UPI Flywheel Ready to Engulf Credit

How UPI Credit Lines Can Reshape Retail Lending in India

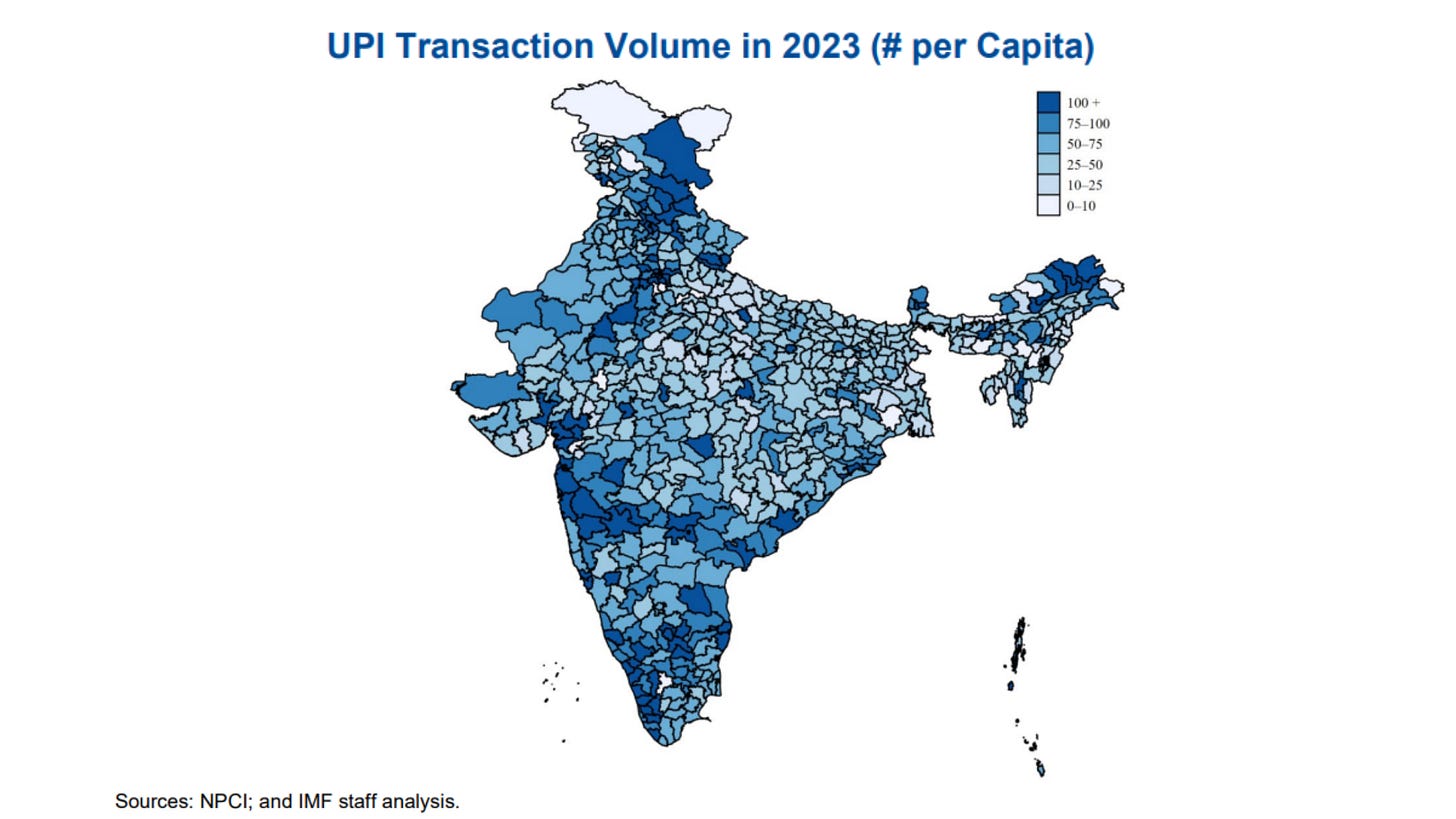

Unified Payments Interface (UPI) is one of the most transformative successes of India’s financial system, powering 85% of India’s digital payments and about 50% of global digital transactions.

Launched in 2016 by the National Payments Corporation of India (NCPI), you can pay merchants, or send money to friends in real time with just a few taps. Its appeal lies in its speed and ease of use, and therefore processing over 20 Bn transactions every month in India (as of Aug ‘25), and growing 32%+ YoY. It has led whole digital ecosystem growing rapidly, reaching more than 600+ banks and more than 200+ apps.

