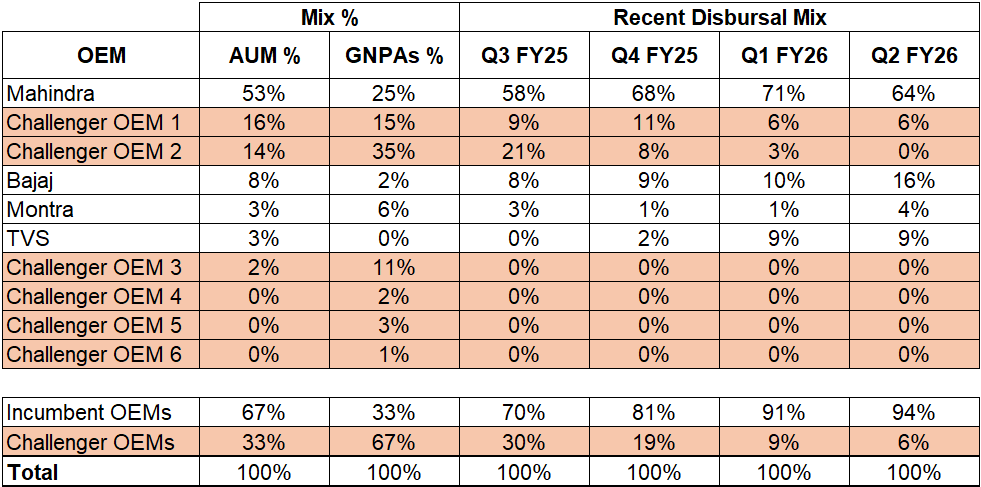

Policy support under the new PM E-DRIVE scheme, which allocated budget in 2024 to support the roll-out of more than 300,000 electric 3Ws for commercial use has helped. When one looks at leading companies, the biggest share is held by legacy players like Mahindra and Bajaj, with 70% market share in the E-3W transport (non e-rick) segment and around 60% in the overall 3W market.