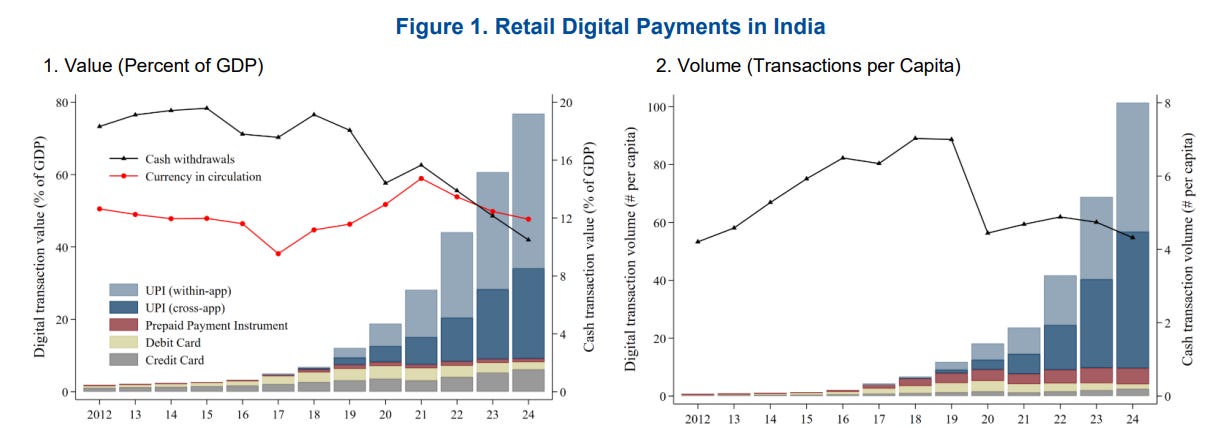

And one of the biggest impact it has had is in form of reduced requirement to have cash in your wallet. It takes away the need for regular cash withdrawals from the banks & ATMs, and therefore also a stagnation/negative trend in the existing ‘Currency in Circulation’ in India’s economy as the IMF chart shows below. In fact in 2024, RBI introduced UPI cash deposits at ATMs, slowly eliminating the need to carry a debit card.

UPI’s success truly lies in its sheer scale, now serving nearly 500 million users and over 65 million merchants across India. Compare this scale with 108 million users of credit card (unique users ~40-50 Mn) users which is accepted at just 25 million merchants in India. With government subsidizing the cost of operating UPI in the country, leading to wide adoption from both customers and vendors who don’t have to pay any per transaction charges that are generally paid in case of a credit card (by the merchants).

Credit card penetration estimated at <5% of the total population (i.e. <10% of adult population), whereas in United States, around 82% of adults own at least one credit card. Even countries like Brazil have a credit card penetration of over 33%.

Now credit is one area where UPI could potentially have a big impact where it fulfils the role that credit cards plays world wide, i.e. Democratization of Credit.

Government data shows that by 2021, about 96% of households had at least one member with a bank account. However, credit penetration, the asset side of banking, has lagged. Despite the surge in account openings, India’s financial inclusion ranking remains below peers like Brazil, South Africa, and Russia. When compared to developed world, the differences are stark! World Bank estimates India’s private credit-to-GDP ratio at just 55%, far below the 162% average of other four largest economies. This deficit translates into a lack of growth capital, stifling entrepreneurship and household economic mobility.

The lack of credit score and credit history for unserved consumers is an impediment for getting credit opportunities, as many lenders are hesitant to extend credit to consumers without any credit history or score. For these traditionally unscorable consumers, they face a “chicken or egg” conundrum of how to get that first credit product when they lack a credit history.

Now, the UPI can solve this so called ‘trust’ problem and this is what we shall be discussing in the blog later. Before that we discuss how need for retail credit is bound to triple from 2024 to 2030.

India’s Credit Gap

India’s economic story is increasingly being defined by its hunger for credit. As of FY25, the total retail credit in India stood at ₹82 lakh crore, reflecting a strong CAGR of 15.1% between FY19 and FY25. For the upcoming years, it is expected to increase 14-16% between FY25 and FY28. Consumers across the country are embracing new borrowing options, from credit cards and personal loans to digital lending platforms. With a population that is becoming more urbanized and aspirational, India is only scratching the surface of what is possible in terms of credit penetration.

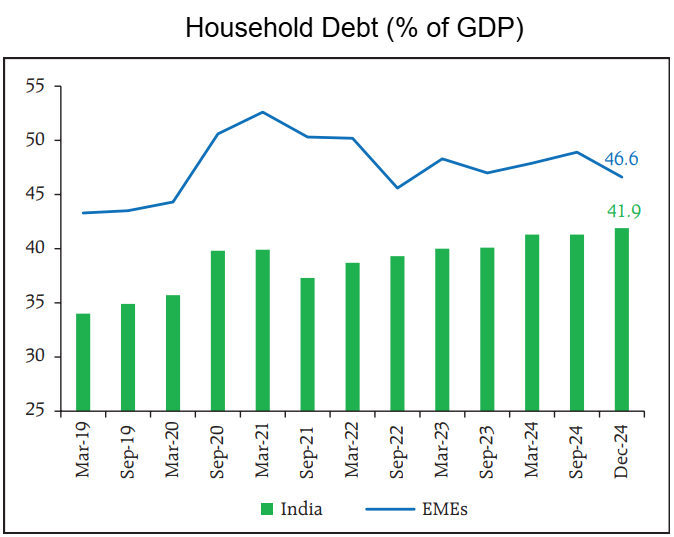

Although personal loans and credit card spending have surged in recent years, India’s household debt to GDP ratio remains notably below that of other emerging market economies (EMEs). India’s ratio hovers around 41-42%, while EMEs tend to be around 46-50%, reinforcing that Indian households are not over-leveraged and the credit cycle has a long run to complete. With rating upgrades flowing from global agencies, financial resilience allows policymakers and lenders to deepen credit penetration without triggering systemic risks, further strengthening the case for sustained credit growth in India.

If one looks at macro level, India's overall credit-to-GDP ratio was 93% in CY2024, compared to 138% for the United Kingdom, and 198% for China, and is not expected to rise due to fiscal prudence of central government to bring down the fiscal deficit further.

India’s composite Financial Inclusion (FI) index to measure and evaluate the extent of financial inclusion too has improved substantially from 49.9 in 2019 to 64.2 in 2024 indicating progress in deepening of financial inclusion led by rapid digitalization and fintech proliferation.

But an estimated 451 million Indian adults still lack access to any formal credit facilities, according to TransUnion CIBIL data from 2025. Credit availability to underserved Indians remains among the lowest globally - even after a phenomenal 12x growth in digital disbursements between 2017 and 2022. For example, India’s retail credit penetration at 11% is significantly lower than 55% in China or 75% in the US. Deep divides remain between urban and rural segments, as well as between genders and income brackets.

“There are approximately 5 crore unique credit card holders, there could be roughly 50 crore UPI users. A secured credit card could be offered to 30 to 40 crore users at least…”

- Rohit Chhibbar, Paisabazzar (ET - Sep’25)

With rise of digital payments in the country, can data provides valuable real-time insights into an individual's financial behavior and transaction patterns, enabling lenders to make more accurate and timely credit risk assessments? This could essentially help in streamlining loan approvals and enhance lending decisions, benefiting both borrowers and lenders alike - and therefore solve the lower levels of credit penetration in the country.

Can Transaction History Impact Creditworthiness?

Getting a premium credit card in India as a newbie is tough. If you have never applied for a loan, you have a limited credit history, it makes assessing your creditworthiness difficult and therefore most of the times, banks would recommend you to apply for beginner credit card with limited benefits.

“In the US, even a student will start using a credit card, because they want to build their credit identity so in the future when they go on to buy a house, they have a mature score that is available”

- Praveena Rai, COO, NPCI (source)

Traditionally credit products in India have faced limited reach due to challenges in access and distribution. Biggest hurdle of them is that India’s credit scoring largely depends on past credit history, excluding many rural and under banked populations who lack formal data.

However, the rise of digital payments is opening new doors for assessing creditworthiness. Transaction data from digital platforms offers valuable insights into income levels, spending patterns, and overall financial stability. Additionally, timely bill payments and active participation in savings platforms can signal strong financial discipline. While integrating such alternative data sources can broaden credit access, it also raises important concerns around privacy and bias. This calls for robust ethical standards and regulatory frameworks to ensure lending practices are fair, transparent, and non-discriminatory.

Research has found that transactional history along salary could be good enough way to access credit risks UPI Credit line could be relatively low riskier way of disbursal for lenders as they are able to. - Open Banking and Digital Payments: Implications for Credit Access

Innovating around building new credit algorithms alongside digital loan distribution & collection systems will be key to truly expanding credit access across India.