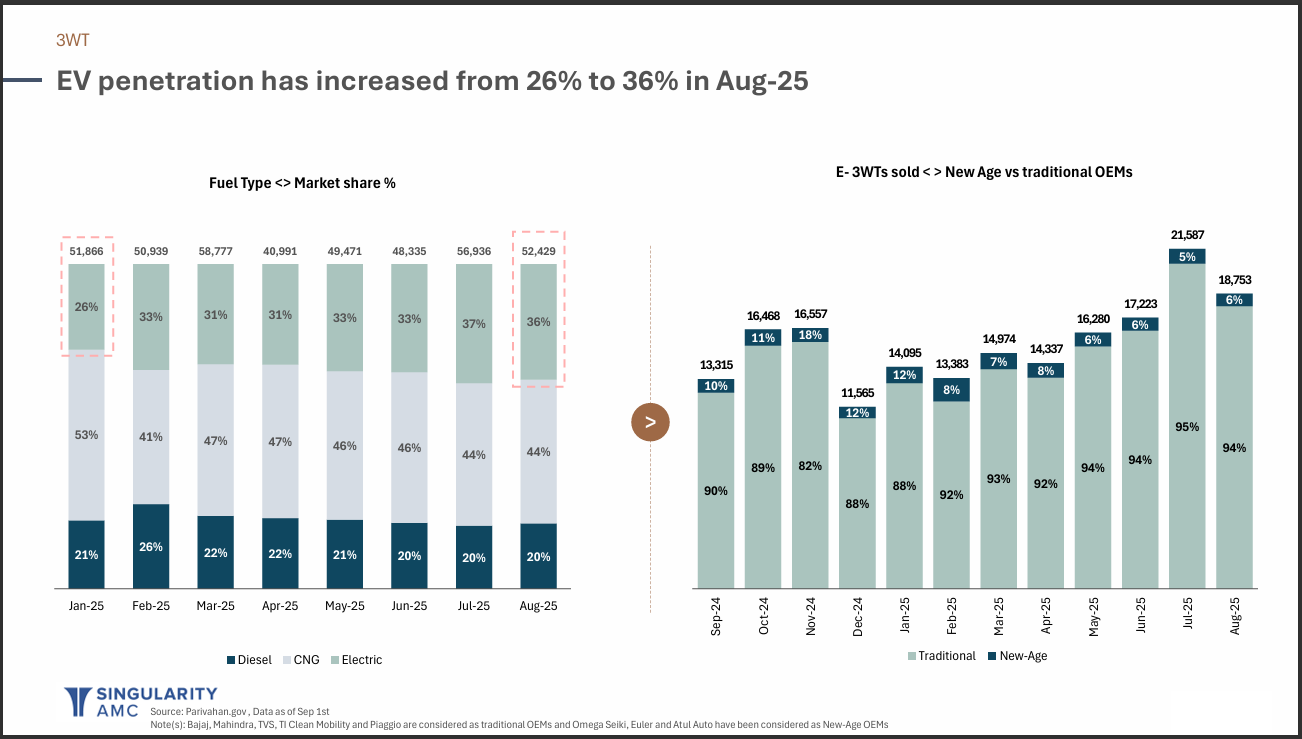

In just the first 8 months of 2025, the penetration of Electric 3Ws (non e-rickshaws) has grown by a healthy 10% points, from 26% to 36%. Within that, legacy players have not only maintained but even gained further share against new-age companies in the space. Therefore, the scope for new OEMs to emerge and take away market share from legacy players in this category has been extremely limited. Large corporate-backed players (like Montra – TI Clean by Murugappa Group) are the only credible challengers to the incumbents in our view.

Even financiers are increasingly directing their disbursal towards incumbent OEMs with established track records rather than newer entrants.

Larger players continue to command the bulk of fresh disbursal, reflecting financiers’ preference for scale, reliable service networks, and stronger warranty frameworks. This reduces risk, as evident from their relatively lower gross NPA ratios compared with newer competitors.

In contrast, financing support for emerging players has steadily declined in recent quarters due to concerns around higher delinquency levels and weaker after-sales reliability. This highlights how incumbents continue to lead the electric 3W market, with financiers reinforcing this momentum by backing their purchasers.

The three-wheeler (3W) segment had some of the lowest barriers to entry in the EV market. From an engineering standpoint, 3Ws are far less complex than two-wheelers or cars, and setting up manufacturing requires minimal capex.

This made it easy for new players to jump in. For challenger OEMs, the real edge often came from design, engineering and tech-first approaches, essentially building ‘smartphones on wheels’. But beyond the product, they lacked advantages in critical areas like distribution, branding, financing, service networks and supply chain efficiency.

That is where incumbents like Bajaj had the upper hand. They waited on the sidelines as consumers tested EVs and grew comfortable with the idea. Once adoption began to take off, Bajaj quickly rolled out new models and leveraged its massive distribution network to capture market share.