Therefore in 2024, NPCI, proposed the concept of Digital Payment Scores (DPS) as a tool for lenders to assess the creditworthiness of borrowers via their digital transaction history. DPS would analyze an individual’s digital payment behavior, including factors like transaction frequency, volume, and patterns. This data-driven approach aims to provide lenders with an alternative risk assessment mechanism, supplementing traditional credit scoring models.

With the need to build a credit identity and create an awareness about credit score lacking in India, DPS can potentially solve the problem. While NPCI is still working on the concept, it would be interesting to see how big could be the potential impact of the same on increasing penetration.

How Does It Impact Traditional Banking?

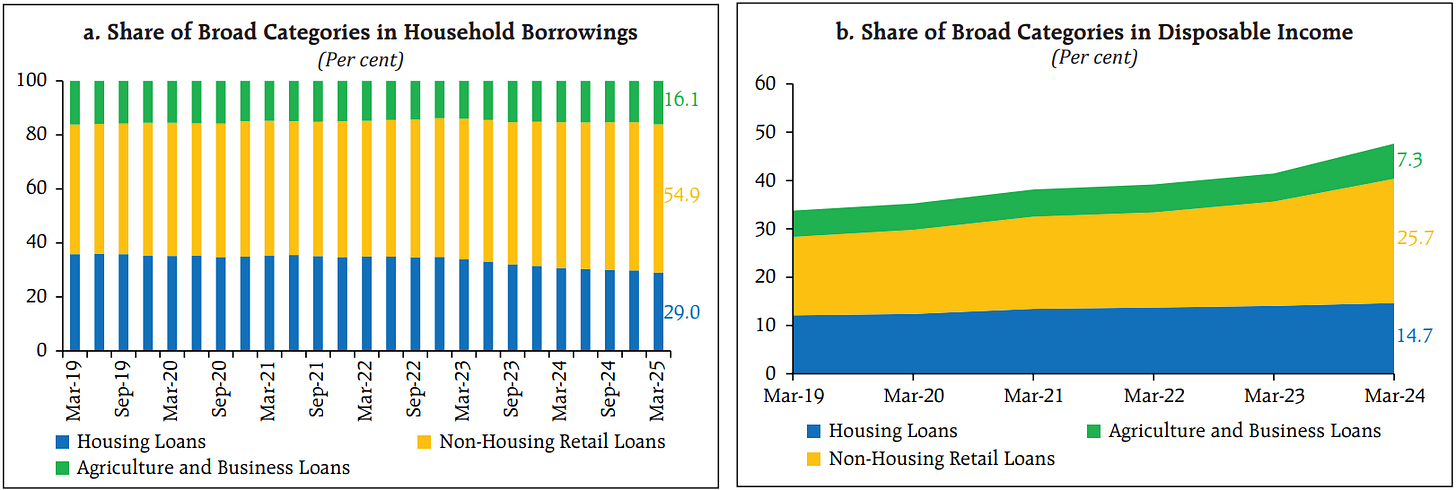

One of the key highlights in recent years in Indian banking has been how retail loans have been growing much faster than overall system loan growth. With rising incomes that enables more consumers to access credit for vehicles, education, and lifestyle needs, and increasing urbanization along growing middle class, now ~55% of India’s household borrowings are in form of retail loans.

While India’s retail credit penetration hovers around 11%, it is significantly lower than 55% in China or 75% in the US. Access to retail credit still relies heavily on physical branches due to most lending happening via traditional banking, which is often inconvenient and expensive, especially in semi-urban and rural areas. Small-ticket borrowers are often ignored as it isn’t economically viable to serve them.

Here is how digital banking along sharply rising UPI adoption could help the financial system to grow credit faster:

Distribution is vastly improved as digital channels and UPI enable instant, convenient access to financial services across urban and rural areas without the need for costly branches.

Underwriting benefits from rich digital transaction data and initiatives such as DPS, allowing banks to better assess creditworthiness, especially for thin-file and new-to-credit borrowers.

Collection processes become more efficient with digital repayments and automated reminders integrated through UPI-enabled platforms, reducing defaults and operational costs.

Cost of operations for banks lowers as digital onboarding and transactions reduce manual intervention and processing overheads.