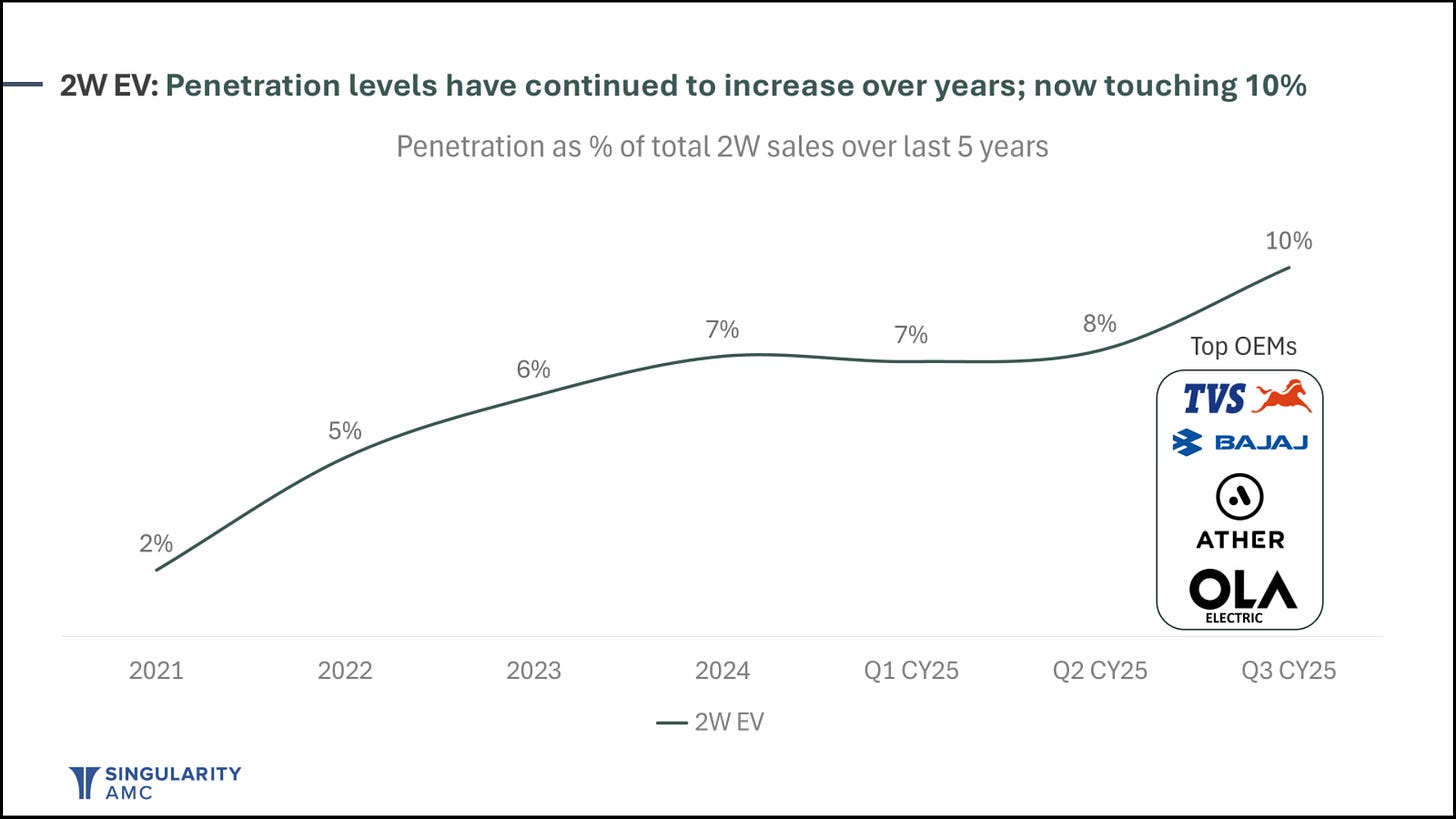

Electric 2Ws 🛵Rise, Profitability Catching Up

India has witnessed an exponential rise in electric 2-Ws since 2021 and has now become the second-largest market in terms of vehicles sold, after China. The country hosted 220 OEMs in 2024, up from 180 in 2023, although the top four market leaders together accounted for 80% of the 1.3 million electric 2-Ws sold that year.

Affordability, driven by government subsidies, reducing battery prices and supply chain optimisation, has been the biggest contributor. Policy support is also helping bridge the affordability gap through the PM E-DRIVE scheme (earlier under FAME-II and the Electric Mobility Promotion Scheme), which offers purchase subsidies of up to INR 5,000 for 2-Ws fitted with lithium-ion batteries.

In terms of penetration levels within the segment, we have seen a steady increase over the last 5 years where the sharpest increase happened from 2% to 5% from 2021 to 2022, followed by a rise to 7-8% in following years.

Recently in Q3 CY2025, the penetration touched ~10% led by the top OEMs namely TVS Motors, Bajaj, Ather & OLA.

Though, with GST rate cuts on petrol/diesel 2W (ICE) which have made them relative more affordable vs their EV counterparts can impact penetration levels in short term but long term trend remains intact.