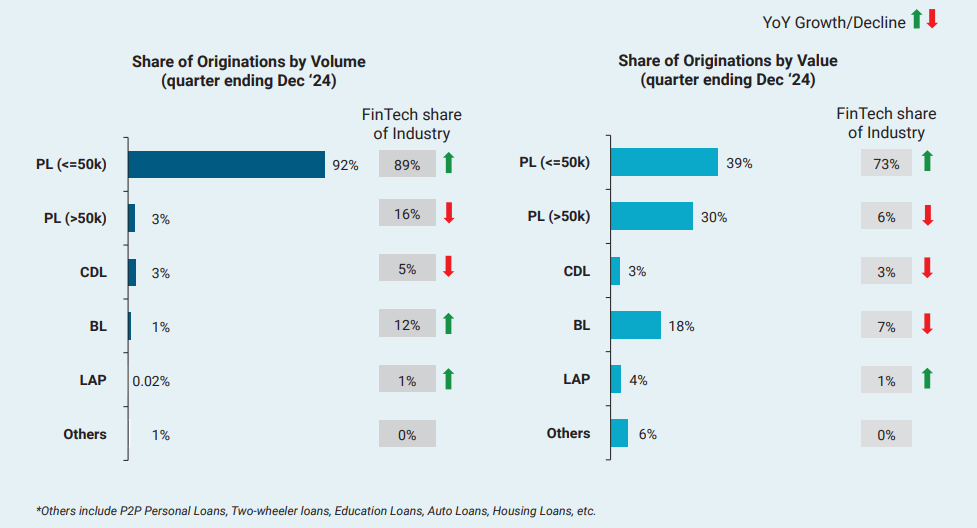

This is the role that India’s fintech sector has started to play now, especially post covid. With steady increase in its market share within the retail lending ecosystem, now 8% of all retail consumers actively engaging with fintechs by December 2024. The outstanding balance for FinTech stood at INR 1.3 trillion, showing a 32% year-on-year growth.

Fintech Leading India’s Credit ‘Sachetization’

In age of digitization, fintechs have been able to create a new segment of ‘small ticket personal loan’ (STPL) which most banks don’t find economical to be served.

Fintechs like Navi, Paytm, Mobikwik dominate the small ticket personal loan (ticket size less than INR 100,000) space contributing to 89% of industry originations. Off the total fintech originations, 92% were of small ticket personal loans implying most of their focus has been toward going deeper in this segment.

Fintech lenders attract younger with no major credit history along with rural consumers who often don’t have access to banks in their village, thus promoting financial inclusion with average ticket size of INR 44,000 as of December 2024. The digital-first approach eliminates many traditional bottlenecks like physical paperwork and lengthy approvals, making STPLs highly attractive to customers with immediate liquidity needs. And it is not limited to pushing retail loans, but now 12% of industry originations in business loans in quarter ending December 2024 were by fintechs.

They are steadily trying to increase their share in other lending products such as loans against property, gold loans and home loans as well but have achieved little success yet, with customer loyalty towards FinTech remain low other than for STPL.

In overall scheme of things, credit via fintechs is still in early stages in India, make up only ~1% of the total balances in the industry.

The need of the hour is to reimagine the access, availability, and consumption of credit products in a digital-first context single credit store carrying borrowing power along with the flexibility to avail it in different forms.

Enters CLOU - Credit Line on UPI!

Imagine booking a Vande Bharat train ticket of Rs 1,500 from IRCTC towards end of your month when your salary has already exhausted and you are somehow managing your expenses and desperately waiting for your salary to get credited which is still a few day away?

This is often the plight of many young Indians <30 year who are just starting out their careers, somehow balancing their monthly expense and often end up spending more before next salary day. Now, you might not apply for a high interest bearing personal loan for such small amount, and nor might the bank would immediately issue you a good credit card considering you don’t have any past credit history. This is where Credit Line on UPI (CLOU) enters! Within less than a minute of assessment, your UPI app would facilitate you an interest free credit line of few thousands which you can use for a few days, with payback at beginning of next month.

NPCI in GFF (Global FinTech Fest) in 2023 launched CLOU which allows banks to connect pre-approved credit lines directly to the UPI user base. This translates to easier credit access for individuals and businesses while offering banks access to a much wider audience through the established UPI app ecosystem. It removes most of the friction (and therefore costs) of customer acquisition, onboarding, disbursal and collections.

This innovation democratizes credit by enabling real-time loan access and EMI conversions for everyday purchases like groceries and utility bills, thus extending credit to millions of previously underserved individuals and MSMEs. CLOU’s simplified and transparent credit process reduces costs and fosters responsible borrowing by offering lower interest rates and clear terms compared to traditional credit options.

Imagine buying an entry level smartphone of Rs 10,000 from an offline authorize dealer and while making the payment via your UPI app, you get multiple credit line options from various banks with different payment plans and interest rates! These credit providers were able to instantly access your credit worthiness by accessing your past spending history and were also able to spontaneously define the purpose of the loan. This is the power of UPI.

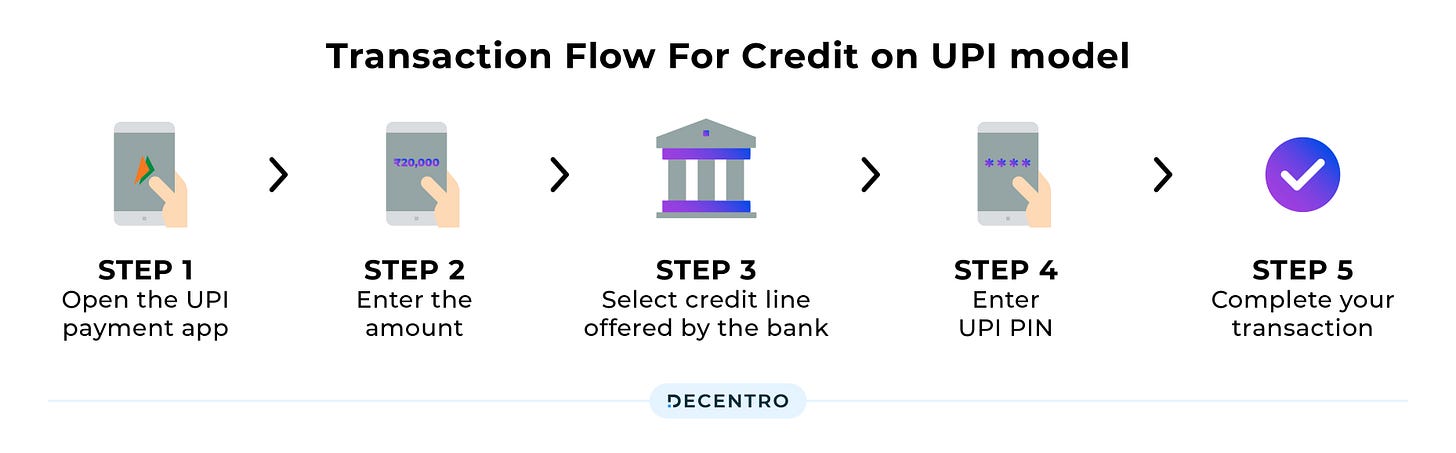

How Exactly Credit Line On UPI Works?