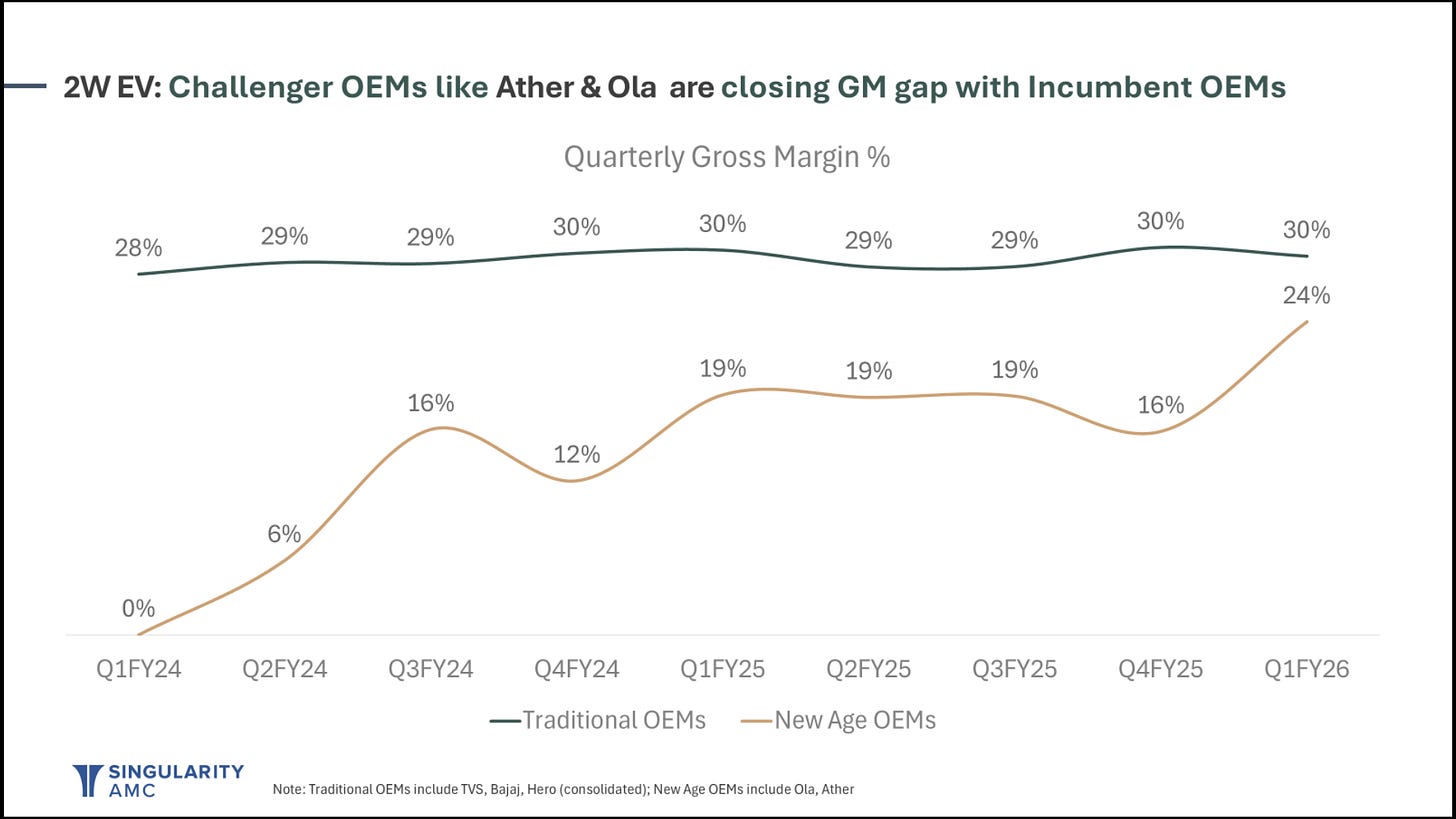

On the profitability front, it is worth noting that gross margins have continued to expand quarter after quarter, and is now reaching at par with incumbent OEMs. While incumbent players are yet to achieve sustainable profitability, Q1 FY26 results for Ola’s auto segment, EBITDA improved to -11.6% compared to -90.6% in preivous quarter, and June marked ‘the first EBITDA-positive month for the auto business’. On other side, Ather reported an EBITDA loss of (-)16% in Q1 FY26, improving on QoQ & YoY basis.

In terms of market share, challenger OEMs are finding it difficult to incrementally break into the top five. Established players such as Hero Electric are becoming increasingly aggressive to defend their position, while newer entrants like Bgauss/River Mobility might struggle to get into the Top 5 by volumes, but can create leadership in niche use cases. We’re also watching how electric bikes evolve with Ola’s launch, as challengers like Tork have so far been unable to make significant inroads.

Why India’s Electric Car🚗 Adoption Lagging Globally?

In India, 98% of the vehicle fleet comprises either small vehicles (2-wheelers or small cars), public transport, or goods vehicles. Only about 2% of vehicles are larger cars costing more than INR 10 lakhs. Since most EV cars are priced well above this threshold, affordability remains a major challenge for mass adoption. The base model of India’s best-selling EV in FY2025, the MG Windsor EV, starts from INR 14 Lakh on road. Therefore India’s EV Car penetration continues to be ~3% in both 2023 and 2024.

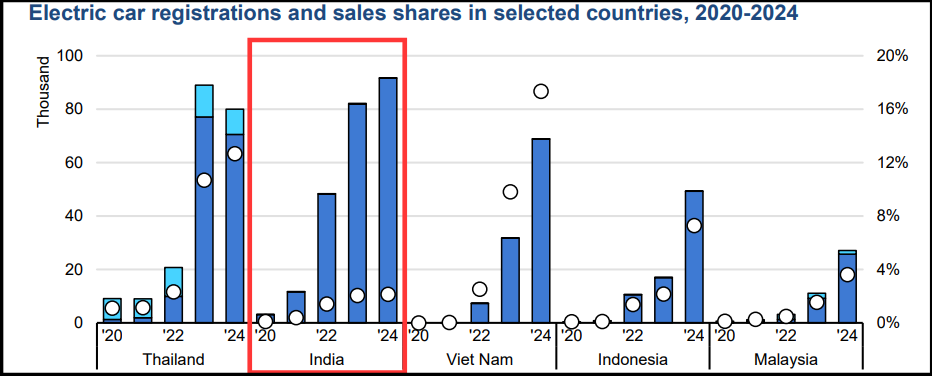

Compare this with Thailand. With high imports of affordable Chinese battery electric cars at prices often lower than average price of a conventional car in Thailand, EV penetration suddenly jumped from 3% in 2022 to 13% in 2024. Similar has been the case with multiple South East Asian countries where the adoption has seen sharp increase as shown in graph below. But, India continues to have high % of taxes on car imports.

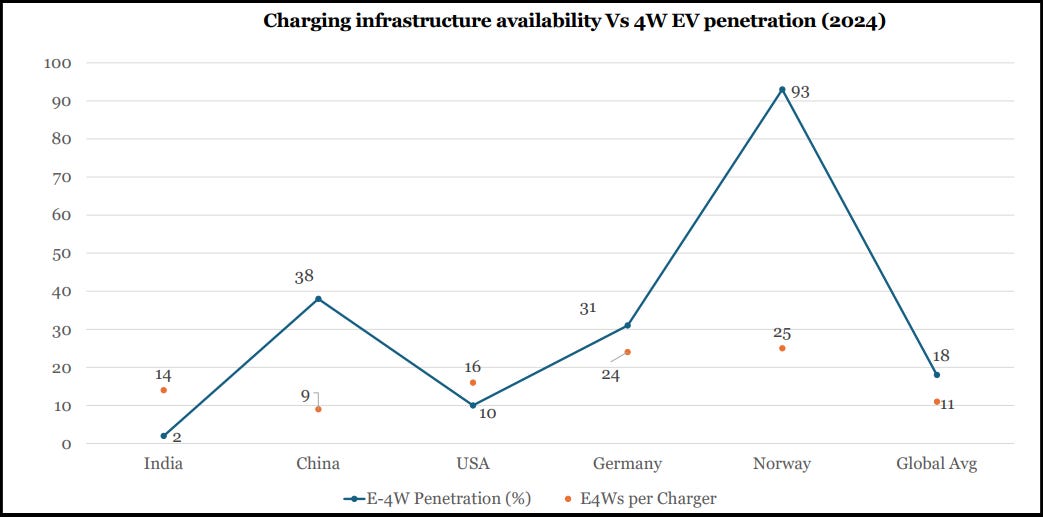

Another key aspect is charging station availability. As of 2024, India had one charging station for every 14 cars, which is relatively healthy compared to some major countries, yet EV penetration has remained stagnant at just 2 to 3%.

EV four-wheeler penetration in India remains an unsolved puzzle. Despite adequate charging infrastructure, adoption has yet to take off, largely due to high price points and the heavy capital investment required from OEMs.

How e-Buses🚌 Continue to Gain Momentum?