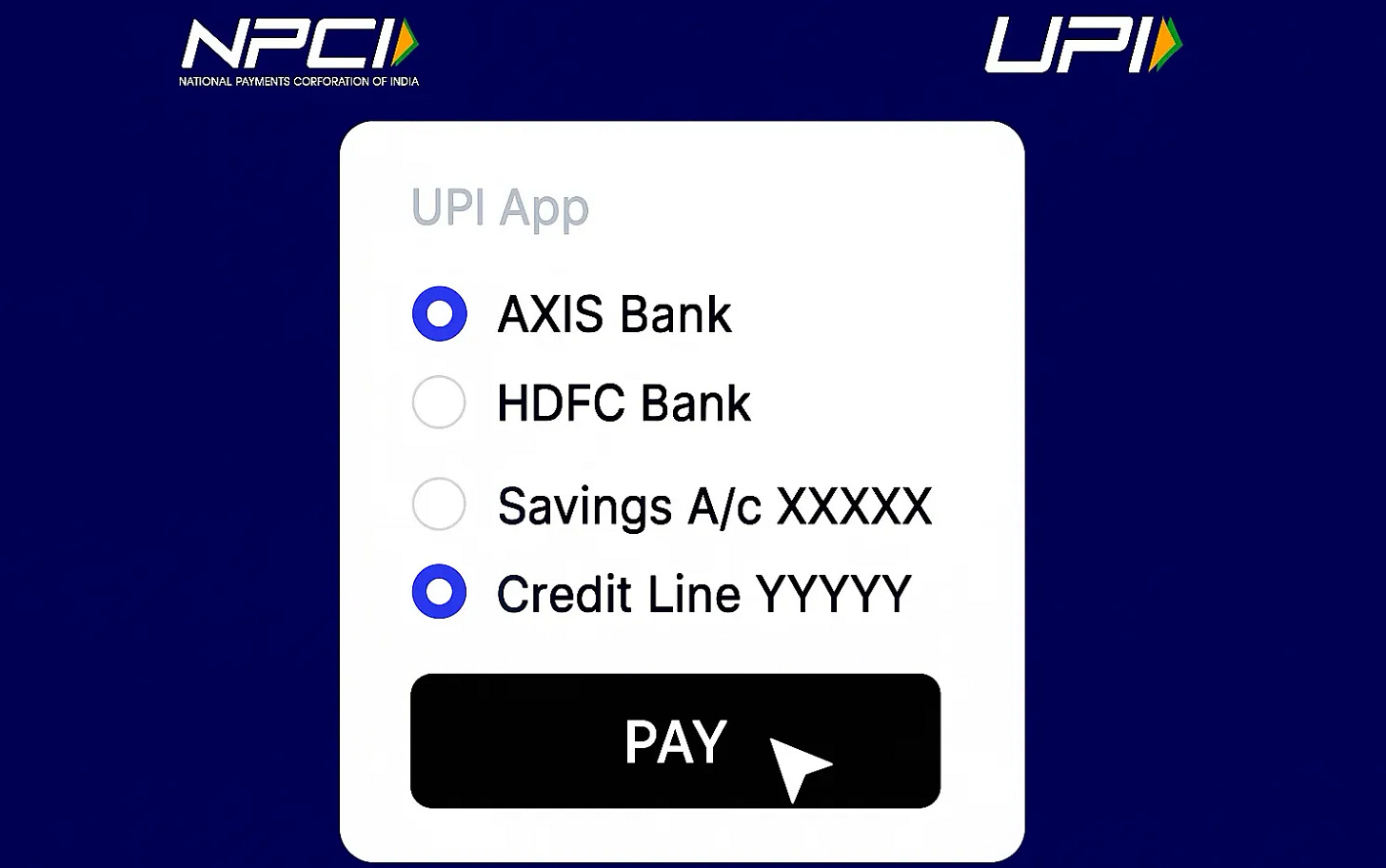

A credit line provides access to credit to a person using UPI. This eliminates the need for traditional credit cards or paperwork and provides quick access to credit, making credit usage as seamless as a regular bank transfer.

Here’s how it gets enabled:

Credit Line Approval: Users apply to a bank for a credit line through their preferred UPI app, which is reviewed and sanctioned based on creditworthiness. The process generally takes few minutes and once approved, this credit facility is linked to the user’s account.

UPI Integration: The approved credit line is enabled in the user’s preferred UPI app, similar to adding a bank account. When making a payment, the user selects the credit line as their source of funds, rather than their savings or current account.

Usage: The credit line can be used for any UPI merchant transaction. Payments are authorized in real-time using a UPI PIN. Transaction amounts are debited from the credit line, with the merchant receiving funds instantly.

Repayment: The user repays the drawn credit amount later, often within a defined billing cycle, either as a lump sum or in installments (EMIs), with interest charged as per the bank’s policy. Repayments are done digitally, again via UPI or other channels.

Tracking & Flexibility: Usage, remaining limit, repayment schedule, and history can all be monitored in the UPI or banking app.

Initial Response

When the CLOU was launched formally in September 2023, within a year, most of popular UPI apps in the country had started experimenting with the product through collaborations with banks. Market leader Phonepay entered into the space in Aug’24, and GPAY also has it for its users. Credit focused UPI players like Navi partnered with Karnataka Bank with intent to provide ‘freedom to credit access’ and how people pay without cards through UPI.

[Note: The case of Navi & other players is discussed in the blog, do note - Singularity AMC is not related to any of these companies mentioned directly/indirectly; kindly refer to the sources link]

“Credit line on UPI offering will become the future of credit,”

- Sachin Bansal, MD and CEO, Navi Technologies (Source)

And when it comes to the repayments and credit quality of loans that has been issued via CLOU, while these are still early period, Karnataka bank spoke about it in 2025:

“The entire process(of CLOU) is fully digital, and the product has performed well in terms of portfolio size. More importantly, repayment behavior has been timely, and the portfolio quality has been exemplary.”

Maintaining low credit delinquencies and stringent monitoring is crucial for CLOU product line to grow, considering the RBI stance in the past on risks associated with personal unsecured loans.

Regulatory Clarity Flowing In

Indian regulators have always been on a forefront in ensuring India’s digital ecosystem is nurtured well. RBI has advanced India’s digital public infrastructure (DPI) by driving strategy on three foundational pillars: near-universal Aadhaar digital identity coverage for 1.4 billion people, over 500 million Jan Dhan bank accounts expanding financial access for underserved segments, and robust digital connectivity now present across 900 million mobile internet users with rural mobile tele-density reaching 60 percent. This “JAM Trinity” has enabled inclusive access to government payments and services, with over two-thirds of beneficiaries from rural or semi-urban areas and a majority being women, showcasing DPI’s role in bridging the inclusion gap.

By guiding the creation of ubiquitous systems such as INFINET, SFMS, RTGS, NEFT, and retail payments through UPI, RBI has ensured that instant, safe, and affordable payment options reach every section of society, establishing India as a global leader in scalable, interoperable, and secure digital infrastructure.

In case of CLOU, post few of initial pilot, many of the high-street banks did not go live with the feature due to technical challenges & lesser clarity from regulators. As of Aug 2024, Credit on UPI was getting about Rs 10,000 crore in transaction value, but most of it was through the Rupay Credit Cards integrated within UPI and only Rs 100-200 crore comes from the Credit Line on UPI, implying much lower than 1% of total UPI transactions in the nation. The product was off to a slow start since NPCI has not yet defined the interchange fee for this facility.

Later in Aug ‘24, with a circular from NCPI clarified how charges will be levied on the pre-sanctioned credit line on UPI offered by banks, how starting from October 2024. By allowing an interchange charge of 1.2% of the transaction amount for transactions above Rs 2,000, the regulator set the incentive structure in place for players to participate and focus more on product innovation for wider adoption.

Further in July ‘25, NCPI further brought more structure & compliance to how these credit lines are used through UPI through its circular. It stated that from August 31st, 2025, credit lines linked to UPI must be used strictly for the purpose the loan was granted (such as education, healthcare, business, etc.), implying borrowers cannot divert loans to unrelated expenditures, with banks required to monitor and enforce usage based on the stated loan purpose. This provides the required regulatory clarity, letting players/banks to go ahead to go ahead with full launch.

Who gets impacted?

Credit Line on UPI (CLOU) benefits a wide range of stakeholders by making instant, small-ticket credit more accessible for consumers and micro-businesses, improving financial inclusion for those without traditional credit histories. Banks and Small Finance Banks see operational efficiencies, cost savings, and improved customer engagement through data-driven risk assessment and new loan products. Fintechs and UPI apps gain fresh revenue streams and enhanced user engagement via platform-based lending. Merchants benefit from higher sales due to greater customer spending power, while MSMEs enjoy smoother access to working capital through seamless digital credit on UPI platforms. Therefore it eventually becomes a win-win for all the stakeholders part of its ecosystem.

On the other side, customer preference may shift from credit cards to CLOU for everyday small-ticket + big-ticket purchases and bill payments due to simpler processes and direct UPI integration. This could directly impact credit card companies; providers of Point-of-Sale (PoS) terminals for merchants to accept card payments could also get impacted. While the plans to incentivize the players is in place but most merchants who have been using UPI QR code as a mode of receiving payments till now are not used to paying a 1.2 - 1.5% charge on UPI payments similar to how credit card payments are received. Therefore will merchants be open to idea of paying a charge on receipts if the payment is made by CLOU?

Bottom line

UPI’s rise has fundamentally reshaped India’s financial landscape, reaching nearly 500 million users and 65 million merchants, and accounting for 85% of all digital payments in the country now. Its open, seamless, and low-cost architecture has made digital finance an everyday reality - reducing cash dependency, driving financial inclusion, and laying the groundwork for new innovations like Credit Line on UPI. The impact of Digital Payment Scores (DPS) as a tool for lenders to assess the creditworthiness also remains to be seen.

As questions get answered while credit on UPI continues to evolve, it offers a powerful blueprint for democratizing both payments and credit coverage, putting India at the forefront of global digital transformation.

In case you find this blog insightful, consider sharing this blog further:

Read recent blogs by Singularity One:

Rewiring Grid For A Brighter Tomorrow

In this deep dive, we explore the hidden backbone of our energy future: the electricity grid.

Inside the Battery: Critical Minerals Powering Our Autonomous Future

In this long deep-dive, we explore the interconnected trends shaping the future of mobility, energy, and geopolitics - powered by one core technology: Batteries.