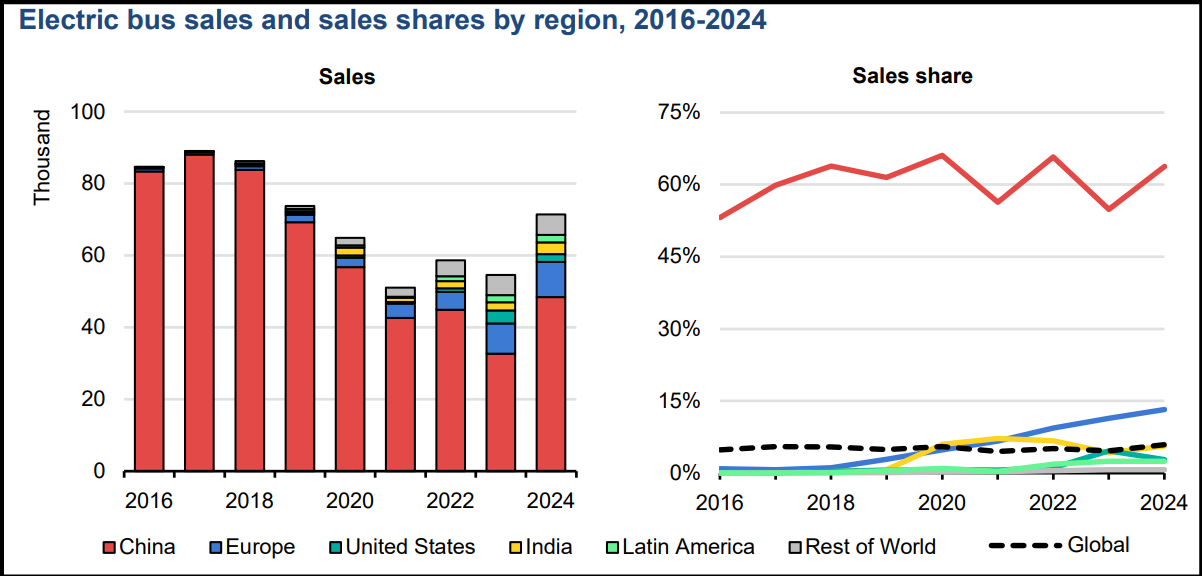

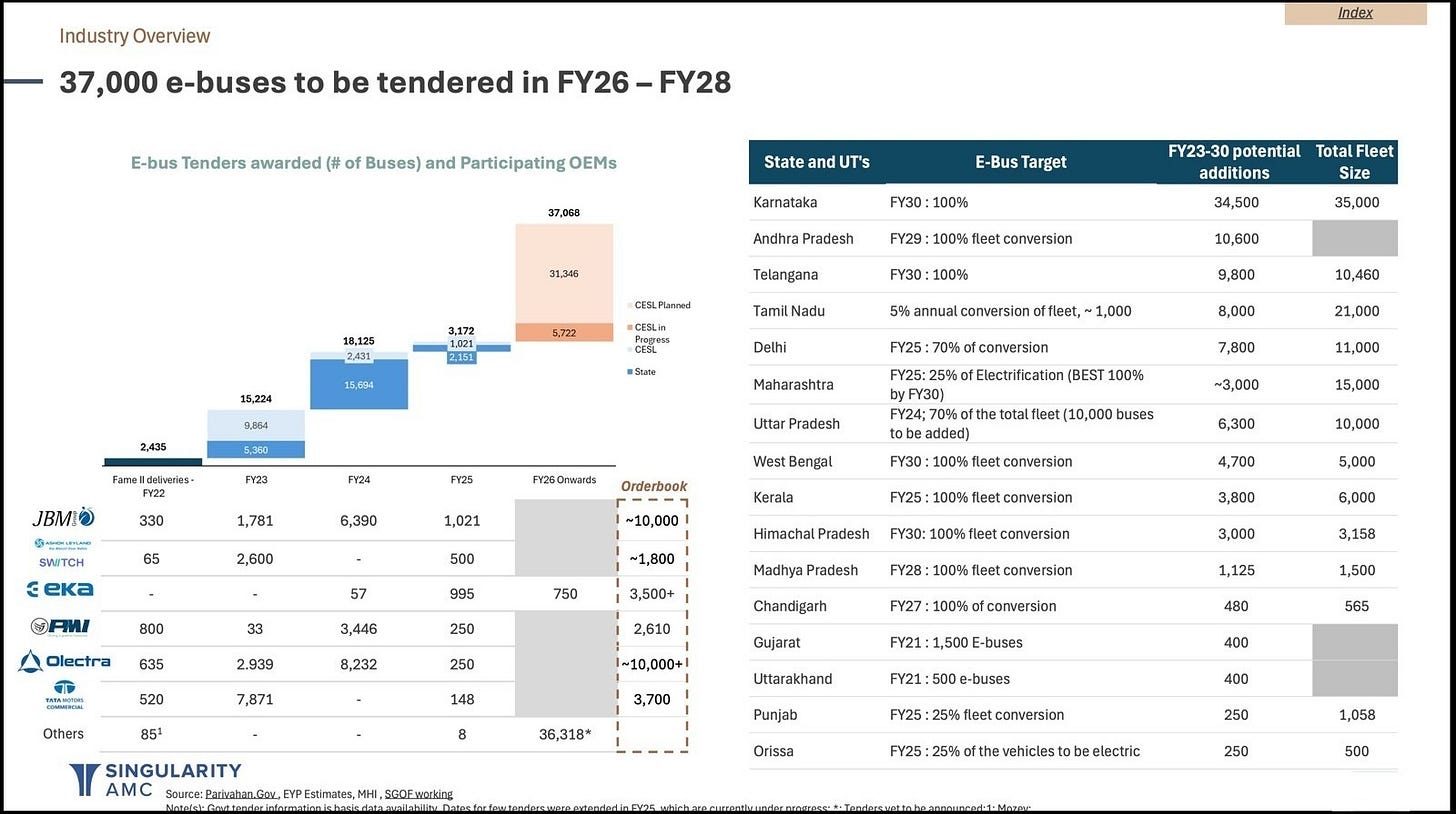

India has seen rapid growth in electric bus deployment since 2020, with stock increasing from less than 3,000 to more than 11,500 at the end of 2024, and penetration hovering around 4% - 5%.

Demand has been boosted by schemes such as the National Electric Bus Programme, which targets deploying a further 40,000 electric buses by 2027, helping to generate large orderbooks and use aggregated procurement to drive down costs. This is further strengthened by new schemes such as PM E-DRIVE, which could support sales of a further 14,028 electric buses, with preference given to replacements of old public buses. The forthcoming Bharat Urban Megabus Mission aims to introduce 100,000 electric buses to cities with a population of over 1 million.

This is why India’s share of global electronic bus sales continues to rise (yellow part).

By setting up Convergence Energy Services Limited (CESL) which acts as a central aggregator and program manager for the procurement of electric buses across India, government is ensuring improved procurement of EV buses at better prices at scale. Therefore, about 37,000 e-buses are expected to be tendered between FY26 to FY28 period from multiple states.

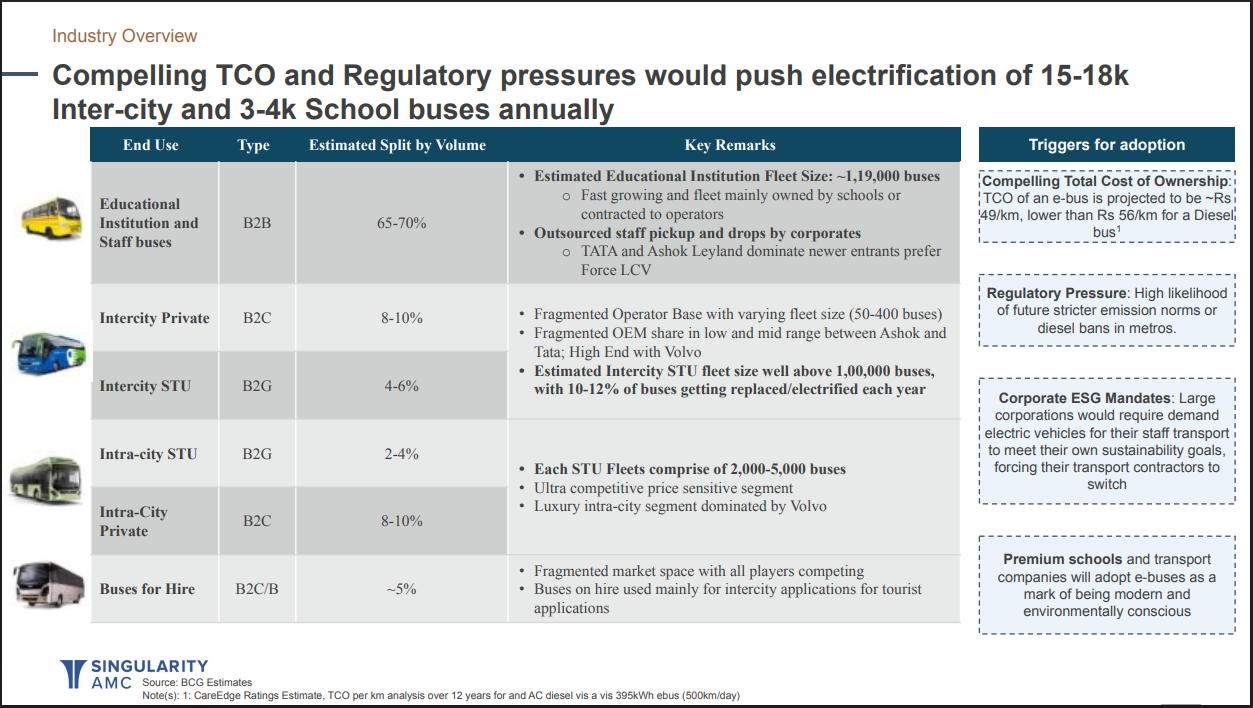

From a cost perspective, the total cost of ownership (TCO) for electric buses is now competitive with diesel alternatives, with estimates showing operational savings as battery technologies have matured, resulting in increased reliability and longer lifecycles.

Electric buses cost about ₹7 less per kilometer than diesel ones, mainly due to lower fuel and maintenance expenses, operating at around ₹49 versus ₹56 per kilometer for diesel bus.

Alongside, high likelihood of future stricter emission norms or diesel bans in metros, Corporate ESG Mandates for their staff transport, and many segment specific triggers continue to help improve penetration of EV Buses.

Green Shots in Electric HGVs & LGVs🚛

Heavy Goods Vehicles (HGVs) & Light Goods Vehicles (LGVs) are the commercial trucks & other vehicles, used primarily for transporting goods making them vital for freight industry. Long-haul, heavy-duty trucks are often considered one of the hardest-to-electrify vehicle segments due to the need to balance battery size, range and payload constraints with charging requirements. The upfront cost of a battery electric truck is generally 2 to 3 times that of a diesel truck.

Therefore the penetration in this category have been very low. In India, in CNG and Electric HGVs make less than 3% of the total sales, with diesel dominating at 97% market share. And when it comes to Electric LGVs, its share is now ~3% in 2025.

Government is keen to kick start the early adoption of e-trucks and therefore have allocated Rs 500 Crores for purchase of 5,643 e-trucks under PM e-DRIVE scheme launched in 2024. The environmental angle (read carbon emission) is even more crucial here.

Medium and Heavy-duty trucks comprise 2% of the total vehicle population but contribute to 45% of the overall vehicular road transport emissions. (source)

Early green shots are visible. In Nov ‘24, India’s biggest cement major, UltraTech Cement ordered 100 electric trucks to decarbonize a 400 km route between two of their operations, and orders for 180 electric trucks from Billion E-Mobility (including 45 with a gross vehicle weight of 55 tonnes) have spurred Ashok Leyland to increase their production capacity.

India’s fast-growing economy and expanding e-commerce sector are now amplifying demand for cleaner, cost-effective, and reliable commercial EVs. In November 2024, Amazon India launched ‘Laneshift Project’ to test long-range electric trucks on the 350km Bengaluru-Chennai highway.

With government support & increasing early adoption from corporate, electric HGVs/ LGVs, and Buses have fertile grounds for challenger OEMs and that’s where Singularity Growth Fund is investing.

Portfolio Success Stories: PMI Electro Mobility & Qucev

PMI Electro Mobility stands out as a portfolio leader, specializing in electric buses. Leveraging a strategic partnership with Foton for core EV technology & benefiting from robust government schemes such as the PM-eBus Sewa, PMI has emerged as the market leader.

As of Aug 2025, PMI continues to lead in number of deliveries YTD (649), followed by Switch Mobility (622) and Olectra (553).

PMI has delivered more buses YTD (649) than it did in CY24 (534) and commands about 17% of India’s e-bus market deliveries since 2020. The company’s growing order book (currently ~2,600 buses) with target of 15,000 new orders wins in next 2 years, along an expanding manufacturing capacity (3,000 buses per year). Company is focusing on backward integration, enabling margin expansion and supply chain stability. PMI's manufacturing strategy going forward involves strengthening bus body fabrication facilities, and assembly of core EV components like Battery pack, Motor, Software, 6in1 - tapping maximum localization.

In the commercial vehicle segment, Qucev is emerging as a promising player focused on commercial EVs with potential to drive electrification in the HCV category. It is making inroads in the CV category with 3.5 Ton LCV and 55 Ton HCVs. Partnerships and Technology transfer arrangements with global players like Foton, BYD, CALB give a right to win for PMI and Qucev.

Singularity AMC is well-positioned to capture emerging value in these sectors by fostering domestic EV component production (read ecosystem) to reduce import dependency. Key investment opportunities do exist in manufacturing critical components such as battery cells, battery management systems (BMS), electric motors, and power electronics.

Therefore, when it comes critical components that goes into lithion-ion battery of EVs, we have the privilege of investing in HEG Ltd which is into graphite (anode) and Lohum which is into lithium-ion battery recycling (cathode).

Bottom Line

India’s EV adoption is moving fast. We have emerged as world leader in electric 3W adoption and is doing well in electric 2W with growing number of OEMs entering the space. While affordability continues to be a key concern in electric 4W, the e-buses category is taking off in a big way. When it comes to E-HGVs & E-LGVs, considered one of the hardest-to-electrify vehicle segments, there are multiple green shots implying that time is ripe for penetration to increase here too.

Singularity AMC will continue to be at forefront in this space to accelerate India’s adoption of EVs.

Read our recent blog on energy transition: